The North Carolina paycheck calculator is a valuable tool for employees and employers alike, helping to ensure accurate calculations of take-home pay and adherence to state and federal tax laws. North Carolina, with its thriving economy and diverse industries, requires a paycheck calculator that can handle the complexities of state income tax, federal income tax, and other deductions. In this article, we will delve into the specifics of the North Carolina paycheck calculator, exploring its key features, how it works, and the importance of using such a tool for financial planning and compliance.

Key Points

- The North Carolina paycheck calculator is designed to handle state income tax, federal income tax, and other deductions.

- It takes into account the state's progressive income tax system, with rates ranging from 4.99% to 5.25%.

- Federal income tax rates also apply, ranging from 10% to 37%.

- Other deductions, such as Social Security tax and Medicare tax, are also considered.

- Using a paycheck calculator can help employees understand their take-home pay and plan their finances accordingly.

Understanding North Carolina Income Tax

North Carolina has a progressive income tax system, meaning that higher income earners are subject to higher tax rates. The state income tax rates range from 4.99% to 5.25%, with the top rate applying to incomes above $100,000. This progressive system ensures that those who earn more contribute a larger share of their income towards state taxes. When using the North Carolina paycheck calculator, it’s essential to input the correct income tax rate to ensure accurate calculations.

Federal Income Tax Considerations

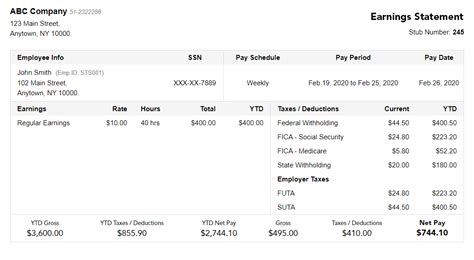

In addition to state income tax, federal income tax also plays a significant role in determining take-home pay. Federal income tax rates range from 10% to 37%, with seven tax brackets in total. The North Carolina paycheck calculator must account for these federal tax rates, as well as other deductions such as Social Security tax and Medicare tax. For the 2022 tax year, Social Security tax is 6.2% of earnings up to $147,000, while Medicare tax is 1.45% of all earnings.

| Tax Type | Tax Rate |

|---|---|

| North Carolina State Income Tax | 4.99% - 5.25% |

| Federal Income Tax | 10% - 37% |

| Social Security Tax | 6.2% (up to $147,000) |

| Medicare Tax | 1.45% (all earnings) |

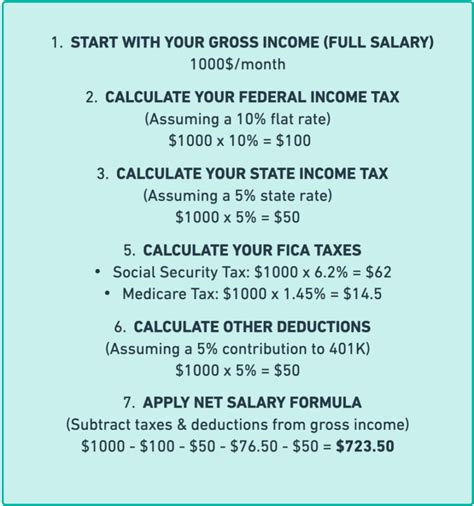

How the North Carolina Paycheck Calculator Works

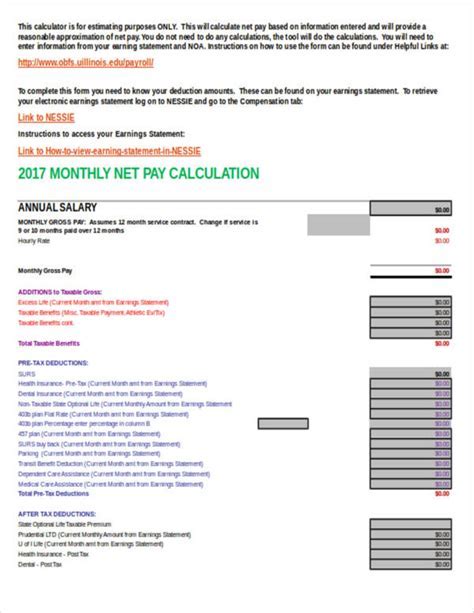

The North Carolina paycheck calculator is designed to be user-friendly, allowing employees and employers to input relevant information and receive accurate calculations of take-home pay. The calculator typically requires inputs such as gross income, number of dependents, and filing status. It then applies the relevant tax rates and deductions to arrive at the net pay amount. By using a reliable paycheck calculator, individuals can better understand their financial situation and plan accordingly.

Importance of Using a Paycheck Calculator

Using a paycheck calculator is essential for several reasons. Firstly, it helps employees understand their take-home pay and plan their finances accordingly. Secondly, it ensures compliance with state and federal tax laws, reducing the risk of penalties and fines. Finally, it provides a transparent and accurate calculation of deductions, allowing individuals to make informed decisions about their financial situation. By leveraging the North Carolina paycheck calculator, employees and employers can navigate the complexities of payroll taxation with confidence.

What is the purpose of the North Carolina paycheck calculator?

+The North Carolina paycheck calculator is designed to help employees and employers calculate take-home pay, ensuring accurate calculations of state and federal income tax, as well as other deductions.

How do I use the North Carolina paycheck calculator?

+To use the North Carolina paycheck calculator, simply input your gross income, number of dependents, and filing status. The calculator will then apply the relevant tax rates and deductions to arrive at your net pay amount.

What are the benefits of using a paycheck calculator?

+The benefits of using a paycheck calculator include accurate calculations of take-home pay, compliance with state and federal tax laws, and transparency in deductions. By using a reliable paycheck calculator, individuals can better understand their financial situation and plan accordingly.

In conclusion, the North Carolina paycheck calculator is a valuable tool for employees and employers, providing accurate calculations of take-home pay and ensuring compliance with state and federal tax laws. By understanding how the calculator works and using it effectively, individuals can navigate the complexities of payroll taxation with confidence. As an expert in payroll taxation, I recommend using a reliable paycheck calculator to ensure accurate calculations and transparency in deductions.

Meta Description: “Use the North Carolina paycheck calculator to accurately calculate take-home pay and ensure compliance with state and federal tax laws. Learn how to use the calculator and understand its benefits.”