The Securian claim process is a crucial aspect of the company's life insurance and annuity products, designed to provide financial support to policyholders and their beneficiaries during difficult times. As a leading insurance provider, Securian Financial Group has established a comprehensive claims process to ensure that policyholders receive the benefits they are entitled to in a timely and efficient manner. In this article, we will delve into the details of the Securian claim process, exploring the steps involved, the required documentation, and the importance of timely submission.

Key Points

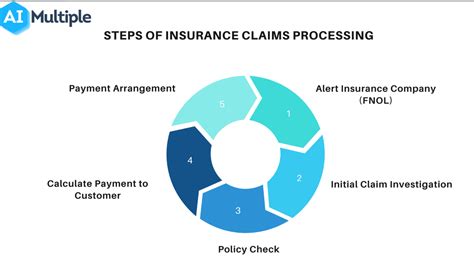

- The Securian claim process involves several steps, including notification, documentation, and review.

- Policyholders must provide required documentation, such as death certificates and proof of identity, to support their claim.

- Timely submission of claims is essential to ensure prompt payment of benefits.

- Securian offers various claim submission options, including online, phone, and mail.

- The company's claims team is available to assist policyholders throughout the process.

Understanding the Securian Claim Process

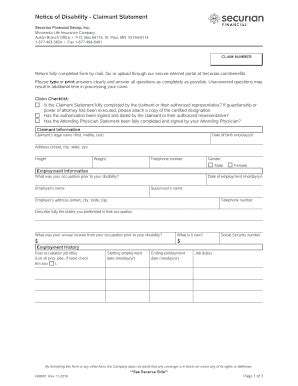

The Securian claim process is designed to be straightforward and efficient, with the goal of providing policyholders with the financial support they need as quickly as possible. The process typically begins with notification of the claim, which can be done online, by phone, or through the mail. Policyholders or their beneficiaries must provide required documentation, such as death certificates, proof of identity, and policy information, to support their claim. The claims team at Securian will then review the submission and verify the information provided.

Required Documentation

The documentation required to support a claim with Securian may vary depending on the type of policy and the nature of the claim. However, some common documents that may be required include:

- Death certificate

- Proof of identity (driver’s license, passport, etc.)

- Policy information (policy number, beneficiary information, etc.)

- Medical records or autopsy reports (if applicable)

It is essential to ensure that all required documentation is provided to avoid delays in the claims process. Policyholders can contact Securian’s claims team to confirm the specific documentation needed to support their claim.

| Claim Type | Required Documentation |

|---|---|

| Life Insurance Claim | Death certificate, proof of identity, policy information |

| Accidental Death Benefit Claim | Death certificate, proof of identity, policy information, medical records or autopsy reports |

| Annuity Claim | Proof of identity, policy information, annuity contract |

Submission Options

Securian offers various claim submission options to accommodate the needs of policyholders. Claims can be submitted online, by phone, or through the mail. The online submission option is available 24⁄7, allowing policyholders to initiate the claims process at their convenience. Phone submissions can be made by calling Securian’s claims department during business hours, while mail submissions can be sent to the address listed on the company’s website.

Claims Team Support

Securian’s claims team is available to assist policyholders throughout the claims process. The team can provide guidance on required documentation, answer questions about the claims process, and offer support during a difficult time. Policyholders can contact the claims team by phone or email to seek assistance or ask questions about their claim.

What is the first step in the Securian claim process?

+The first step in the Securian claim process is to notify the company of the claim, which can be done online, by phone, or through the mail.

What documentation is required to support a life insurance claim with Securian?

+The documentation required to support a life insurance claim with Securian may include a death certificate, proof of identity, and policy information.

How long does the Securian claim process typically take?

+The length of time it takes to process a claim with Securian may vary depending on the complexity of the claim and the timeliness of documentation submission. However, the company strives to process claims as quickly as possible, typically within 5-10 business days.

In conclusion, the Securian claim process is designed to provide policyholders with the financial support they need during difficult times. By understanding the steps involved, the required documentation, and the importance of timely submission, policyholders can navigate the claims process with confidence. With the support of Securian’s claims team, policyholders can trust that their claims will be processed efficiently and accurately, providing them with the benefits they are entitled to.