Understanding pay stubs is crucial for both employees and employers in New Jersey, as they provide a detailed breakdown of an employee's earnings and deductions. A pay stub calculator can be a valuable tool for calculating gross pay, net pay, and deductions, ensuring compliance with New Jersey's labor laws and regulations. In this article, we'll explore the ins and outs of pay stub calculators in New Jersey, including their benefits, how to use them, and key considerations for employers and employees alike.

Key Points

- Pay stub calculators help in accurately calculating employee earnings and deductions.

- Understanding New Jersey labor laws is essential for using pay stub calculators effectively.

- Calculators can simplify payroll processing and reduce errors.

- Employers must provide detailed pay stubs to employees, including all required information.

- Employees can use pay stub calculators to verify their pay and deductions.

Benefits of Using a Pay Stub Calculator in New Jersey

A pay stub calculator offers numerous benefits for both employers and employees. For employers, it simplifies the payroll process, reduces the likelihood of errors, and ensures compliance with state labor laws. Employees benefit from being able to verify their earnings and deductions, understand their take-home pay, and plan their finances more effectively. Additionally, pay stub calculators can help in calculating taxes, which is particularly useful in a state like New Jersey with its specific tax laws and regulations.

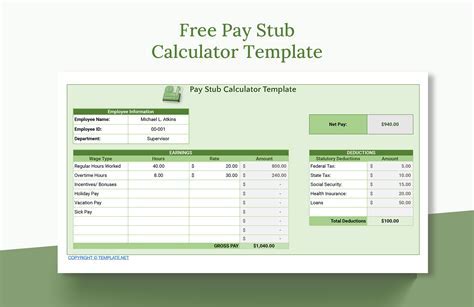

How to Use a Pay Stub Calculator

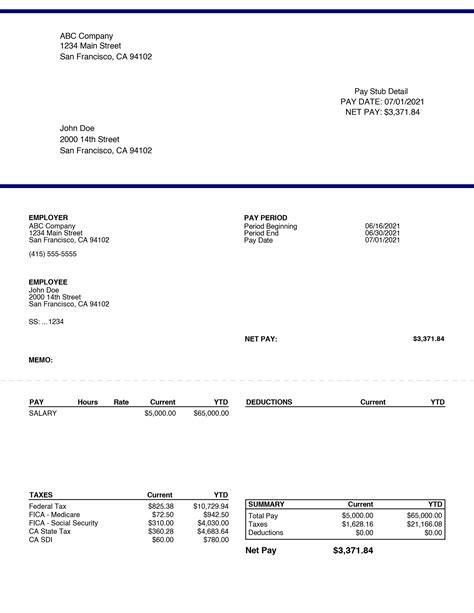

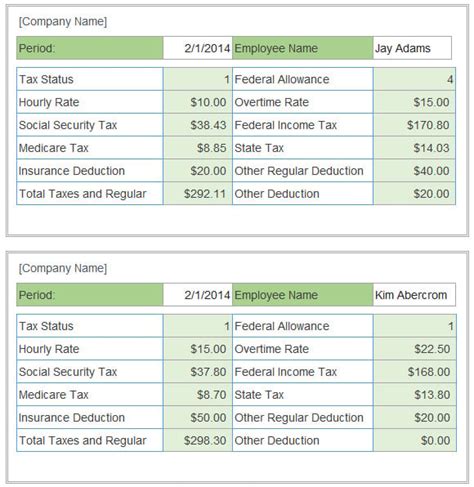

Using a pay stub calculator in New Jersey involves several steps. First, gather all necessary information, including the employee’s gross pay, tax filing status, number of dependents, and any deductions such as health insurance premiums or 401(k) contributions. Next, input this data into the calculator, which will then compute the net pay, deductions, and taxes withheld. It’s essential to ensure the calculator is updated with the latest tax rates and labor laws to provide accurate results.

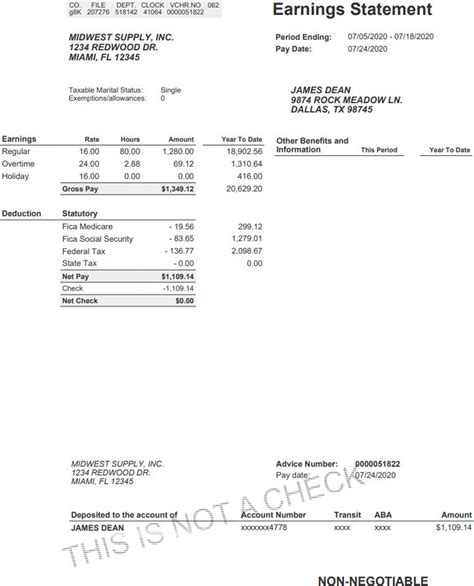

| Category | Description | Amount |

|---|---|---|

| Gross Pay | Employee's total earnings before deductions | $50,000 |

| Federal Income Tax | Tax withheld based on tax filing status and income | $8,000 |

| State Income Tax (NJ) | Tax withheld based on New Jersey state tax rates | $2,500 |

| Other Deductions | Health insurance, 401(k), etc. | $5,000 |

| Net Pay | Take-home pay after all deductions | $34,500 |

Compliance with New Jersey Labor Laws

New Jersey has strict labor laws and regulations that employers must adhere to, including those related to payroll and pay stubs. Employers are required to provide employees with detailed pay stubs for each pay period, outlining all earnings and deductions. A pay stub calculator can help ensure compliance by automatically generating pay stubs with the required information, thus reducing the risk of non-compliance and potential penalties.

Importance of Accurate Payroll Processing

Accurate payroll processing is vital for maintaining good employer-employee relationships and avoiding legal issues. Pay stub calculators play a significant role in this process by ensuring that all calculations are accurate and up-to-date, reflecting any changes in tax laws, deductions, or employee status. This not only helps in preventing disputes over pay but also contributes to a more transparent and trustworthy work environment.

What information is required on a pay stub in New Jersey?

+A pay stub in New Jersey must include the employee's name, address, and occupation, the pay rate and number of hours worked, gross and net earnings, and all deductions. It's also essential to include any information related to the employer, such as their name, address, and contact information.

How often must employers provide pay stubs in New Jersey?

+Employers in New Jersey are required to provide pay stubs to their employees for each pay period. This ensures that employees have regular access to detailed information about their earnings and deductions, facilitating better financial planning and oversight.

Can employees use pay stub calculators to verify their pay?

+Yes, employees can use pay stub calculators to verify their pay and deductions. This can be particularly useful for ensuring accuracy and understanding the breakdown of their earnings. Employees can input their gross pay, deductions, and other relevant information into the calculator to see a detailed breakdown of their pay and compare it with their pay stubs.

In conclusion, pay stub calculators are indispensable tools for both employers and employees in New Jersey, offering a convenient and accurate way to calculate earnings and deductions. By understanding how to use these calculators effectively and ensuring compliance with New Jersey’s labor laws, individuals can streamline payroll processing, reduce errors, and maintain a transparent and trustworthy work environment. As payroll laws and regulations continue to evolve, the role of pay stub calculators will only become more significant, making them a vital component of modern payroll management.