Calculating one's paycheck can be a complex task, especially when considering the various taxes and deductions that apply. In the state of Indiana, employees face a unique set of tax laws and regulations that affect their take-home pay. To accurately determine the amount of money an individual will receive on their paycheck, it's essential to understand the different factors that influence their net pay. This includes federal income taxes, state income taxes, local taxes, and various deductions such as health insurance, 401(k) contributions, and other benefits.

Indiana State Income Tax

Indiana has a flat state income tax rate of 3.23%, which applies to all residents regardless of their income level. This means that whether an individual earns 20,000 or 200,000 per year, they will pay the same percentage of their income in state taxes. However, it’s worth noting that some cities and counties in Indiana impose additional local taxes, which can range from 0.1% to 3.38% of an individual’s income. For example, residents of Indianapolis face a local income tax rate of 1.62%, while those living in Gary pay a rate of 1.25%.

Federal Income Taxes

In addition to state and local taxes, Indiana residents must also pay federal income taxes. The federal tax system is progressive, meaning that higher-income individuals pay a higher percentage of their income in taxes. The federal income tax rates range from 10% to 37%, depending on an individual’s filing status and income level. For the 2022 tax year, the federal income tax brackets are as follows:

| Filing Status | Taxable Income | Tax Rate |

|---|---|---|

| Single | $0 - $10,275 | 10% |

| Single | $10,276 - $41,775 | 12% |

| Single | $41,776 - $89,075 | 22% |

| Single | $89,076 - $170,050 | 24% |

| Single | $170,051 - $215,950 | 32% |

| Single | $215,951 - $539,900 | 35% |

| Single | $539,901+ | 37% |

Deductions and Benefits

In addition to taxes, there are various deductions and benefits that can affect an individual’s net pay. These may include health insurance premiums, 401(k) contributions, and other benefits such as life insurance or disability insurance. For example, an individual who contributes 10% of their income to a 401(k) plan may see a reduction in their taxable income, which can in turn reduce their federal and state tax liability.

Paycheck Calculator Indiana

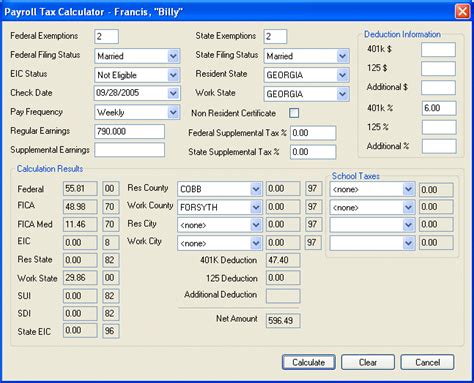

To calculate an individual’s net pay in Indiana, it’s essential to consider all the factors mentioned above. A paycheck calculator can be a useful tool in this regard, as it allows individuals to input their income, taxes, and deductions to determine their take-home pay. Some key factors to consider when using a paycheck calculator include:

- Gross income: The individual's total income before taxes and deductions

- Federal income taxes: The amount of federal taxes withheld from the individual's income

- State income taxes: The amount of state taxes withheld from the individual's income

- Local taxes: The amount of local taxes withheld from the individual's income

- Deductions: The amount of deductions withheld from the individual's income, such as health insurance premiums or 401(k) contributions

Key Points

- Indiana has a flat state income tax rate of 3.23%

- Federal income taxes range from 10% to 37%, depending on income level and filing status

- Local taxes in Indiana can range from 0.1% to 3.38%, depending on the city or county

- Deductions and benefits, such as health insurance premiums and 401(k) contributions, can affect an individual's net pay

- A paycheck calculator can be a useful tool in determining an individual's take-home pay

In conclusion, calculating an individual's net pay in Indiana requires careful consideration of various factors, including federal and state taxes, local taxes, and deductions. By understanding these factors and using a paycheck calculator, individuals can gain a better understanding of their take-home pay and make informed decisions about their financial planning.

What is the state income tax rate in Indiana?

+The state income tax rate in Indiana is 3.23%, which is a flat rate that applies to all residents regardless of their income level.

How do I calculate my net pay in Indiana?

+To calculate your net pay in Indiana, you’ll need to consider your gross income, federal income taxes, state income taxes, local taxes, and deductions. You can use a paycheck calculator to help you determine your take-home pay.

What are some common deductions and benefits that can affect my net pay?

+Some common deductions and benefits that can affect your net pay include health insurance premiums, 401(k) contributions, and other benefits such as life insurance or disability insurance.