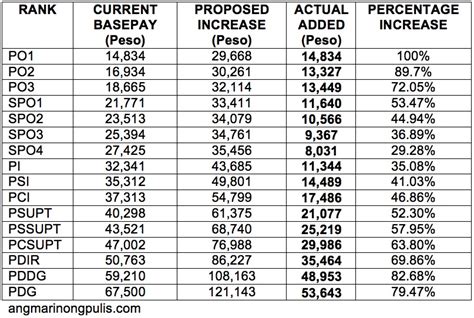

Understanding the concept of base pay and its relationship with taxes is essential for individuals to manage their finances effectively. Base pay, also known as gross income, refers to the total amount of money an employee earns before any deductions are made. This includes wages, salaries, commissions, and any other forms of compensation. The base pay is typically the foundation upon which various deductions, including taxes, are calculated.

Components of Base Pay

Base pay can be composed of several elements, including but not limited to, hourly wages, annual salaries, overtime pay, bonuses, and commissions. Each of these components contributes to the overall gross income of an individual. For instance, an employee who is paid an hourly wage of 25 and works 40 hours a week would have a base pay of 1000 per week, before considering any overtime or deductions.

Taxation and Base Pay

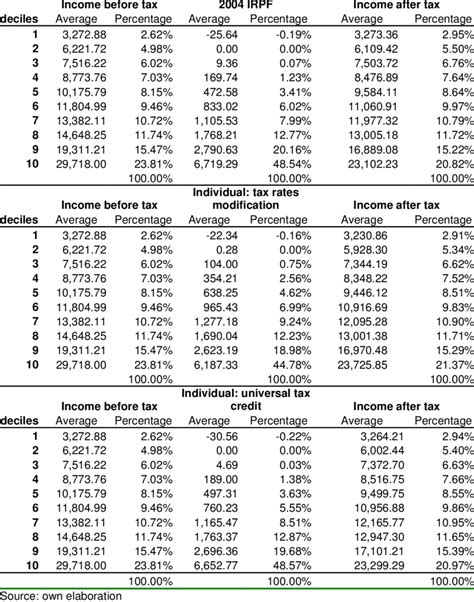

Taxes are deductions made from an individual’s base pay, and they vary based on factors such as the country, state, or province of residence, marital status, number of dependents, and the tax bracket into which the individual falls. Taxes are usually withheld by the employer and paid directly to the government on behalf of the employee. This process is known as payroll tax withholding. The amount of taxes withheld from an individual’s base pay depends on the tax rates and laws applicable in their jurisdiction.

| Component of Income | Description | Example |

|---|---|---|

| Hourly Wage | Compensation per hour worked | $25/hour |

| Annual Salary | Total compensation per year | $50,000/year |

| Overtime Pay | Additional compensation for work beyond regular hours | 1.5 times hourly wage |

Calculating Net Income from Base Pay

To calculate net income from base pay, one must subtract all deductions, including federal, state, and local taxes, social security taxes, health insurance premiums, and any other pre-tax deductions, from the gross income. For example, if an individual has a base pay of 50,000 per year and faces a total tax deduction of 25%, their net income would be 37,500 per year.

Impact of Taxes on Base Pay

Taxes significantly impact the base pay, as they directly reduce the amount of money an individual takes home. Understanding the tax implications on base pay is vital for making informed decisions about personal finance, including savings, investments, and expenditure planning. It’s also important to note that tax laws and rates can change, which may affect the amount of taxes withheld from base pay and, consequently, the net income.

Key Points

- Base pay refers to the total compensation before deductions, including taxes.

- Taxes are deducted from base pay, and the amount depends on various factors, including tax laws and personal circumstances.

- Understanding the difference between base pay and net income is crucial for financial planning.

- Calculating net income involves subtracting all deductions from the base pay.

- Tax implications on base pay can significantly affect personal finance decisions.

In conclusion, base pay is indeed the income before taxes and other deductions. It serves as the foundation for calculating net income and is a critical component of personal finance management. By understanding how base pay is calculated and how taxes affect it, individuals can make more informed decisions about their financial lives.

What is considered base pay?

+Base pay, or gross income, includes all forms of compensation before deductions, such as wages, salaries, commissions, and bonuses.

How are taxes deducted from base pay?

+Taxes are typically withheld by the employer based on the employee’s tax filing status, number of dependents, and other factors, and then paid to the government on behalf of the employee.

Why is it important to understand the difference between base pay and net income?

+Understanding this difference is crucial for budgeting, financial planning, and making informed decisions about personal finance, as net income represents the actual take-home pay after all deductions.