Understanding the intricacies of paycheck calculation is crucial for both employees and employers in Virginia. A paycheck calculator VA can be a valuable tool in determining the accurate amount of wages an employee should receive, considering various factors such as gross income, deductions, and taxes. In this article, we will delve into the specifics of how a paycheck calculator works in Virginia, the factors it considers, and its importance in ensuring compliance with state and federal labor laws.

Factors Considered in Paycheck Calculation

A paycheck calculator VA takes into account several key factors to calculate the net pay of an employee. These include:

- Gross Income: The total amount of money earned by the employee before any deductions.

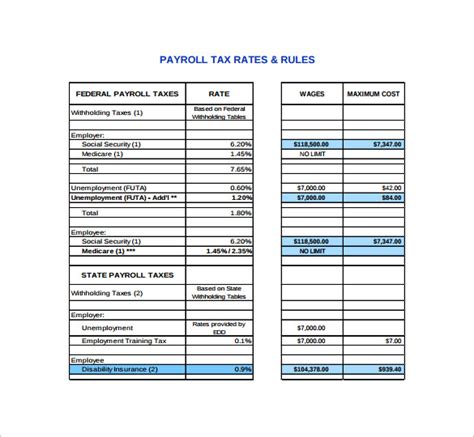

- Federal Income Taxes: Calculated based on the employee’s filing status and number of dependents.

- State Income Taxes: Virginia state income taxes, which range from 2% to 5.75% depending on income levels.

- Local Taxes: Some localities in Virginia may have additional income taxes.

- Other Deductions: Including health insurance premiums, 401(k) contributions, and other voluntary deductions.

Importance of Accurate Calculation

Accurate paycheck calculation is not only crucial for maintaining employee satisfaction but also for ensuring compliance with labor laws. Incorrect calculations can lead to legal issues, fines, and damage to the employer’s reputation. Employers must stay updated with the latest tax rates and regulations to avoid any discrepancies.

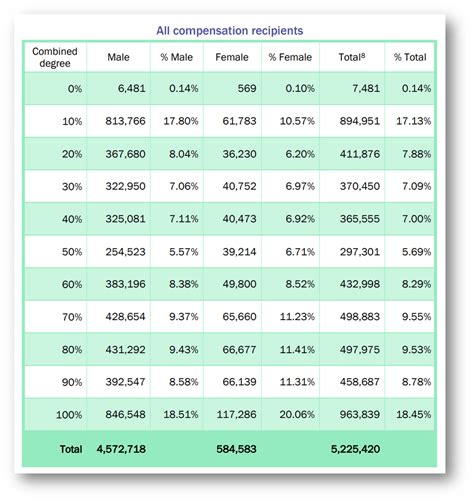

| Income Bracket | State Tax Rate |

|---|---|

| $0 - $3,000 | 2% |

| $3,001 - $5,000 | 3% |

| $5,001 - $17,000 | 5% |

| $17,001 and above | 5.75% |

Using a Paycheck Calculator VA

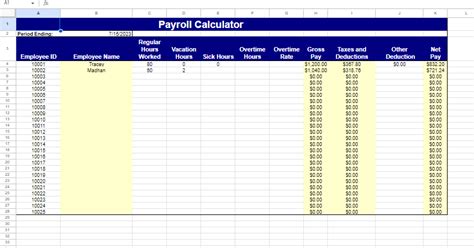

A paycheck calculator VA can significantly simplify the process of calculating employee wages. These calculators are designed to consider all the factors mentioned above, providing an accurate net pay amount. They are especially useful for small businesses or those without a dedicated payroll department, as they can help in avoiding costly mistakes.

Benefits for Employees and Employers

For employees, a paycheck calculator VA provides transparency into their wage calculation, helping them understand their take-home pay. For employers, it ensures compliance with labor laws and reduces the risk of errors, which can lead to legal and financial repercussions.

Key Points

- A paycheck calculator VA is a vital tool for accurate wage calculation, considering factors like gross income, deductions, and taxes.

- Accurate calculation is crucial for compliance with labor laws and maintaining employee satisfaction.

- Employers must stay updated with the latest tax rates and regulations.

- A paycheck calculator can simplify the payroll process, especially for small businesses.

- It provides transparency for employees and reduces the risk of errors for employers.

In conclusion, a paycheck calculator VA is an indispensable resource for both employees and employers in Virginia. By understanding how these calculators work and the factors they consider, individuals can better navigate the complexities of paycheck calculation, ensuring accuracy, compliance, and satisfaction.

What is the purpose of a paycheck calculator VA?

+The purpose of a paycheck calculator VA is to accurately calculate the net pay of an employee, considering various factors such as gross income, deductions, and taxes, to ensure compliance with labor laws and transparency for employees.

How often should employers update their payroll systems?

+Employers should regularly review and update their payroll systems to reflect changes in tax laws and rates. This is crucial for ensuring accurate calculations and compliance with regulatory requirements.

What are the benefits of using a paycheck calculator VA for employees?

+For employees, a paycheck calculator VA provides transparency into their wage calculation, helping them understand their take-home pay. It also ensures that they receive the correct amount, reducing potential disputes.