The state of South Carolina offers its employees a comprehensive health insurance program, which is designed to provide affordable and high-quality coverage to its workforce. The program is administered by the South Carolina Public Employee Benefit Authority (PEBA), which is responsible for managing the state's health insurance plans, including the State Health Plan. As a state employee, understanding the health insurance premiums and how they are structured is essential for making informed decisions about one's benefits.

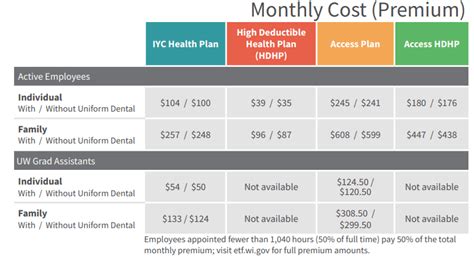

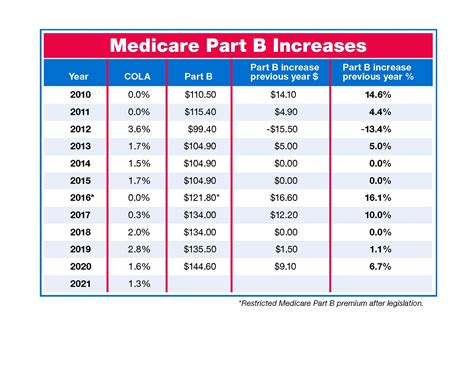

In South Carolina, state employee health insurance premiums are determined by a variety of factors, including the employee's salary, job classification, and the level of coverage chosen. The state offers several different health insurance plans, each with its own premium rates and coverage levels. The most popular plans include the Standard Plan, the Savings Plan, and the Premium Plan, each with varying levels of coverage and corresponding premium rates. For instance, in 2022, the monthly premium for the Standard Plan was $134.50 for single coverage, while the Savings Plan and Premium Plan were $104.50 and $164.50, respectively.

Key Points

- The South Carolina Public Employee Benefit Authority (PEBA) administers the state's health insurance program.

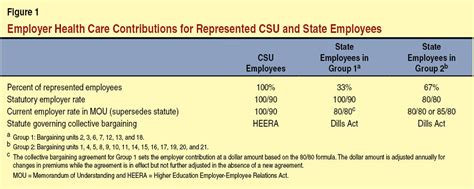

- State employee health insurance premiums are determined by factors such as salary, job classification, and level of coverage chosen.

- The state offers several health insurance plans, including the Standard Plan, the Savings Plan, and the Premium Plan.

- Premium rates vary depending on the plan and level of coverage, with single coverage ranging from $104.50 to $164.50 per month in 2022.

- Employees may be eligible for subsidies or discounts on their premiums based on their income level or participation in wellness programs.

Understanding the Different Health Insurance Plans

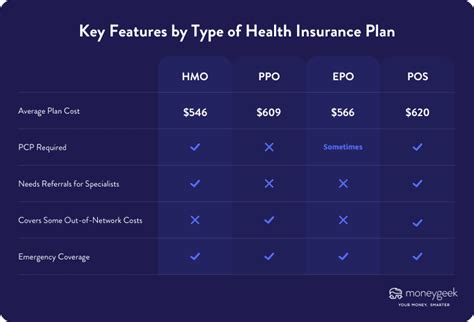

The Standard Plan is the most comprehensive plan offered by the state, providing a high level of coverage for medical expenses, including doctor visits, hospital stays, and prescriptions. The Savings Plan, on the other hand, has a lower premium rate but requires employees to pay a higher deductible and copayment for certain services. The Premium Plan offers the highest level of coverage, with lower deductibles and copayments, but at a higher premium rate. According to the PEBA’s annual report, in 2022, the Standard Plan had a participation rate of 62%, while the Savings Plan and Premium Plan had participation rates of 21% and 17%, respectively.

Factors Affecting Premium Rates

Premium rates for state employee health insurance in South Carolina are influenced by a variety of factors, including the employee’s age, health status, and tobacco use. Employees who are older or have pre-existing medical conditions may pay higher premiums, while those who participate in wellness programs or do not use tobacco may be eligible for discounts. For example, a study by the Centers for Disease Control and Prevention (CDC) found that employees who participate in wellness programs can reduce their health care costs by up to 30%. Additionally, the state’s health insurance program offers a tobacco cessation program, which provides employees with resources and support to quit smoking and reduce their premium rates.

| Plan | Monthly Premium (Single Coverage) | Monthly Premium (Family Coverage) |

|---|---|---|

| Standard Plan | $134.50 | $341.50 |

| Savings Plan | $104.50 | $261.50 |

| Premium Plan | $164.50 | $414.50 |

Subsidies and Discounts

Some state employees may be eligible for subsidies or discounts on their health insurance premiums based on their income level or participation in wellness programs. For example, employees who participate in the state’s wellness program, which includes activities such as health screenings and fitness classes, may be eligible for a discount on their premium rates. Additionally, employees with lower incomes may be eligible for subsidies to help reduce their premium costs. According to the PEBA’s website, in 2022, over 10,000 state employees participated in the wellness program, resulting in an average premium reduction of $20 per month.

Open Enrollment and Plan Changes

State employees in South Carolina typically have the opportunity to change their health insurance plan or add/drop dependents during the annual open enrollment period, which usually takes place in the fall. During this time, employees can review their current coverage and make changes to their plan selection, dependent coverage, or premium payments. It’s essential for employees to carefully review their benefits and premium rates during this period to ensure they are making the most of their coverage. For instance, employees who experience a change in family status, such as marriage or divorce, may need to update their dependent coverage during open enrollment.

How do I enroll in the state's health insurance program?

+New employees can enroll in the state's health insurance program during their initial benefits enrollment period, which typically takes place within the first 30 days of employment. Existing employees can make changes to their coverage during the annual open enrollment period or due to a qualifying life event, such as marriage or divorce.

Can I change my health insurance plan outside of open enrollment?

+Yes, employees may be able to change their health insurance plan outside of open enrollment due to a qualifying life event, such as marriage, divorce, or the birth of a child. Employees should contact the PEBA to determine if they are eligible to make changes to their coverage.

How do I determine which health insurance plan is best for me?

+Employees should carefully review the benefits and premium rates for each health insurance plan to determine which plan best meets their needs. Factors to consider include the level of coverage, premium rates, deductible, copayment, and coinsurance. Employees may also want to consult with a benefits representative or financial advisor to help make an informed decision.

In conclusion, state employee health insurance premiums in South Carolina are an essential part of the state’s benefits package, providing employees with access to high-quality health care at an affordable cost. By understanding the different health insurance plans, factors affecting premium rates, and subsidies and discounts available, employees can make informed decisions about their benefits and ensure they are making the most of their coverage. As the healthcare landscape continues to evolve, it’s crucial for employees to stay informed and adapt to changes in the health insurance market to optimize their benefits and premium rates.