Utah, known for its diverse landscapes and outdoor recreational opportunities, is home to a unique set of challenges when it comes to health insurance. With a population that is both rural and urban, finding the right health insurance plan can be a daunting task. In this article, we will delve into the complexities of Utah health insurance, exploring the various options available, the costs associated with these plans, and the demographic factors that influence the health insurance landscape in the state.

Key Points

- The Affordable Care Act (ACA) has significantly impacted Utah's health insurance market, with many residents now eligible for subsidized plans.

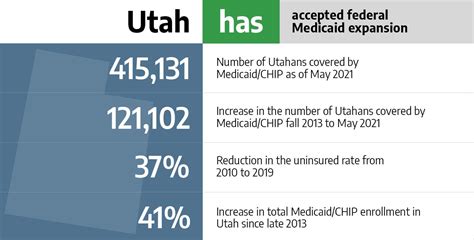

- Utah's Medicaid expansion has extended coverage to thousands of low-income individuals and families.

- The state's short-term health insurance plans offer an alternative to traditional major medical insurance, but often come with limitations and exclusions.

- Group health insurance plans, offered through employers, remain a popular option for many Utah residents.

- Utah's health insurance marketplace, Avenue H, provides a platform for individuals and families to compare and purchase health insurance plans.

Understanding Utah Health Insurance Options

When it comes to health insurance in Utah, residents have a range of options to choose from. These include individual and family plans, group health insurance plans, Medicaid, and short-term health insurance plans. Each of these options has its own set of benefits and drawbacks, and the right choice will depend on an individual’s specific needs and circumstances.

Individual and Family Plans

Individual and family plans are a popular option for those who are not eligible for group health insurance through their employer. These plans can be purchased through the health insurance marketplace, Avenue H, or directly from insurance providers. In 2022, the average monthly premium for an individual plan in Utah was 434, while the average monthly premium for a family plan was 1,244.

| Plan Type | Average Monthly Premium |

|---|---|

| Individual Plan | $434 |

| Family Plan | $1,244 |

Group Health Insurance Plans

Group health insurance plans are offered through employers and are often more affordable than individual plans. These plans typically require a minimum number of participants and may have more comprehensive coverage than individual plans. In Utah, 54.4% of residents receive their health insurance through their employer.

Utah’s Health Insurance Marketplace

Utah’s health insurance marketplace, Avenue H, provides a platform for individuals and families to compare and purchase health insurance plans. The marketplace offers a range of plans from various insurance providers, including SelectHealth, Regence BlueCross BlueShield of Utah, and University of Utah Health Plans. In 2022, over 200,000 Utah residents enrolled in health insurance plans through the marketplace.

Medicaid Expansion in Utah

In 2019, Utah expanded its Medicaid program to include low-income adults, extending coverage to thousands of residents. This expansion has had a significant impact on the state’s health insurance landscape, with many residents now eligible for subsidized plans. As of 2022, over 120,000 Utah residents have enrolled in Medicaid expansion plans.

Short-Term Health Insurance Plans in Utah

Short-term health insurance plans are a type of limited-duration insurance that provides temporary coverage for individuals and families. These plans are often less expensive than traditional major medical insurance but may come with limitations and exclusions. In Utah, short-term health insurance plans can be purchased for up to 12 months, with the option to renew for an additional 12 months.

What is the difference between a short-term health insurance plan and a traditional major medical plan?

+A short-term health insurance plan provides temporary coverage for a limited period, typically up to 12 months. These plans often have limitations and exclusions, such as pre-existing condition exclusions and limited provider networks. Traditional major medical plans, on the other hand, provide comprehensive coverage for a longer period, often with more comprehensive benefits and fewer exclusions.

Can I purchase a health insurance plan through the marketplace if I have a pre-existing condition?

+Yes, you can purchase a health insurance plan through the marketplace even if you have a pre-existing condition. The Affordable Care Act prohibits insurance providers from denying coverage or charging higher premiums based on pre-existing conditions.

What is the average cost of a health insurance plan in Utah?

+The average cost of a health insurance plan in Utah varies depending on the type of plan, age, and location. However, according to data from 2022, the average monthly premium for an individual plan in Utah was $434, while the average monthly premium for a family plan was $1,244.

In conclusion, Utah’s health insurance landscape is complex and multifaceted, with a range of options available to residents. Whether you’re eligible for group health insurance through your employer, or you’re looking for an individual or family plan, it’s essential to carefully review your options and choose a plan that meets your specific needs and budget. By understanding the various health insurance options available in Utah, residents can make informed decisions and ensure they have access to quality, affordable healthcare.