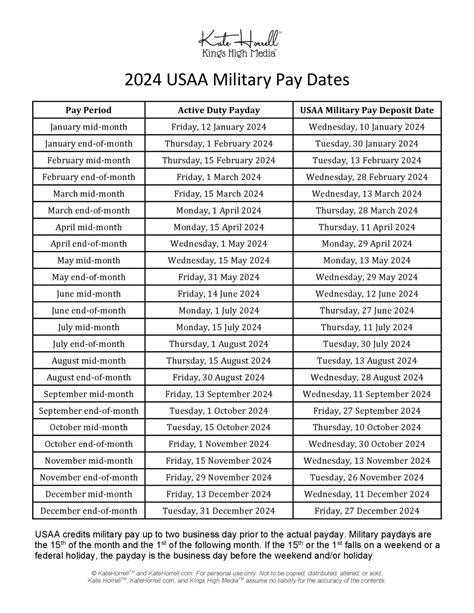

Understanding the payment schedule is crucial for members of the United Services Automobile Association (USAA) who are looking to manage their financial obligations effectively. USAA, known for its comprehensive range of financial services tailored to military personnel and their families, offers various payment plans and schedules to accommodate the unique needs of its members. The payment schedule for USAA can vary depending on the type of insurance or financial product a member has. For instance, auto insurance, home insurance, and life insurance policies may have different payment due dates and frequencies.

Payment Frequency Options

USAA typically offers several payment frequency options to its members, including monthly, quarterly, semi-annually, and annually. This flexibility allows members to choose a payment schedule that aligns with their financial situation and preferences. For example, members who prefer to budget on a monthly basis can opt for monthly payments, while those who might find it more convenient to pay less frequently can choose a quarterly, semi-annual, or annual payment plan.

Payment Methods

USAA provides its members with a variety of payment methods to make premium payments convenient and accessible. These methods include online payments through the USAA website or mobile app, phone payments, mail payments, and automatic bank drafts. The ability to set up automatic payments can be particularly useful for ensuring that payments are made on time, thus avoiding late fees and potential lapses in coverage.

| Payment Method | Description |

|---|---|

| Online Payment | Payment made through the USAA website or mobile app |

| Phone Payment | Payment made over the phone with a USAA representative |

| Mail Payment | Payment made by mailing a check or money order to USAA |

| Automatic Bank Draft | Automatic payment from the member's bank account |

Grace Period and Late Fees

USAA, like most insurance providers, offers a grace period for payments. This grace period is a short time frame after the due date during which a payment can still be made without penalty or lapse in coverage. However, it’s crucial for members to be aware of the exact length of their grace period, as it can vary. Making payments within this period is vital to avoid late fees and ensure uninterrupted insurance coverage.

Payment Schedule Changes

Members may need to adjust their payment schedule due to changes in financial circumstances or personal preferences. USAA allows members to modify their payment frequency or method, though certain restrictions or requirements may apply. It’s recommended that members contact USAA customer service to discuss potential changes to their payment schedule, ensuring that any adjustments are made correctly and do not negatively impact their coverage.

Key Points

- USAA offers flexible payment schedules, including monthly, quarterly, semi-annual, and annual payments, to accommodate different member needs.

- Various payment methods are available, such as online payments, phone payments, mail payments, and automatic bank drafts, making it convenient for members to make payments.

- A grace period is provided for late payments, but members should be aware of the specific duration to avoid late fees and lapses in coverage.

- Members can adjust their payment schedule by contacting USAA customer service, though certain conditions may apply.

- Reviewing policy documents or contacting USAA directly is essential for understanding the specific payment terms and options for each insurance or financial product.

In conclusion, understanding and managing the USAA payment schedule effectively is vital for maintaining continuous insurance coverage and avoiding unnecessary fees. By being aware of the payment frequency options, methods, grace period, and the process for making changes to the payment schedule, USAA members can better navigate their financial obligations and make informed decisions about their insurance and financial products.

How can I change my USAA payment schedule?

+To change your USAA payment schedule, you should contact USAA customer service. They will guide you through the process and inform you of any requirements or restrictions that may apply to changing your payment frequency or method.

What happens if I miss a payment?

+If you miss a payment, you may be subject to late fees, and your coverage could potentially lapse if the payment is not made within the grace period. It’s essential to make payments on time or contact USAA to discuss possible arrangements if you’re facing difficulties in making a payment.

Can I pay my USAA bill online?

+Yes, USAA offers online payments as a convenient option for its members. You can log in to your account on the USAA website or through the USAA mobile app to make payments securely and efficiently.