Trading in the financial markets can be a daunting task, especially for those who are new to the game. With so many factors to consider and an overwhelming amount of information to process, it's easy to feel lost. However, with the right strategies and mindset, anyone can become a successful trader. In this article, we'll explore five TDR trade tips that can help you navigate the markets with confidence.

Key Points

- Understanding market trends and patterns is crucial for making informed trading decisions

- Setting clear goals and risk management strategies can help you stay focused and avoid costly mistakes

- Staying up-to-date with market news and analysis can provide valuable insights and trading opportunities

- Developing a trading plan and sticking to it can help you avoid emotional decision-making and stay on track

- Continuously learning and improving your trading skills can help you stay ahead of the curve and achieve long-term success

Tip 1: Understand Market Trends and Patterns

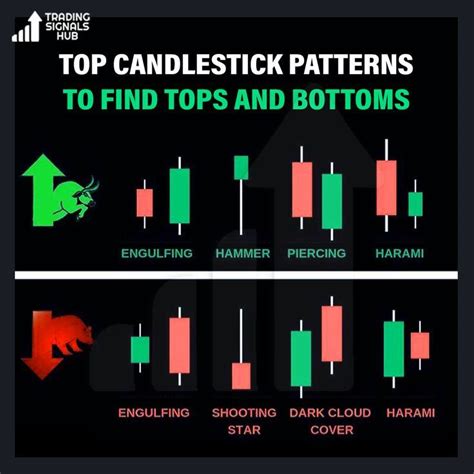

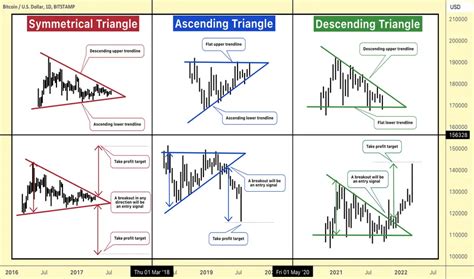

One of the most important things to understand when it comes to trading is market trends and patterns. By recognizing and analyzing these trends, you can make more informed trading decisions and increase your chances of success. There are several types of trends to look out for, including uptrends, downtrends, and sideways trends. Uptrends occur when the market is consistently moving higher, while downtrends occur when the market is consistently moving lower. Sideways trends, on the other hand, occur when the market is trading within a narrow range. By understanding these trends and patterns, you can develop a more effective trading strategy and improve your overall performance.

Identifying Trends and Patterns

So, how do you identify trends and patterns in the market? One way to do this is by using technical analysis tools such as charts and indicators. Charts can help you visualize the market’s price action and identify trends and patterns, while indicators can provide additional insights and confirmations. Some popular technical indicators include moving averages, relative strength index (RSI), and Bollinger Bands. By combining these tools with fundamental analysis and market news, you can gain a more complete understanding of the market and make more informed trading decisions.

| Trend Type | Characteristics |

|---|---|

| Uptrend | Consistently higher highs and higher lows |

| Downtrend | Consistently lower highs and lower lows |

| Sideways Trend | Trading within a narrow range |

Tip 2: Set Clear Goals and Risk Management Strategies

Setting clear goals and risk management strategies is essential for achieving success in trading. By defining your goals and risk tolerance, you can develop a more effective trading plan and avoid costly mistakes. Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART), and should align with your overall trading strategy. Your risk management strategy, on the other hand, should include position sizing, stop-loss orders, and risk-reward ratios. By managing your risk effectively, you can protect your capital and achieve your long-term goals.

Developing a Risk Management Strategy

So, how do you develop a risk management strategy? One way to do this is by using a position sizing formula, which can help you determine the optimal position size based on your risk tolerance and market conditions. You can also use stop-loss orders to limit your potential losses and protect your capital. Additionally, you can use risk-reward ratios to ensure that your potential rewards outweigh your potential risks. By combining these strategies, you can develop a more effective risk management plan and improve your overall performance.

Tip 3: Stay Up-to-Date with Market News and Analysis

Staying up-to-date with market news and analysis is essential for making informed trading decisions. By staying informed, you can gain valuable insights and trading opportunities, and stay ahead of the curve. There are several ways to stay up-to-date, including reading financial news and analysis, following market experts and analysts, and using social media and online forums. By combining these sources, you can gain a more complete understanding of the market and make more informed trading decisions.

Using Market News and Analysis

So, how do you use market news and analysis to inform your trading decisions? One way to do this is by using a news-based trading strategy, which involves making trades based on market news and events. You can also use technical analysis tools such as charts and indicators to confirm your trading decisions and identify potential trading opportunities. Additionally, you can use fundamental analysis to understand the underlying factors driving market trends and make more informed trading decisions.

Tip 4: Develop a Trading Plan and Stick to It

Developing a trading plan and sticking to it is essential for achieving success in trading. By defining your trading strategy and risk management plan, you can avoid emotional decision-making and stay on track. Your trading plan should include your goals, risk management strategy, and trading rules, and should be based on your market analysis and research. By sticking to your plan, you can avoid costly mistakes and achieve your long-term goals.

Creating a Trading Plan

So, how do you create a trading plan? One way to do this is by using a trading plan template, which can help you define your goals, risk management strategy, and trading rules. You can also use a trading journal to track your trades and identify areas for improvement. Additionally, you can use backtesting and simulation tools to test your trading plan and identify potential weaknesses. By combining these tools, you can develop a more effective trading plan and improve your overall performance.

Tip 5: Continuously Learn and Improve Your Trading Skills

Continuously learning and improving your trading skills is essential for achieving long-term success in trading. By staying up-to-date with market trends and analysis, and continuously learning and improving your trading skills, you can stay ahead of the curve and achieve your goals. There are several ways to continuously learn and improve, including reading books and articles, attending seminars and workshops, and using online resources and courses. By combining these sources, you can gain a more complete understanding of the market and improve your overall performance.

What is the most important thing to consider when developing a trading plan?

+The most important thing to consider when developing a trading plan is your risk management strategy. By defining your risk tolerance and developing a risk management plan, you can protect your capital and achieve your long-term goals.

How do I stay up-to-date with market news and analysis?

+There are several ways to stay up-to-date with market news and analysis, including reading financial news and analysis, following market experts and analysts, and using social media and online forums. By combining these sources, you can gain a more complete understanding of the market and make more informed trading decisions.

What is the best way to develop a trading plan?

+The best way to develop a trading plan is by using a trading plan template, which can help you define your goals, risk management strategy, and trading rules. You can also use a trading journal to track your trades and identify areas for improvement. Additionally, you can use backtesting and simulation tools to test your trading plan and identify potential weaknesses.

In conclusion, trading in the financial markets can be a challenging but rewarding experience. By understanding market trends and patterns, setting clear goals and risk management strategies, staying up-to-date with market news and analysis, developing a trading plan and sticking to it, and continuously learning and improving your trading skills, you can achieve long-term success and reach your financial goals. Remember to always stay disciplined, patient, and informed, and to continuously adapt to changing market conditions. With the right mindset and strategies, you can become a successful trader and achieve your financial objectives.