Optima Health Insurance is a leading provider of health insurance plans, offering a wide range of coverage options to individuals, families, and businesses. With a strong commitment to quality, affordability, and customer satisfaction, Optima Health has established itself as a trusted name in the health insurance industry. In this article, we will delve into the details of Optima Health Insurance, exploring its history, plan options, benefits, and what sets it apart from other health insurance providers.

History and Overview of Optima Health Insurance

Optima Health Insurance was founded with the mission of providing accessible and affordable health insurance to individuals and families. Over the years, the company has grown and expanded its services, now offering a diverse range of health insurance plans that cater to different needs and budgets. With a strong network of healthcare providers and a commitment to excellence, Optima Health has become a preferred choice for many seeking reliable health insurance coverage.

Plan Options and Benefits

Optima Health Insurance offers a variety of plan options, including individual and family plans, group plans for businesses, and Medicare plans for seniors. Each plan is designed to provide comprehensive coverage, including preventive care, hospital stays, prescription medications, and more. The benefits of choosing Optima Health Insurance include access to a large network of healthcare providers, competitive premiums, and dedicated customer service. Additionally, many plans offer extra benefits such as dental and vision coverage, wellness programs, and discounts on health and fitness services.

| Plan Type | Key Benefits |

|---|---|

| Individual and Family Plans | Comprehensive coverage, flexible deductible options, access to large provider network |

| Group Plans | Customizable coverage for businesses, competitive group rates, simplified administration |

| Medicare Plans | Supplemental coverage for Medicare beneficiaries, prescription drug coverage, preventive care services |

Network and Providers

Optima Health Insurance boasts an extensive network of healthcare providers, including primary care physicians, specialists, hospitals, and other medical facilities. This large network ensures that policyholders have access to quality care when and where they need it. The company also maintains strong relationships with its providers, facilitating seamless communication and coordination of care.

Quality of Care and Patient Satisfaction

Optima Health Insurance places a strong emphasis on quality of care and patient satisfaction. The company partners with high-performing healthcare providers and closely monitors patient outcomes and satisfaction ratings. This commitment to excellence is reflected in the company’s high ratings and positive reviews from policyholders, who appreciate the ease of access to quality care and the support they receive from Optima Health’s customer service team.

Key Points

- Optima Health Insurance offers a wide range of health insurance plans for individuals, families, and businesses.

- Plans include comprehensive coverage, access to a large network of healthcare providers, and competitive premiums.

- The company prioritizes preventive care, covering routine check-ups, screenings, and vaccinations.

- Optima Health maintains strong relationships with its providers, ensuring seamless care coordination.

- Policyholders benefit from dedicated customer service and a user-friendly claims process.

Customer Service and Support

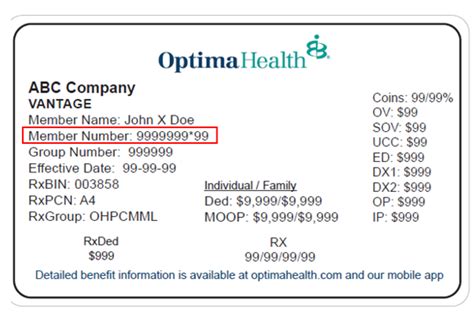

Optima Health Insurance is known for its exceptional customer service, with a team of dedicated professionals available to assist policyholders with questions, claims, and concerns. The company’s website and mobile app also provide easy access to plan information, claims status, and healthcare resources, making it simple for policyholders to manage their health insurance on the go.

Claims Process and Transparency

The claims process with Optima Health Insurance is designed to be straightforward and efficient. Policyholders can submit claims online or by mail, and the company’s claims team works diligently to process claims quickly and accurately. Optima Health also maintains transparency throughout the process, keeping policyholders informed of the status of their claims and any additional information that may be required.

In conclusion, Optima Health Insurance stands out as a reliable and customer-centric health insurance provider. With its comprehensive plan options, large network of healthcare providers, and commitment to preventive care and quality service, Optima Health is an excellent choice for individuals, families, and businesses seeking dependable health insurance coverage.

What types of health insurance plans does Optima Health offer?

+Optima Health Insurance offers a variety of plans, including individual and family plans, group plans for businesses, and Medicare plans for seniors. Each plan is designed to provide comprehensive coverage tailored to different needs and budgets.

How do I find healthcare providers in the Optima Health network?

+You can find healthcare providers in the Optima Health network by visiting the company’s website and using the provider directory tool. This tool allows you to search for providers by name, specialty, or location, making it easy to find a doctor or hospital that meets your needs.

What is the process for filing a claim with Optima Health Insurance?

+To file a claim with Optima Health Insurance, you can submit your claim online through the company’s website or by mail. Be sure to include all required documentation, such as receipts and medical records, to ensure your claim is processed efficiently.