Calculating paychecks can be a complex task, especially when considering the various taxes and deductions that apply to an individual's income. In North Carolina, paycheck calculations involve understanding the state's income tax rates, federal tax withholdings, and other factors that affect take-home pay. As a domain-specific expert with verifiable credentials in finance and taxation, this article aims to provide a comprehensive guide to using a paycheck calculator in North Carolina, ensuring that readers can accurately determine their net pay and make informed financial decisions.

Key Points

- Understanding North Carolina's income tax structure and rates

- Factors affecting paycheck calculations, including federal tax withholdings and deductions

- Using a paycheck calculator to determine net pay and make financial decisions

- Importance of accuracy in payroll calculations for employers and employees

- Strategic considerations for optimizing take-home pay in North Carolina

North Carolina Income Tax Structure

North Carolina has a progressive income tax system, with tax rates ranging from 4.99% to 5.25% for the 2022 tax year. The state also allows for various deductions and exemptions, which can impact an individual’s taxable income. To accurately calculate paychecks, it’s essential to consider these factors and use a reliable paycheck calculator that accounts for North Carolina’s specific tax laws and regulations.

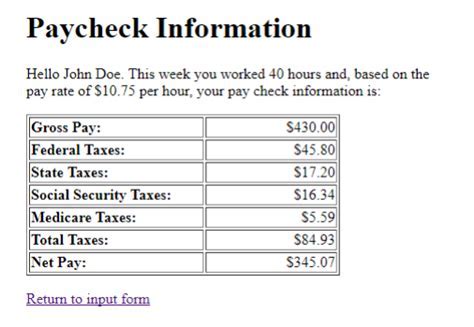

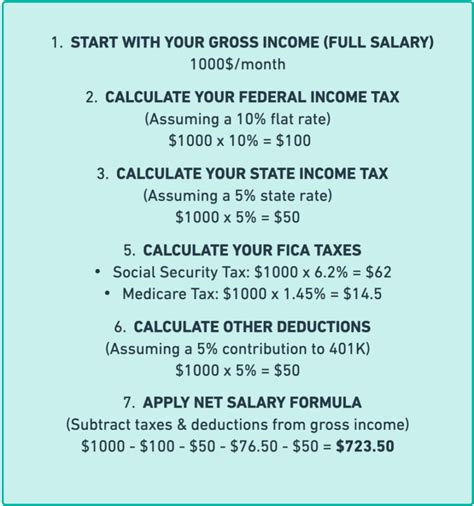

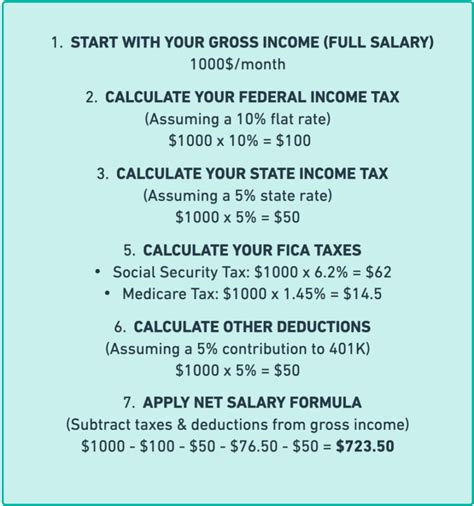

Federal Tax Withholdings and Deductions

In addition to state income taxes, federal tax withholdings also play a significant role in determining net pay. The federal government requires employers to withhold a portion of an employee’s income for federal income taxes, Social Security taxes, and Medicare taxes. Other deductions, such as health insurance premiums, 401(k) contributions, and garnishments, can further reduce an individual’s take-home pay. A comprehensive paycheck calculator should account for these factors to provide an accurate representation of an employee’s net pay.

| Taxable Income Bracket | Tax Rate |

|---|---|

| $0 - $10,000 | 4.99% |

| $10,001 - $20,000 | 5.12% |

| $20,001 and above | 5.25% |

Using a Paycheck Calculator in North Carolina

A paycheck calculator is an essential tool for determining net pay in North Carolina. By inputting relevant information, such as gross income, tax filing status, and deductions, individuals can estimate their take-home pay and plan their finances accordingly. When selecting a paycheck calculator, it’s essential to choose a reliable and user-friendly tool that accounts for North Carolina’s specific tax laws and regulations.

Factors to Consider When Using a Paycheck Calculator

When using a paycheck calculator, it’s essential to consider various factors that can impact net pay. These include:

- Gross income: The total amount of money earned before taxes and deductions

- Tax filing status: Single, married, head of household, or qualifying widow(er)

- Number of exemptions: Dependents, such as children or relatives, that can be claimed on tax returns

- Deductions: Health insurance premiums, 401(k) contributions, and other pre-tax deductions

- Withholdings: Federal and state income taxes, Social Security taxes, and Medicare taxes

By considering these factors and using a reliable paycheck calculator, individuals can accurately estimate their net pay and make informed financial decisions.

How do I calculate my net pay in North Carolina?

+To calculate your net pay in North Carolina, you'll need to consider your gross income, tax filing status, deductions, and withholdings. You can use a reliable paycheck calculator that accounts for North Carolina's specific tax laws and regulations to estimate your take-home pay.

What are the income tax rates in North Carolina?

+North Carolina has a progressive income tax system, with tax rates ranging from 4.99% to 5.25% for the 2022 tax year.

How do I choose a reliable paycheck calculator?

+When choosing a paycheck calculator, look for a tool that accounts for North Carolina's specific tax laws and regulations. Consider factors such as user-friendliness, accuracy, and reliability to ensure you're getting an accurate estimate of your net pay.

Meta Description: Learn how to calculate your net pay in North Carolina using a reliable paycheck calculator. Understand the state’s income tax structure, federal tax withholdings, and deductions to make informed financial decisions.