The concept of a healthcare credit card has been around for several decades, offering individuals a financial tool to cover unexpected medical expenses or elective procedures not fully covered by insurance. These specialized credit cards are designed to provide patients with flexible financing options for healthcare services, allowing them to manage their medical bills more effectively. With the rising costs of healthcare in the United States and worldwide, the demand for such financial instruments has increased, making healthcare credit cards a significant aspect of the healthcare financing landscape.

Healthcare credit cards function similarly to traditional credit cards but are specifically tailored for healthcare expenses. They are often offered by healthcare providers, financial institutions, or companies specializing in healthcare financing. These cards can be used to pay for a wide range of medical services, including dental care, vision care, cosmetic surgery, and veterinary care for pets. One of the key benefits of healthcare credit cards is their ability to provide financing options with promotional periods that offer 0% interest rates for a specified period, typically ranging from 6 to 24 months, depending on the card issuer and the agreement with the healthcare provider.

Key Points

- Healthcare credit cards are designed to cover medical expenses not fully covered by insurance.

- They offer flexible financing options, including promotional 0% interest rates for specified periods.

- These cards can be used for various medical services, including dental, vision, cosmetic, and veterinary care.

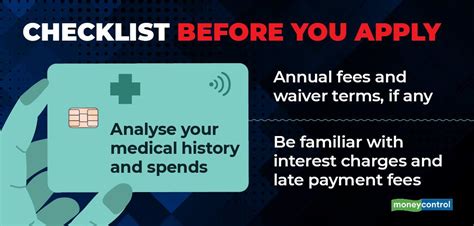

- Understanding the terms and conditions, including interest rates and repayment terms, is crucial before applying.

- Healthcare credit cards can be beneficial for managing unexpected medical expenses or planning for elective procedures.

Benefits and Considerations of Healthcare Credit Cards

One of the primary benefits of healthcare credit cards is their ability to provide immediate financing for necessary medical procedures, allowing individuals to receive the care they need without delay. Additionally, these cards often come with rewards programs or discounts on certain healthcare services, which can help reduce the overall cost of care. However, it’s essential for consumers to carefully review the terms and conditions of these credit cards, as they can come with significant interest rates and fees if not managed properly. For instance, if the promotional period ends and the balance is not paid in full, the accumulated interest can substantially increase the debt, leading to financial hardship.

Financial Implications and Management

The financial implications of using a healthcare credit card can be significant, and it’s crucial for individuals to manage their debt effectively. This includes making timely payments, understanding the interest rates and fees associated with the card, and avoiding overspending. Moreover, individuals should consider their overall financial situation and ability to repay the debt before applying for a healthcare credit card. Financial planning and budgeting are key to avoiding debt traps and ensuring that these credit cards serve their intended purpose of facilitating access to necessary healthcare services.

| Feature | Description |

|---|---|

| Promotional Interest Rate | 0% interest rate for a specified period (e.g., 6-24 months) |

| Regular Interest Rate | Varies by card issuer, often higher than traditional credit cards |

| Fees | May include annual fees, late fees, and balance transfer fees |

| Repayment Terms | Minimum monthly payments, with the option for larger payments to pay off the balance sooner |

Regulations and Consumer Protection

The use of healthcare credit cards is subject to various regulations and consumer protection laws. The Truth in Lending Act (TILA) and the Credit Card Accountability Responsibility and Disclosure (CARD) Act are among the key pieces of legislation that regulate credit card practices, including those related to healthcare credit cards. These laws are designed to ensure transparency in credit terms, protect consumers from unfair practices, and provide them with the necessary information to make informed decisions about their credit. Additionally, the No Surprises Act, which went into effect in 2022, aims to protect consumers from surprise medical bills, further emphasizing the need for transparency and fairness in healthcare billing and financing.

Evolution of Healthcare Financing

The landscape of healthcare financing is evolving, with a shift towards more patient-centric and transparent models. The rise of healthcare credit cards is part of this evolution, offering patients more control over their healthcare expenses and financing options. However, this shift also underscores the need for consumers to be well-informed and vigilant about the terms and conditions of these financial products. As the healthcare industry continues to adapt to changing regulations, technological advancements, and patient needs, the role of healthcare credit cards is likely to become even more significant, necessitating ongoing evaluation and refinement of these financing tools to ensure they serve the best interests of patients.

What are the main benefits of using a healthcare credit card?

+The main benefits include flexible financing options for medical expenses, promotional 0% interest rates for specified periods, and the ability to manage unexpected healthcare costs or plan for elective procedures.

How do I choose the right healthcare credit card for my needs?

+Consider the interest rates, fees, repayment terms, and promotional offers. It's also crucial to evaluate your financial situation and ability to repay the debt. Comparing different cards and potentially consulting with a financial advisor can help make an informed decision.

Are healthcare credit cards regulated, and what protections are in place for consumers?

+Yes, healthcare credit cards are subject to various regulations, including the Truth in Lending Act and the Credit Card Accountability Responsibility and Disclosure Act. These laws aim to ensure transparency and fairness in credit practices, protecting consumers from unfair terms and surprise charges.

In conclusion, healthcare credit cards offer a valuable financing option for individuals facing medical expenses, providing a means to manage costs and access necessary care. However, it’s critical for consumers to approach these credit cards with a clear understanding of their terms, potential risks, and the importance of responsible financial management. As the healthcare financing landscape continues to evolve, the role of healthcare credit cards will likely become more pronounced, emphasizing the need for ongoing consumer education and regulatory oversight to protect patient interests.