Pentagon Federal Credit Union, commonly referred to as PenFed, is a renowned financial institution that offers a wide range of services, including insurance products. For individuals seeking to manage their insurance information through PenFed, it's essential to understand the various options and resources available. PenFed's insurance services are designed to provide members with comprehensive coverage and protection for their assets, health, and well-being. This article aims to guide users through the process of accessing and managing their insurance information with PenFed, emphasizing the importance of staying informed and up-to-date on their policies.

Accessing PenFed My Insurance Info

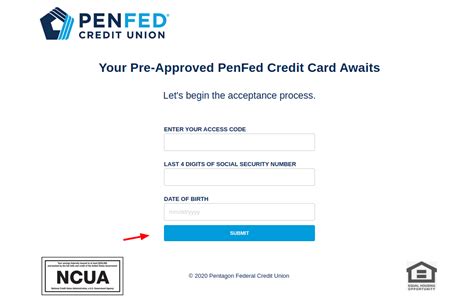

To access and manage your insurance information with PenFed, you can start by visiting their official website. The website is user-friendly and allows members to log in to their accounts securely. Once logged in, you can navigate to the insurance section, where you’ll find detailed information about your current policies, including policy numbers, coverage details, and billing information. It’s crucial to regularly review this information to ensure it’s accurate and up-to-date, as this can impact the effectiveness of your insurance coverage.

Understanding PenFed Insurance Products

PenFed offers a variety of insurance products to cater to the diverse needs of its members. These products include life insurance, disability insurance, long-term care insurance, and more. Each type of insurance is designed to address specific risks and provide financial protection under different circumstances. For instance, life insurance can provide a financial safety net for your loved ones in the event of your passing, while disability insurance can offer income replacement if you become unable to work due to illness or injury. Understanding the specifics of each insurance product is vital for making informed decisions about your coverage.

| Insurance Product | Description |

|---|---|

| Life Insurance | Provides a death benefit to beneficiaries upon the policyholder's death. |

| Disability Insurance | Offers income replacement if the policyholder becomes disabled and unable to work. |

| Long-Term Care Insurance | Covers the cost of long-term care services, such as nursing home care or home health care. |

Key Points

- Access your insurance information through the PenFed website or mobile app.

- Regularly review policy details to ensure accuracy and relevance to your current needs.

- Understand the different types of insurance products offered by PenFed and how they can benefit you.

- Consider consulting with a financial advisor for personalized advice on insurance and financial planning.

- Keep your contact and beneficiary information up-to-date to avoid any potential issues with policy administration or claims.

Managing Your PenFed Insurance Policies

Effective management of your insurance policies involves not only understanding the terms and conditions of your coverage but also regularly reviewing and updating your policies as needed. Life changes, such as marriage, divorce, the birth of a child, or a change in employment, can significantly impact your insurance needs. Additionally, it’s essential to be aware of any changes in insurance laws or regulations that might affect your policies. PenFed provides resources and tools to help members manage their insurance portfolios efficiently, including online account management, customer service support, and educational materials on insurance and financial planning.

Utilizing PenFed Resources for Insurance Management

PenFed is committed to empowering its members with the knowledge and tools necessary to make informed decisions about their insurance coverage. The credit union offers a range of resources, from detailed policy documents and FAQs to financial planning guides and workshops. Members can also consult with insurance professionals who can provide personalized advice and help with policy adjustments or new applications. By leveraging these resources, individuals can ensure they are maximizing the benefits of their insurance policies and maintaining a strong financial foundation.

How do I update my beneficiary information for my PenFed insurance policy?

+To update your beneficiary information, you can log in to your account on the PenFed website, navigate to the insurance section, and follow the prompts to edit your beneficiary details. Alternatively, you can contact PenFed's customer service for assistance.

What types of insurance does PenFed offer, and how can I apply for a policy?

+PenFed offers a variety of insurance products, including life, disability, and long-term care insurance. You can find more information and apply for a policy through the PenFed website or by consulting with a PenFed insurance representative.

How can I access my insurance policy documents and details online?

+You can access your insurance policy documents and details by logging in to your PenFed account online. Once logged in, navigate to the insurance section, where you can view and download policy documents, check coverage details, and perform other policy management tasks.

In conclusion, managing your insurance information with PenFed involves a combination of understanding the available insurance products, regularly reviewing policy details, and leveraging the resources provided by the credit union. By taking an active and informed approach to insurance management, individuals can ensure they have the right coverage in place to protect their financial well-being and achieve their long-term goals. Remember, your insurance policies are an integral part of your overall financial plan, and staying engaged with your coverage can provide peace of mind and financial security.