Peoplesoft, a comprehensive human capital management (HCM) solution, is widely used by organizations to streamline their payroll processes. For employees and HR personnel alike, understanding how to navigate and utilize Peoplesoft for paycheck-related tasks is essential. This guide aims to provide a detailed overview of the Peoplesoft paycheck process, covering key aspects such as paycheck calculation, payment methods, and troubleshooting common issues.

Key Points

- Understanding Peoplesoft paycheck calculation and payment methods

- Navigating the Peoplesoft interface for paycheck-related tasks

- Troubleshooting common issues with Peoplesoft paychecks

- Utilizing Peoplesoft reporting and analytics for payroll insights

- Best practices for maintaining accurate and compliant payroll data in Peoplesoft

Peoplesoft Paycheck Calculation and Payment Methods

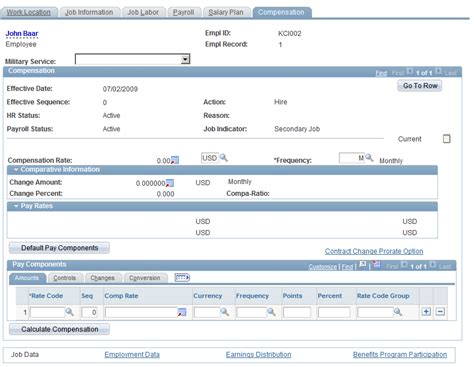

Peoplesoft utilizes a sophisticated algorithm to calculate employee paychecks, taking into account various factors such as salary, benefits, deductions, and tax withholdings. The system supports multiple payment methods, including direct deposit, paper checks, and paycards. Employees can access their paycheck information, including pay stubs and year-end tax forms, through the Peoplesoft self-service portal.

Understanding Paycheck Components

A typical paycheck in Peoplesoft consists of several components, including gross pay, deductions, taxes, and net pay. Gross pay represents the employee’s total earnings before any deductions or taxes are applied. Deductions may include health insurance premiums, 401(k) contributions, and other voluntary benefits. Taxes, including federal, state, and local income taxes, are withheld from the employee’s gross pay. Net pay, also known as take-home pay, is the amount of money the employee receives after all deductions and taxes have been applied.

| Paycheck Component | Description |

|---|---|

| Gross Pay | Total earnings before deductions and taxes |

| Deductions | Voluntary benefits, such as health insurance and 401(k) contributions |

| Taxes | Federal, state, and local income taxes withheld from gross pay |

| Net Pay | Take-home pay after all deductions and taxes have been applied |

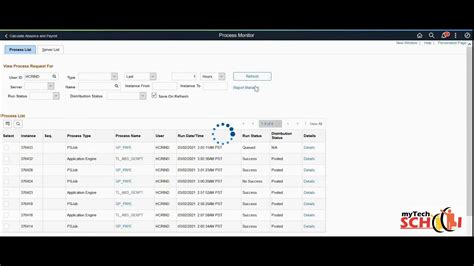

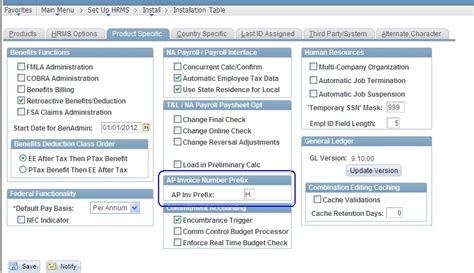

Navigating the Peoplesoft Interface for Paycheck-Related Tasks

The Peoplesoft interface provides a user-friendly platform for employees and HR personnel to manage paycheck-related tasks. Employees can access their paycheck information, update their personal and banking information, and view their pay stubs and tax forms. HR personnel can use the system to manage payroll processing, including running payroll reports, processing payroll corrections, and troubleshooting common issues.

Common Paycheck-Related Tasks in Peoplesoft

Some common paycheck-related tasks in Peoplesoft include:

- Viewing pay stubs and tax forms

- Updating personal and banking information

- Running payroll reports

- Processing payroll corrections

- Troubleshooting common paycheck issues

Troubleshooting Common Issues with Peoplesoft Paychecks

Despite the sophistication of Peoplesoft, issues can arise with paychecks. Common problems include incorrect pay amounts, missing or delayed payments, and tax withholding errors. To troubleshoot these issues, HR personnel can use Peoplesoft’s built-in reporting and analytics tools to identify the root cause of the problem and apply corrective actions.

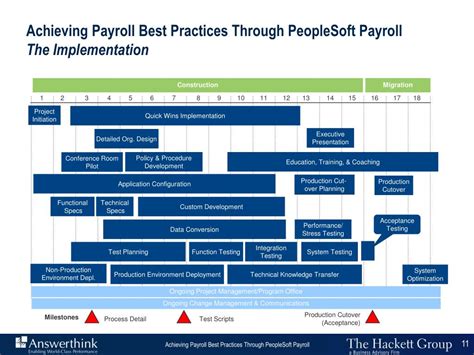

Best Practices for Maintaining Accurate and Compliant Payroll Data

To ensure accurate and compliant payroll data, organizations should adhere to best practices, including:

- Regularly reviewing and updating employee data

- Verifying payroll calculations and payments

- Maintaining accurate and complete payroll records

- Complying with relevant tax laws and regulations

- Providing ongoing training and support for HR personnel

How do I view my pay stubs and tax forms in Peoplesoft?

+To view your pay stubs and tax forms in Peoplesoft, log in to the self-service portal and navigate to the "Pay" section. From there, you can access your pay stubs and tax forms, including W-2 and 1099 forms.

What should I do if I notice an error on my paycheck?

+If you notice an error on your paycheck, contact your HR representative or payroll administrator immediately. They can help you identify the cause of the error and apply corrective actions to ensure accurate payment.

How can I update my personal and banking information in Peoplesoft?

+To update your personal and banking information in Peoplesoft, log in to the self-service portal and navigate to the "Personal Data" section. From there, you can update your address, phone number, and banking information, including direct deposit details.

Meta description suggestion: “Navigate the Peoplesoft paycheck process with ease. Learn how to calculate paychecks, manage payment methods, and troubleshoot common issues. Get expert insights and best practices for maintaining accurate and compliant payroll data.” (147 characters)