Zero deductible health insurance plans have gained popularity in recent years due to their potential to reduce out-of-pocket expenses for policyholders. These plans, also known as "zero-deductible" or "first-dollar coverage" plans, eliminate the need for insured individuals to pay a deductible before their health insurance coverage kicks in. This can be particularly beneficial for those who require frequent medical care or have ongoing health conditions. In this article, we will delve into the details of zero deductible health insurance, exploring its benefits, drawbacks, and key considerations for those seeking to enroll in such a plan.

Key Points

- Zero deductible health insurance plans eliminate the need for a deductible, reducing out-of-pocket expenses for policyholders.

- These plans often come with higher premiums to compensate for the lack of a deductible.

- Policyholders should carefully consider their healthcare needs and budget before enrolling in a zero deductible plan.

- Some zero deductible plans may have limitations or exclusions, such as copays or coinsurance for certain services.

- It is essential to review the plan's terms and conditions before making a decision.

How Zero Deductible Health Insurance Works

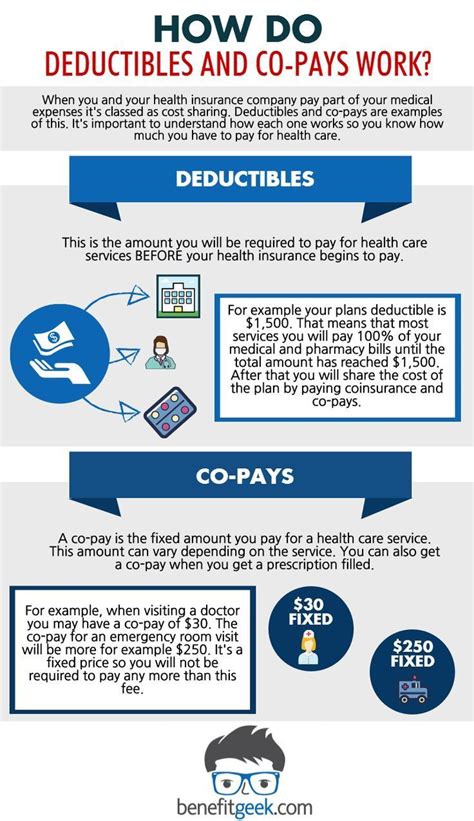

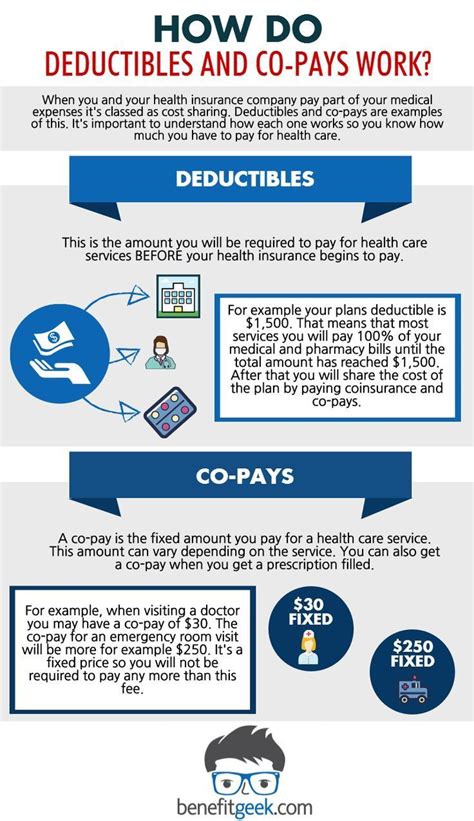

Traditional health insurance plans typically require policyholders to pay a deductible, which can range from a few hundred to several thousand dollars, before their insurance coverage begins. In contrast, zero deductible health insurance plans cover medical expenses from the first dollar, eliminating the need for policyholders to pay a deductible. This can provide significant financial relief, especially for those with chronic conditions or who require frequent medical care. However, it is essential to note that zero deductible plans often come with higher premiums to compensate for the lack of a deductible.

Benefits of Zero Deductible Health Insurance

The primary benefit of zero deductible health insurance is the reduction of out-of-pocket expenses for policyholders. By eliminating the deductible, individuals can avoid the financial burden of paying for medical care upfront. This can be particularly beneficial for those with ongoing health conditions or who require frequent medical care. Additionally, zero deductible plans can provide peace of mind, as policyholders know that their medical expenses will be covered from the first dollar.

| Plan Type | Premium | Deductible |

|---|---|---|

| Traditional Plan | $300/month | $1,000 |

| Zero Deductible Plan | $400/month | $0 |

Drawbacks and Limitations of Zero Deductible Health Insurance

While zero deductible health insurance plans can provide significant benefits, they also have some drawbacks and limitations. One of the primary concerns is the higher premium cost, which can be a challenge for those on a tight budget. Additionally, some zero deductible plans may have limitations or exclusions, such as copays or coinsurance for certain services. It is essential to carefully review the plan’s terms and conditions before making a decision.

Key Considerations for Policyholders

When evaluating zero deductible health insurance plans, policyholders should consider several key factors. First, they should assess their healthcare needs and budget to determine whether a zero deductible plan is the best option. Additionally, they should review the plan’s terms and conditions, including any limitations or exclusions, to ensure they understand what is covered and what is not. Finally, policyholders should compare the premium costs of zero deductible plans with traditional plans to determine which option provides the best value.

What is the primary benefit of zero deductible health insurance?

+The primary benefit of zero deductible health insurance is the reduction of out-of-pocket expenses for policyholders, as they do not have to pay a deductible before their insurance coverage kicks in.

Are zero deductible health insurance plans more expensive than traditional plans?

+Yes, zero deductible health insurance plans often come with higher premiums to compensate for the lack of a deductible. However, the exact cost difference will depend on the specific plan and insurer.

What should policyholders consider when evaluating zero deductible health insurance plans?

+Policyholders should consider their healthcare needs and budget, review the plan's terms and conditions, and compare the premium costs of zero deductible plans with traditional plans to determine which option provides the best value.

In conclusion, zero deductible health insurance plans can provide significant benefits for policyholders, including reduced out-of-pocket expenses and peace of mind. However, these plans often come with higher premiums and may have limitations or exclusions. It is essential for policyholders to carefully consider their healthcare needs and budget, review the plan’s terms and conditions, and compare the premium costs of zero deductible plans with traditional plans to determine which option provides the best value. By doing so, individuals can make informed decisions about their health insurance coverage and ensure they have the financial protection they need to maintain their health and well-being.