Calculating active duty pay for military personnel involves considering various factors such as rank, time in service, and family size. The United States military uses a standardized pay scale to determine the basic pay for its active-duty members. To calculate active duty pay, one must first identify the appropriate pay grade and time-in-service category. The pay grades are divided into three main categories: enlisted, warrant officer, and officer. Each category has its own pay scale, which is adjusted annually to reflect cost-of-living increases.

Understanding the Active Duty Pay Scale

The active duty pay scale is based on a combination of rank and time in service. The scale is divided into two main components: basic pay and allowances. Basic pay is the primary source of income for military personnel and is taxable. Allowances, on the other hand, are non-taxable and are provided to help offset the cost of living expenses such as housing and food. The basic pay scale is adjusted annually to reflect changes in the cost of living, and the rates are published by the Department of Defense.

Calculating Basic Pay

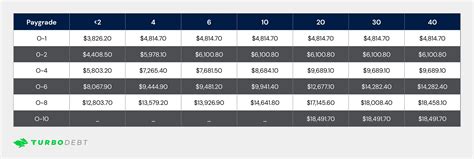

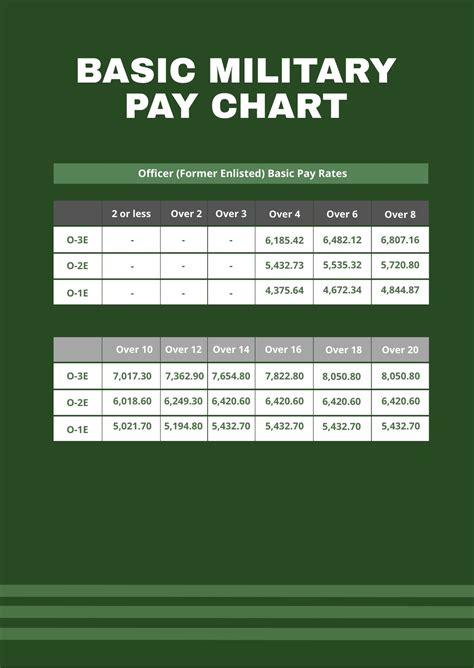

To calculate basic pay, one must first determine the appropriate pay grade and time-in-service category. The pay grades range from E-1 (Private) to E-9 (Sergeant Major) for enlisted personnel, W-1 (Warrant Officer 1) to W-5 (Chief Warrant Officer 5) for warrant officers, and O-1 (Second Lieutenant) to O-10 (General) for officers. The time-in-service categories range from less than 2 years to over 20 years. Once the pay grade and time-in-service category are determined, the basic pay can be calculated using the standardized pay scale.

| Pay Grade | Time in Service | Basic Pay |

|---|---|---|

| E-1 | Less than 2 years | $1,733.40 |

| E-5 | 6-8 years | $2,960.50 |

| O-3 | 10-12 years | $6,439.10 |

Allowances and Benefits

In addition to basic pay, military personnel are eligible for various allowances and benefits. The Basic Allowance for Housing (BAH) is a non-taxable allowance provided to help offset the cost of housing. The rate of BAH varies depending on the location and the rank of the service member. The Basic Allowance for Subsistence (BAS) is another non-taxable allowance provided to help offset the cost of food. The rate of BAS is adjusted annually to reflect changes in the cost of living.

Calculating Total Compensation

To calculate total compensation, one must add the basic pay, BAH, and BAS. Other allowances and benefits, such as special duty pay and hazardous duty pay, may also be included. The total compensation package can vary significantly depending on the individual circumstances of the service member.

Key Points

- The active duty pay scale is based on a combination of rank and time in service.

- Basic pay is the primary source of income for military personnel and is taxable.

- Allowances, such as BAH and BAS, are non-taxable and are provided to help offset living expenses.

- Total compensation includes basic pay, allowances, and other benefits.

- The total compensation package can vary significantly depending on individual circumstances.

The active duty pay calculator is a useful tool for military personnel to estimate their total compensation package. By considering the various factors that impact pay, including rank, time in service, and family size, service members can gain a better understanding of their overall compensation. It's essential to note that the calculator is only an estimate, and actual pay may vary depending on individual circumstances.

What is the difference between basic pay and allowances?

+Basic pay is the primary source of income for military personnel and is taxable. Allowances, on the other hand, are non-taxable and are provided to help offset living expenses such as housing and food.

How is the active duty pay scale adjusted annually?

+The active duty pay scale is adjusted annually to reflect changes in the cost of living. The rates are published by the Department of Defense and are based on a combination of rank and time in service.

What is the Basic Allowance for Housing (BAH)?

+The Basic Allowance for Housing (BAH) is a non-taxable allowance provided to help offset the cost of housing. The rate of BAH varies depending on the location and the rank of the service member.

In conclusion, calculating active duty pay involves considering various factors such as rank, time in service, and family size. By using the active duty pay calculator and understanding the different components of the total compensation package, military personnel can gain a better understanding of their overall compensation. It’s essential to note that the calculator is only an estimate, and actual pay may vary depending on individual circumstances.