New Jersey, known for its beautiful beaches, vibrant cities, and diverse economy, is also recognized for its complex tax system. Understanding how taxes work in New Jersey is crucial for both residents and non-residents who earn income within the state. The New Jersey tax calculator is a tool designed to help individuals estimate their tax liability based on their income, filing status, and other factors. In this article, we will delve into the intricacies of New Jersey's tax system, explore how the NJ tax calculator works, and provide insights into making the most out of tax planning strategies.

Understanding New Jersey’s Tax System

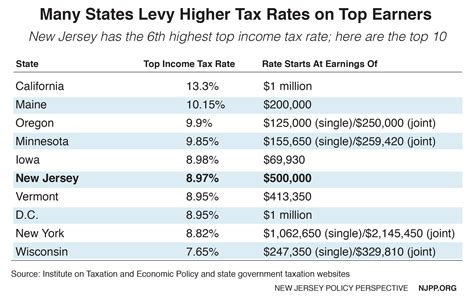

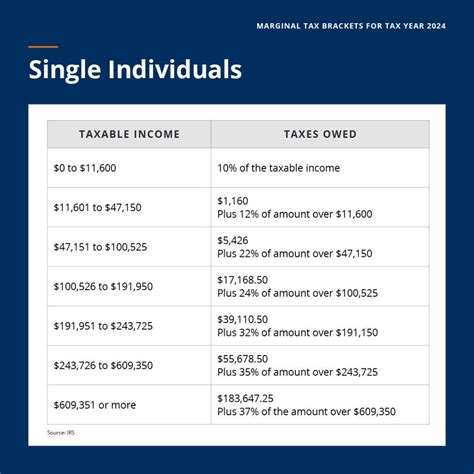

New Jersey has a progressive income tax system, meaning that higher income levels are taxed at a higher rate. As of the last update, the state has seven tax brackets, ranging from 5.525% to 10.75%. The tax rate applies to the amount of income that falls within each bracket. For instance, if you are single and your taxable income is 50,000, you would not pay 8.97% on the entire 50,000. Instead, you would pay 5.525% on the first 20,000, 6.37% on income between 20,001 and 35,000, and 6.92% on the amount between 35,001 and 40,000, with 8.97% applying to income over 40,000 but less than $75,000, and so on.

Tax Brackets and Rates

It’s essential to understand the current tax brackets and rates to accurately estimate your tax liability. The rates and brackets are subject to change, so it’s crucial to check for updates. For the most recent year, the tax brackets are as follows:

| Taxable Income | Tax Rate |

|---|---|

| Up to $20,000 | 5.525% |

| $20,001 to $35,000 | 6.37% |

| $35,001 to $40,000 | 6.92% |

| $40,001 to $75,000 | 8.97% |

| $75,001 to $500,000 | 10.25% |

| $500,001 to $1,000,000 | 10.75% |

| Above $1,000,000 | 10.75% |

How the NJ Tax Calculator Works

The NJ tax calculator is a straightforward tool that requires you to input your filing status, taxable income, and other relevant information. Based on this data, the calculator estimates your state income tax liability. It’s an excellent resource for planning purposes, allowing you to anticipate your tax obligations and make informed decisions about your financial situation.

Using the Calculator Effectively

To get the most out of the NJ tax calculator, you should have the following information ready:

- Filing status (single, married filing jointly, married filing separately, head of household, qualifying widow(er))

- Gross income from all sources

- Number of dependents

- Itemized deductions or the standard deduction amount

- Any other income or deductions relevant to your tax situation

By accurately inputting this information, you can obtain a reliable estimate of your New Jersey state income tax liability.

Key Points

- New Jersey has a progressive income tax system with seven tax brackets.

- The tax rates range from 5.525% to 10.75%, depending on taxable income and filing status.

- The NJ tax calculator is a useful tool for estimating state income tax liability based on income, filing status, and other factors.

- Understanding the tax brackets and rates, as well as using the calculator effectively, can help in planning and minimizing tax obligations.

- Consulting with a tax professional can provide personalized advice and strategies for managing tax liability.

Tax Planning Strategies

Tax planning involves more than just estimating your tax liability; it’s about strategizing to minimize your tax obligations legally. Here are a few strategies to consider:

Maximize Deductions: Itemizing deductions can significantly reduce your taxable income. Common deductions include mortgage interest, charitable donations, and medical expenses. Ensure you keep detailed records of these expenses to claim them accurately.

Utilize Tax Credits: Tax credits directly reduce your tax liability, dollar for dollar. New Jersey offers several tax credits, such as the Earned Income Tax Credit (EITC) for low-to-moderate-income working individuals and families, and the Homestead Benefit Program for eligible homeowners and tenants.

Contribute to Retirement Accounts: Contributions to traditional IRAs and 401(k) plans are tax-deductible, reducing your taxable income. Additionally, these accounts help you build a nest egg for retirement.

Forward-Looking Implications

As New Jersey continues to evolve economically and demographically, its tax system may undergo changes. Staying informed about potential tax reforms and adjustments to tax brackets and rates is crucial for long-term financial planning. Moreover, considering the impact of federal tax changes on state tax obligations is essential, as federal and state tax systems often interact in complex ways.

What is the highest tax bracket in New Jersey?

+The highest tax bracket in New Jersey is 10.75%, which applies to taxable income over $1,000,000.

How does the NJ tax calculator account for deductions?

+The NJ tax calculator allows you to input your itemized deductions or choose the standard deduction, which it then uses to estimate your taxable income and consequently your tax liability.

Can I use the NJ tax calculator for previous tax years?

+While the NJ tax calculator is primarily designed for estimating current or future tax liabilities, some versions may allow you to calculate taxes for previous years based on the tax laws in effect for those years.

Meta Description: Estimate your New Jersey state income tax liability with the NJ tax calculator and understand the state’s progressive income tax system to plan your finances effectively.