When it comes to determining one's take-home pay in North Carolina, understanding the state's tax laws and how they impact salary is crucial. North Carolina, like many other states, has its own set of income tax rates and regulations that can affect the amount of money an individual takes home after taxes. The North Carolina state income tax rate ranges, and the federal income tax rates also play a significant role in the final take-home pay. A salary calculator can be a valuable tool for individuals looking to understand their net income, helping them plan their finances more effectively.

Understanding North Carolina Income Tax

North Carolina’s income tax system is designed to tax the income of its residents. The state income tax rate in North Carolina is a flat rate, meaning that regardless of the amount of income earned, the same tax rate applies. However, it’s essential to note that while the state tax rate may be flat, the federal income tax system is progressive, with different tax brackets applying to different levels of income. This means that as an individual’s income increases, they may move into a higher tax bracket, affecting their overall tax liability.

Impact of Federal Income Tax

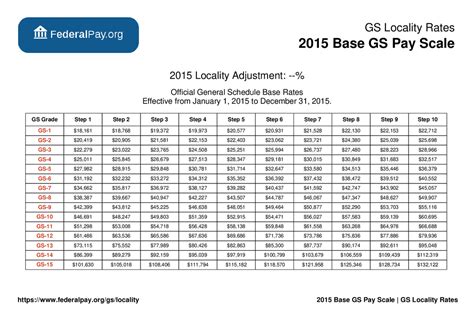

Federal income tax rates are progressive, with seven tax brackets ranging from 10% to 37%. The tax bracket an individual falls into depends on their filing status and the amount of their taxable income. Understanding both the federal and state income tax rates is vital for accurately calculating take-home pay. A salary calculator that takes into account both state and federal taxes can provide a more accurate picture of an individual’s net income.

| Federal Tax Bracket | Tax Rate | Single Filers | Joint Filers |

|---|---|---|---|

| 10% | 10% | $0 - $9,875 | $0 - $19,750 |

| 12% | 12% | $9,876 - $40,125 | $19,751 - $80,250 |

| 22% | 22% | $40,126 - $80,250 | $80,251 - $171,050 |

| 24% | 24% | $80,251 - $164,700 | $171,051 - $326,600 |

| 32% | 32% | $164,701 - $214,700 | $326,601 - $414,700 |

| 35% | 35% | $214,701 - $518,400 | $414,701 - $622,050 |

| 37% | 37% | $518,401+ | $622,051+ |

Utilizing a Salary Calculator for NC

A salary calculator designed for North Carolina can help individuals understand their net income by taking into account both state and federal income taxes. These calculators typically require the user to input their gross income, filing status, and number of dependents. Some advanced calculators may also ask for information about deductions and exemptions the individual is eligible for. By using a salary calculator, individuals can get a more accurate estimate of their take-home pay, helping them make informed financial decisions.

Considerations for Salary Calculations

When calculating salary, several factors can impact the final take-home pay. These include but are not limited to, deductions for health insurance, 401(k) contributions, and other pre-tax deductions. Additionally, post-tax deductions such as union dues or life insurance premiums can also reduce take-home pay. Understanding these factors and how they impact net income is crucial for financial planning.

Key Points

- North Carolina has a flat state income tax rate, but federal income tax rates are progressive.

- A salary calculator can help individuals estimate their take-home pay by considering both state and federal taxes.

- Deductions and exemptions can significantly impact taxable income and thus take-home pay.

- Understanding the impact of federal and state taxes on income is crucial for financial planning.

- Utilizing a salary calculator specific to North Carolina can provide a more accurate estimate of net income.

In conclusion, calculating take-home pay in North Carolina involves understanding both state and federal income tax laws. A salary calculator can be a valuable tool in estimating net income, helping individuals make informed financial decisions. By considering factors such as deductions, exemptions, and the progressive nature of federal income tax rates, individuals can get a more accurate picture of their financial situation.

How does North Carolina’s flat state income tax rate affect my take-home pay?

+North Carolina’s flat state income tax rate means that the same rate applies to all income levels. However, when combined with federal income taxes, which are progressive, the overall tax liability can still increase with income level.

What factors can impact my take-home pay beyond just income tax rates?

+Beyond income tax rates, factors such as pre-tax deductions (e.g., 401(k) contributions), post-tax deductions (e.g., union dues), and exemptions can all impact take-home pay. Understanding these factors is key to accurately estimating net income.

How can I accurately estimate my take-home pay in North Carolina?

+Using a salary calculator specifically designed for North Carolina can help accurately estimate take-home pay. These calculators take into account both state and federal income taxes, as well as allow for the input of deductions and exemptions.