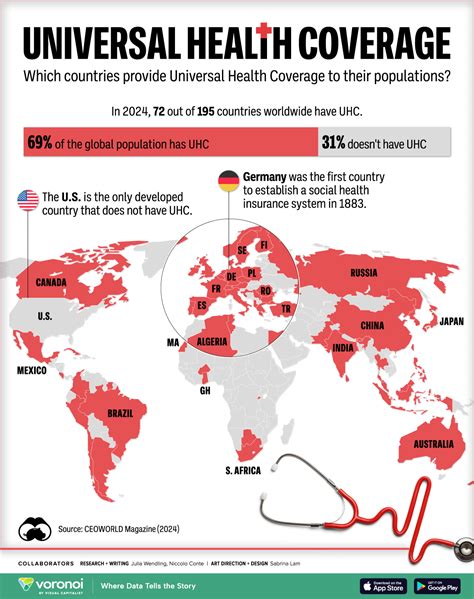

The concept of universal healthcare has been a topic of discussion and debate in many countries, with various models and funding mechanisms being explored. One of the key aspects of implementing universal healthcare is determining the appropriate tax rate to support such a system. As we approach 2024, it is essential to examine the potential tax rates that could be used to fund universal healthcare, considering the complexities and nuances involved in such a system.

Understanding Universal Healthcare and Its Funding Mechanisms

Universal healthcare refers to a healthcare system where every citizen has access to essential healthcare services, regardless of their income or social status. The funding mechanisms for universal healthcare can vary, but they often involve a combination of taxes, premiums, and out-of-pocket payments. In the context of tax-funded universal healthcare, the tax rate is a critical component, as it directly affects the amount of revenue generated to support the healthcare system.

Types of Taxes for Universal Healthcare

There are several types of taxes that can be used to fund universal healthcare, including income taxes, payroll taxes, and value-added taxes (VAT). Each type of tax has its advantages and disadvantages, and the choice of tax ultimately depends on the specific context and goals of the healthcare system. For example, income taxes can be progressive, meaning that higher-income individuals contribute a larger share of their income, while payroll taxes can be regressive, affecting lower-income individuals disproportionately.

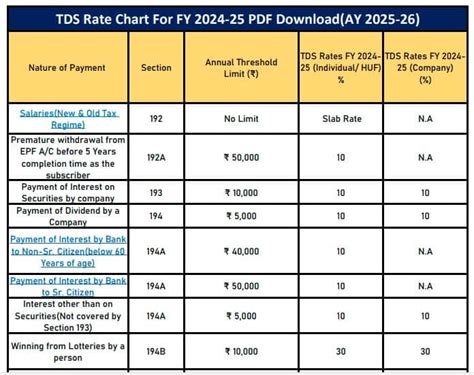

| Tax Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Income Tax | Progressive tax on individual income | Reduces income inequality, encourages economic growth | Complex to administer, may discourage work effort |

| Payroll Tax | Tax on employee wages, often used to fund social insurance programs | Simple to administer, stable revenue source | Regressive, affecting lower-income individuals disproportionately |

| VAT (Value-Added Tax) | Consumption tax on goods and services | Broad tax base, encourages economic efficiency | Regressive, may affect low-income households disproportionately |

Key Points

- Universal healthcare can be funded through a combination of taxes, premiums, and out-of-pocket payments.

- The choice of tax type depends on the specific context and goals of the healthcare system.

- Income taxes can be progressive, while payroll taxes can be regressive.

- VAT can be an efficient tax, but it may affect low-income households disproportionately.

- The tax rate for universal healthcare will depend on various factors, including the scope of services, population demographics, and economic conditions.

Determining the Tax Rate for Universal Healthcare 2024

Determining the optimal tax rate for universal healthcare in 2024 requires careful consideration of various factors, including the scope of services, population demographics, and economic conditions. A higher tax rate can provide more comprehensive coverage, but it may also lead to increased tax burden and potential economic distortions. On the other hand, a lower tax rate may result in inadequate funding, compromising the quality and accessibility of healthcare services.

Factors Influencing the Tax Rate

Several factors can influence the tax rate for universal healthcare, including the cost of healthcare services, population growth, and economic conditions. For example, an aging population may require more healthcare services, increasing the demand for funding. Similarly, economic downturns may reduce tax revenues, making it challenging to maintain adequate funding for universal healthcare.

According to a study by the Organisation for Economic Co-operation and Development (OECD), the average tax-to-GDP ratio for OECD countries is around 34.3%. However, the tax rate for universal healthcare can vary significantly, ranging from around 10% in some countries to over 20% in others. For instance, Sweden has a tax rate of around 22.2%, while Japan has a tax rate of around 10.9%.

Forward-Looking Implications and Recommendations

As we move forward in 2024, it is crucial to consider the long-term implications of the tax rate for universal healthcare. Policymakers must balance the need for adequate funding with the potential economic distortions and tax burden. Some potential strategies for achieving this balance include implementing a progressive tax system, increasing tax efficiency, and exploring alternative funding mechanisms, such as premiums or out-of-pocket payments.

In conclusion, determining the tax rate for universal healthcare in 2024 requires a nuanced understanding of the complex factors involved. By considering the scope of services, population demographics, and economic conditions, policymakers can create a more efficient and effective tax system that supports high-quality, accessible healthcare for all citizens.

What is the average tax-to-GDP ratio for OECD countries?

+The average tax-to-GDP ratio for OECD countries is around 34.3%.

What are some potential strategies for achieving a balance between tax rates and coverage?

+Some potential strategies include implementing a progressive tax system, increasing tax efficiency, and exploring alternative funding mechanisms, such as premiums or out-of-pocket payments.

How can policymakers determine the optimal tax rate for universal healthcare?

+Policymakers can determine the optimal tax rate by considering the scope of services, population demographics, and economic conditions, as well as weighing the trade-offs between tax rates, coverage, and economic efficiency.

Meta Description: Discover the complexities of determining the tax rate for universal healthcare in 2024, including the factors that influence the tax rate and potential strategies for achieving a balance between tax rates and coverage.