As a retiree from Citgo, navigating the complexities of healthcare can be a daunting task, especially when it comes to understanding the specifics of your United Health Care (UHC) benefits. With the ever-changing landscape of healthcare, it's essential to stay informed about the options available to you. In this article, we will delve into the details of UHC plans for Citgo retirees, exploring the key features, benefits, and any potential considerations that may impact your healthcare decisions.

Key Points

- Understanding the UHC plan options available to Citgo retirees, including Medicare Advantage and supplemental plans.

- Recognizing the importance of network coverage and how it affects access to healthcare providers.

- Exploring the costs associated with UHC plans, including premiums, deductibles, and out-of-pocket expenses.

- Considering the role of preventive care and wellness programs in maintaining health and reducing healthcare costs.

- Evaluating the customer service and support offered by UHC to ensure a smooth and satisfactory experience.

Introduction to United Health Care for Citgo Retirees

As a Citgo retiree, you are likely eligible for certain health insurance benefits through United Health Care. UHC offers a range of plans designed to meet the unique needs of retirees, including Medicare Advantage plans and supplemental insurance options. These plans are designed to provide comprehensive coverage, helping you manage healthcare costs and ensure access to quality care.

Understanding UHC Plan Options

UHC offers several plan options for Citgo retirees, each with its own set of benefits and features. Medicare Advantage plans, for example, combine the benefits of Original Medicare (Parts A and B) with additional coverage for things like prescription drugs, vision, and dental care. Supplemental plans, on the other hand, are designed to fill gaps in Original Medicare coverage, providing additional financial protection against out-of-pocket expenses.

| Plan Type | Description | Key Benefits |

|---|---|---|

| Medicare Advantage | Combines Parts A and B with extra benefits | Prescription drug coverage, vision, dental |

| Supplemental Insurance | Covers gaps in Original Medicare | Helps with deductibles, copays, and coinsurance |

Network Coverage and Provider Access

The network of healthcare providers is a critical aspect of any health insurance plan. UHC has an extensive network of participating providers, including doctors, hospitals, and specialty care facilities. Understanding which providers are part of your plan’s network is essential, as seeing an out-of-network provider can result in higher costs or even denial of coverage.

Cost Considerations

The cost of healthcare is a significant concern for many retirees. UHC plans come with various costs, including premiums, deductibles, copays, and coinsurance. It’s essential to understand these costs and how they may impact your budget. Additionally, considering the potential for out-of-pocket expenses can help you prepare financially for unexpected healthcare needs.

According to UHC, the average monthly premium for a Medicare Advantage plan can range from $0 to over $100, depending on the plan and your location. Deductibles can vary widely as well, from $0 to several thousand dollars per year. Understanding these costs and how they apply to your situation can help you make informed decisions about your healthcare coverage.

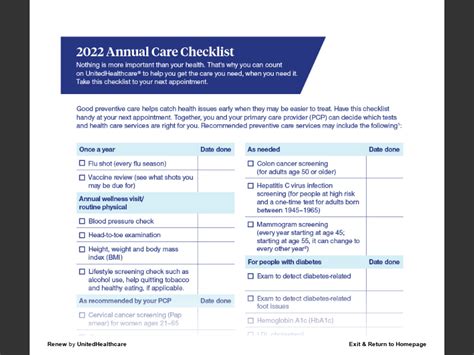

Preventive Care and Wellness Programs

Preventive care and wellness programs are vital components of any healthcare strategy. UHC offers a range of programs and services designed to promote health and prevent illness, including screenings, vaccinations, and health coaching. Participating in these programs can not only improve your health but also help reduce healthcare costs over time.

Customer Service and Support

Finally, the level of customer service and support provided by UHC can significantly impact your overall experience. From help with plan selection to assistance with claims and billing, having access to knowledgeable and responsive customer service representatives can make a big difference. UHC offers various channels for support, including phone, email, and online resources, to help you navigate any questions or concerns you may have.

What UHC plans are available to Citgo retirees?

+Citgo retirees may be eligible for UHC Medicare Advantage plans and supplemental insurance options, designed to provide comprehensive coverage and manage healthcare costs.

How do I choose the right UHC plan for my needs?

+Consider your health needs, budget, and preferences when selecting a UHC plan. Review the plan's network, coverage, and costs to ensure it aligns with your requirements.

What role do preventive care and wellness programs play in my healthcare strategy?

+Preventive care and wellness programs are crucial for promoting health, preventing illness, and reducing healthcare costs. UHC offers various programs and services to support these efforts.

In conclusion, navigating the world of healthcare as a Citgo retiree with United Health Care requires careful consideration of your options and needs. By understanding the UHC plan options available to you, the importance of network coverage, and the role of preventive care and wellness programs, you can make informed decisions about your healthcare. Remember, your health and wellbeing are paramount, and having the right support and resources can make all the difference.