Oregon, known for its natural beauty and outdoor recreational opportunities, also boasts a unique set of labor laws designed to protect the rights of its workers. One of the key tools available to both employers and employees in Oregon is the wage calculator, which helps in determining the correct wages for various types of employment. Understanding how to use an Oregon wage calculator is essential for ensuring compliance with state labor laws and for workers to verify they are being fairly compensated.

Understanding Oregon Labor Laws

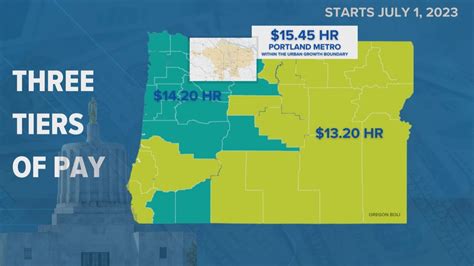

Oregon labor laws cover a wide range of topics, including minimum wage, overtime pay, and meal and rest breaks. As of the latest update, Oregon’s minimum wage varies by location within the state, with higher wages required in the Portland metro area compared to other parts of the state. Employers must also pay overtime to employees who work more than 40 hours in a workweek, unless the employee is exempt under specific criteria outlined by the law.

Minimum Wage in Oregon

The minimum wage in Oregon is adjusted annually based on the Consumer Price Index (CPI). For the current year, the minimum wage rates are as follows: 13.50 per hour inside the Portland Urban Growth Boundary, 12.75 per hour in non-urban counties, and $12.00 in other areas. These rates are subject to change, so it’s crucial to check the latest rates when using an Oregon wage calculator.

| Location | Minimum Wage Rate |

|---|---|

| Portland Urban Growth Boundary | $13.50/hour |

| Non-urban counties | $12.75/hour |

| Other areas | $12.00/hour |

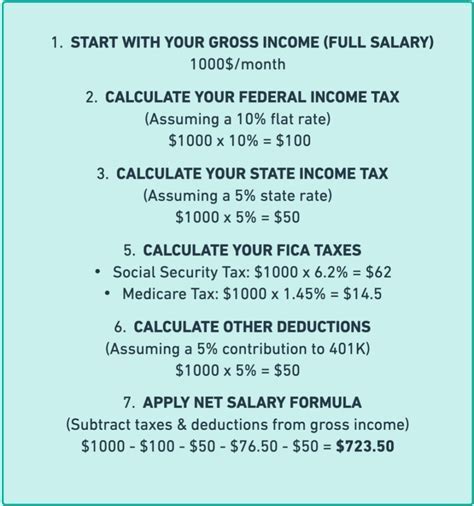

Using an Oregon Wage Calculator

An Oregon wage calculator is a tool that helps employers and employees calculate the correct wages, including minimum wage, overtime, and other compensation required by law. When using a wage calculator, it’s essential to input the correct information, including the employee’s work location, hours worked, and any overtime hours. The calculator will then provide the total wages due to the employee based on Oregon’s labor laws.

Overtime Pay in Oregon

Oregon law requires that most employees be paid at a rate of 1.5 times their regular rate of pay for all hours worked over 40 in a workweek. This means that if an employee’s regular rate of pay is 15 per hour, they would be entitled to 22.50 per hour for any overtime worked. An Oregon wage calculator will take this into account when calculating the total wages due.

Key Points

- Oregon's minimum wage varies by location within the state.

- Employers must pay overtime to non-exempt employees who work over 40 hours in a workweek.

- An Oregon wage calculator can help ensure compliance with state labor laws.

- It's essential to check the latest minimum wage rates when using a wage calculator.

- Some cities or counties may have their own minimum wage ordinances.

FAQs About Oregon Wage Calculator

What is the current minimum wage in Oregon?

+The current minimum wage in Oregon varies by location: 13.50 per hour inside the Portland Urban Growth Boundary, 12.75 per hour in non-urban counties, and $12.00 per hour in other areas.

How do I calculate overtime pay in Oregon?

+Overtime pay in Oregon is calculated at 1.5 times the employee’s regular rate of pay for all hours worked over 40 in a workweek.

Can I use an Oregon wage calculator for all my employment needs?

+An Oregon wage calculator is a useful tool for calculating wages, including minimum wage and overtime. However, it’s essential to ensure the calculator is updated with the latest labor laws and rates.

In conclusion, an Oregon wage calculator is an indispensable tool for both employers and employees seeking to understand and comply with the state’s labor laws. By providing accurate calculations for minimum wage, overtime, and other forms of compensation, these calculators help ensure fairness and transparency in the workplace. As labor laws and minimum wage rates can change, it’s crucial to stay informed and use the most current data when calculating wages.