UnitedHealth Group, one of the largest health insurance companies in the United States, has been a stalwart on the Nasdaq stock exchange under the ticker symbol UNH. With a history dating back to 1974, the company has evolved significantly over the years, expanding its operations and services to become a leading player in the healthcare industry. As of 2022, UnitedHealth Group boasts a market capitalization of over $400 billion, solidifying its position as one of the most valuable companies in the world.

Company Overview

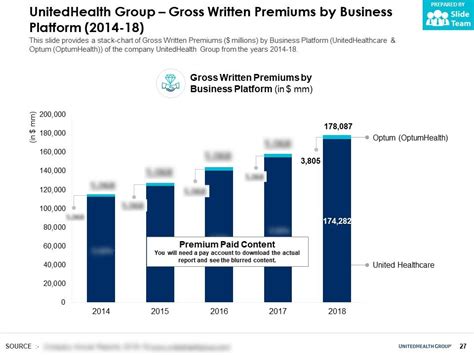

UnitedHealth Group operates through two primary business segments: UnitedHealthcare and Optum. UnitedHealthcare is the company’s health benefits segment, which provides a wide range of health insurance products and services to individuals, employers, and government entities. Optum, on the other hand, is the company’s health services segment, which offers a variety of services, including pharmacy benefit management, health care delivery, and health care technology. This diversified business model allows UnitedHealth Group to maintain a strong presence in the healthcare market, with a customer base of over 149 million individuals worldwide.

Financial Performance

UnitedHealth Group’s financial performance has been impressive in recent years, with the company reporting revenues of 324.1 billion in 2022, representing a 12.8% increase from the previous year. Net earnings for 2022 stood at 20.1 billion, with a net margin of 6.2%. The company’s strong financials are a testament to its ability to navigate the complexities of the healthcare industry, while also investing in innovative technologies and services to drive growth. As of 2022, UnitedHealth Group’s return on equity (ROE) stands at 24.1%, indicating a high level of profitability.

| Financial Metric | 2022 Value |

|---|---|

| Revenue | $324.1 billion |

| Net Earnings | $20.1 billion |

| Net Margin | 6.2% |

| Return on Equity (ROE) | 24.1% |

Key Points

Key Points

- UnitedHealth Group is one of the largest health insurance companies in the United States, with a market capitalization of over 400 billion.</li> <li>The company operates through two primary business segments: UnitedHealthcare and Optum.</li> <li>UnitedHealth Group reported revenues of 324.1 billion in 2022, representing a 12.8% increase from the previous year.

- The company’s net earnings for 2022 stood at $20.1 billion, with a net margin of 6.2%.

- UnitedHealth Group’s return on equity (ROE) stands at 24.1%, indicating a high level of profitability.

Investment Analysis

From an investment perspective, UnitedHealth Group’s stock has been a strong performer in recent years, with the company’s shares trading at a price-to-earnings (P/E) ratio of 22.1 as of 2022. While this may seem high compared to some of its peers, the company’s strong financial performance and growth prospects justify the premium valuation. Additionally, UnitedHealth Group’s dividend yield of 1.3% provides a relatively attractive return for income-seeking investors.

Risk Factors

Despite its strong financial performance, UnitedHealth Group faces several risk factors that could impact its stock price. These include regulatory changes, competition from other health insurance companies, and the potential for increased healthcare costs. Additionally, the company’s reliance on government contracts and reimbursement rates poses a risk to its profitability. However, UnitedHealth Group’s diversified business model and strong management team mitigate some of these risks, making it a relatively attractive investment opportunity.

What is UnitedHealth Group's business model?

+UnitedHealth Group operates through two primary business segments: UnitedHealthcare and Optum. UnitedHealthcare provides health insurance products and services, while Optum offers health services, including pharmacy benefit management, health care delivery, and health care technology.

What are UnitedHealth Group's key financial metrics?

+UnitedHealth Group's key financial metrics include revenue, net earnings, net margin, and return on equity (ROE). As of 2022, the company reported revenues of $324.1 billion, net earnings of $20.1 billion, a net margin of 6.2%, and an ROE of 24.1%.

What are the risks associated with investing in UnitedHealth Group?

+The risks associated with investing in UnitedHealth Group include regulatory changes, competition from other health insurance companies, and the potential for increased healthcare costs. Additionally, the company's reliance on government contracts and reimbursement rates poses a risk to its profitability.

In conclusion, UnitedHealth Group is a well-established player in the healthcare industry, with a strong financial performance and growth prospects. While the company faces several risk factors, its diversified business model and strong management team mitigate some of these risks, making it a relatively attractive investment opportunity. As the healthcare industry continues to evolve, UnitedHealth Group is well-positioned to navigate the complexities of the market and drive long-term growth and profitability.