Calculating payroll checks in Florida involves several steps and considerations, including understanding the state's tax laws, deductions, and employer responsibilities. As of 2023, Florida has a unique set of regulations that employers must follow to ensure compliance with state and federal laws. In this article, we will delve into the specifics of calculating payroll checks in Florida, exploring the key components, deductions, and the role of payroll check calculators in streamlining the process.

Key Points

- Understanding Florida's state income tax exemption and its implications for payroll calculations

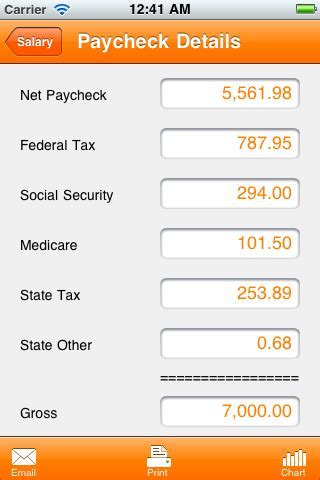

- Calculating federal income taxes, Social Security taxes, and Medicare taxes

- Considering other deductions such as health insurance, 401(k) contributions, and garnishments

- The importance of using a payroll check calculator for accuracy and compliance

- Adhering to Florida's labor laws and regulations regarding minimum wage, overtime, and employee classifications

Understanding Florida’s Tax Environment

Florida is one of the states with no state income tax, which simplifies the payroll calculation process to some extent. However, employers still need to deduct federal income taxes, Social Security taxes, and Medicare taxes from employees’ wages. The Federal Insurance Contributions Act (FICA) mandates that employers withhold 6.2% of an employee’s wages for Social Security and 1.45% for Medicare, with the employer matching these contributions. Understanding these federal tax requirements is crucial for accurate payroll calculations.

Federal Income Tax Withholding

The federal income tax withholding is based on the employee’s Form W-4, which provides the necessary information to determine the appropriate tax withholding. Employers must use the IRS’s income tax withholding tables or an approved alternative method to calculate the correct amount of federal income tax to withhold. As of the last update, the IRS has introduced new W-4 forms to better account for the Tax Cuts and Jobs Act (TCJA) changes, emphasizing the need for employees to review and update their withholding information if necessary.

| Tax Component | Employee Contribution | Employer Contribution |

|---|---|---|

| Social Security Tax | 6.2% of wages up to the wage base | 6.2% of wages up to the wage base |

| Medicare Tax | 1.45% of wages (additional 0.9% on wages above $200,000) | 1.45% of wages |

Using a Payroll Check Calculator in Florida

A payroll check calculator is an indispensable tool for Florida employers, helping to ensure accuracy and compliance with tax laws and labor regulations. These calculators can account for various deductions, including federal taxes, state-specific deductions (if applicable), health insurance premiums, retirement plan contributions, and garnishments. By inputting the employee’s gross pay, tax withholding information, and other relevant data, the calculator can provide the net pay and a detailed breakdown of deductions.

Considerations for Florida Employers

Beyond tax calculations, Florida employers must be aware of other labor laws and regulations. For instance, the minimum wage in Florida is subject to annual adjustments based on the Consumer Price Index. Employers must also comply with overtime pay regulations, classification of employees versus independent contractors, and workers’ compensation insurance requirements. Staying informed about these laws and using a reliable payroll check calculator can help employers navigate the complexities of payroll management in Florida.

In conclusion, calculating payroll checks in Florida requires a comprehensive understanding of federal and state regulations, alongside the use of specialized tools like payroll check calculators. By adhering to these guidelines and utilizing the right resources, employers can ensure compliance, accuracy, and efficiency in their payroll processing, ultimately benefiting both the employer and the employee.

What is the current minimum wage in Florida?

+As of the last update, the minimum wage in Florida is $10.00 per hour, with tipped employees receiving a minimum wage of $6.98 per hour, provided that the tips received bring the employee's total hourly wage to at least $10.00.

Do I need to withhold state income taxes from my employees' wages in Florida?

+No, Florida does not have a state income tax. However, you are still required to withhold federal income taxes, Social Security taxes, and Medicare taxes.

How often must I pay my employees in Florida?

+Florida law requires that employees be paid at least once a month, but it's common for employers to pay biweekly or weekly. The frequency of pay must be consistently applied.

Meta Description: Learn how to calculate payroll checks in Florida with our comprehensive guide, covering federal taxes, state regulations, and the use of payroll check calculators for accuracy and compliance.