The concept of no deductible health insurance has gained significant attention in recent years, particularly among individuals and families seeking to minimize their out-of-pocket expenses for medical care. In the United States, the Affordable Care Act (ACA) has played a crucial role in shaping the health insurance landscape, with many insurance providers now offering plans with reduced or no deductibles. To understand the intricacies of no deductible health insurance, it's essential to delve into the fundamental aspects of health insurance plans, the role of deductibles, and the implications of having no deductible.

Understanding Health Insurance Deductibles

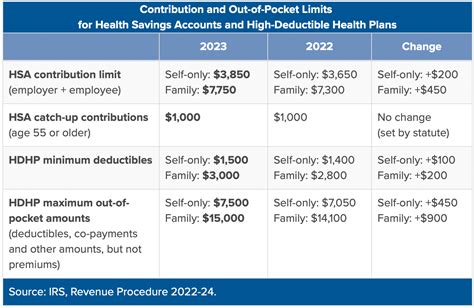

A health insurance deductible is the amount of money that an insured individual must pay out of pocket for healthcare expenses before their insurance plan begins to cover the costs. Deductibles can vary significantly depending on the type of insurance plan, with some plans having low deductibles and others having high deductibles. For instance, according to data from the Kaiser Family Foundation, in 2022, the average deductible for a single person in an employer-sponsored health plan was $1,434. The presence of a deductible serves as a cost-sharing mechanism, where the insured individual bears a portion of the healthcare costs, and the insurance provider covers the remaining amount.

No Deductible Health Insurance Plans

No deductible health insurance plans, as the name suggests, are insurance policies that do not require the insured individual to pay a deductible for certain medical services or treatments. These plans are often more comprehensive and may cover a wider range of healthcare services without requiring the insured to meet a deductible first. No deductible plans can be particularly beneficial for individuals who require frequent medical care or have chronic conditions, as they can help reduce the financial burden associated with healthcare expenses. For example, a study by the Commonwealth Fund found that in 2020, 43% of adults in the United States reported problems paying medical bills or debt, highlighting the need for affordable healthcare options like no deductible plans.

| Insurance Plan Type | Average Deductible |

|---|---|

| Employer-Sponsored Plan | $1,434 (2022 average) |

| Individual Market Plan | $4,364 (2022 average) |

| No Deductible Plan | $0 (for certain services) |

Key Points

- No deductible health insurance plans can help reduce out-of-pocket expenses for medical care.

- These plans often cover a wider range of healthcare services without requiring a deductible.

- No deductible plans can be particularly beneficial for individuals with chronic conditions or those requiring frequent medical care.

- The implementation of no deductible plans can have implications on insurance premiums and the overall healthcare system.

- Understanding the specifics of no deductible health insurance plans is crucial for making informed decisions about healthcare coverage.

Implications and Considerations

The introduction and proliferation of no deductible health insurance plans have significant implications for both insured individuals and the healthcare system as a whole. On one hand, these plans can increase access to healthcare services by reducing the financial barriers associated with deductibles. On the other hand, the costs of providing such comprehensive coverage may be reflected in higher insurance premiums, which could affect the affordability of health insurance for some individuals. Furthermore, the design and implementation of no deductible plans must be carefully considered to ensure that they are financially sustainable and do not lead to adverse selection or increased healthcare utilization that could drive up costs.

Strategic Considerations for No Deductible Plans

For individuals considering no deductible health insurance plans, it’s essential to evaluate the overall cost of the plan, including premiums, copays, and coinsurance, in addition to the absence of a deductible. This comprehensive approach can help in making an informed decision that aligns with one’s healthcare needs and financial situation. Moreover, understanding the network of healthcare providers covered under the plan and the extent of coverage for various medical services is crucial for maximizing the benefits of no deductible health insurance.

In conclusion, no deductible health insurance plans represent a significant development in the health insurance market, offering individuals and families a potentially more affordable and accessible way to manage their healthcare expenses. As with any health insurance plan, it's vital to carefully consider the terms, benefits, and potential drawbacks of no deductible plans to ensure they meet one's specific healthcare needs and financial circumstances.

What are the benefits of no deductible health insurance plans?

+No deductible health insurance plans can help reduce out-of-pocket expenses for medical care, making healthcare more accessible, especially for those with chronic conditions or requiring frequent medical care.

How do no deductible plans affect insurance premiums?

+The costs of providing no deductible plans may be reflected in higher insurance premiums, as the insurance provider covers a larger portion of the healthcare expenses without the insured meeting a deductible first.

What should individuals consider when evaluating no deductible health insurance plans?

+Individuals should consider the overall cost of the plan, including premiums, copays, and coinsurance, as well as the network of healthcare providers and the extent of coverage for various medical services.

Meta Description: “Discover the benefits and implications of no deductible health insurance plans, and learn how to make informed decisions about your healthcare coverage.”