Calculating take-home pay in Georgia can be a complex process due to the various factors that influence an individual's net income. One of the primary tools used for this purpose is a paycheck estimator, which considers federal and state income taxes, deductions, and other relevant factors to provide an accurate estimate of one's paycheck amount. In this article, we will delve into the specifics of using a paycheck estimator in Georgia, exploring how it works, its benefits, and the steps to follow for accurate calculations.

Understanding Paycheck Estimators

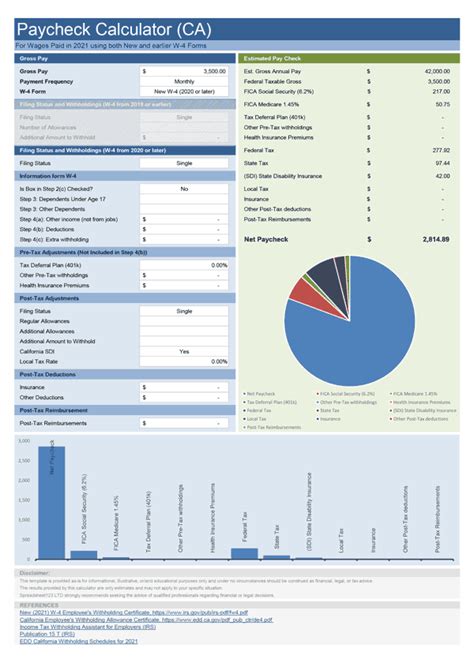

A paycheck estimator is an online tool or software designed to calculate an individual’s take-home pay based on their gross income, tax filing status, number of dependents, and other relevant factors. These tools are especially useful for individuals who are starting a new job, experiencing changes in their income, or adjusting their tax withholdings. In Georgia, paycheck estimators consider both federal income taxes and the state income tax rate, which is a flat 5.75% of taxable income, to provide an accurate estimate of one’s net pay.

Factors Influencing Paycheck Estimations

Several factors can influence the accuracy of paycheck estimations in Georgia. These include the individual’s tax filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)), number of dependents, deductions and exemptions, and any additional income or taxes withheld. The state’s flat income tax rate simplifies calculations compared to states with progressive tax systems, but it’s still crucial to consider all applicable factors for an accurate estimation.

| Tax Filing Status | Standard Deduction (2023) |

|---|---|

| Single | $12,950 |

| Married Filing Jointly | $25,900 |

| Married Filing Separately | $12,950 |

| Head of Household | $19,400 |

Using a Paycheck Estimator in Georgia

To use a paycheck estimator effectively in Georgia, follow these steps:

- Gather Necessary Information: Collect details about your income, including hourly wage or annual salary, number of pay periods per year, tax filing status, number of dependents, and any additional income or deductions.

- Choose a Paycheck Estimator Tool: Select a reputable online paycheck estimator or payroll software that accounts for Georgia’s state income tax rate and allows you to input your specific information.

- Input Your Data: Enter your income, tax status, dependents, and any other relevant details into the estimator tool. Ensure all information is accurate and up-to-date for the best results.

- Review and Adjust: Once you have your estimated take-home pay, review the results to ensure they align with your expectations. If necessary, adjust your tax withholdings or deductions to optimize your net income.

Benefits of Paycheck Estimators

Paycheck estimators offer several benefits, including providing individuals with a clear understanding of their take-home pay, helping them plan their finances more effectively, and enabling them to make informed decisions about their tax withholdings and deductions. For employers, these tools can aid in attracting and retaining employees by offering competitive compensation packages and assisting with payroll planning.

Key Points

- Paycheck estimators are valuable tools for calculating take-home pay in Georgia, considering federal and state income taxes.

- Accuracy of estimations depends on factors like tax filing status, number of dependents, and deductions.

- Georgia's flat state income tax rate of 5.75% simplifies calculations but requires consideration of all applicable factors.

- Using a paycheck estimator involves gathering personal financial information, selecting a tool, inputting data, and reviewing results.

- These tools benefit individuals by providing financial clarity and aiding employers in payroll planning and attracting talent.

As the employment landscape and tax laws evolve, the importance of paycheck estimators in facilitating financial planning and decision-making will continue to grow. By understanding how these tools work and applying them effectively, individuals in Georgia can better navigate their financial obligations and opportunities, ensuring a more secure and prosperous future.

What is the state income tax rate in Georgia?

+The state income tax rate in Georgia is a flat 5.75% of taxable income.

How do I choose the best paycheck estimator tool for my needs?

+Choose a tool that is reputable, easy to use, and accounts for all relevant factors, including federal and state taxes, deductions, and dependents.

Can I use a paycheck estimator if I have multiple income sources?

+Yes, most paycheck estimators allow you to input multiple income sources. Ensure you have detailed information about each source, including the type of income and frequency of payment.

In conclusion, paycheck estimators are indispensable tools for anyone seeking to understand their financial situation accurately, especially in a state like Georgia with its specific tax laws. By leveraging these tools effectively and staying informed about tax changes and financial planning strategies, individuals can make the most of their income and secure a brighter financial future.