New Jersey, known for its diverse economy and high standard of living, has a complex tax system that can significantly impact an individual's take-home pay. Understanding how salaries are calculated and taxed in New Jersey is crucial for both employers and employees to manage their finances effectively. This article delves into the specifics of the New Jersey salary calculator, exploring how it works, the factors that influence salary calculations, and the importance of considering taxes and other deductions when determining net pay.

Understanding the New Jersey Salary Calculator

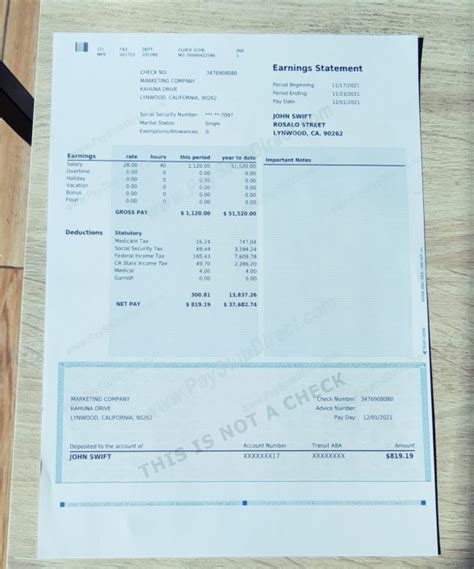

A New Jersey salary calculator is a tool designed to estimate an individual’s net pay based on their gross income, taking into account federal, state, and local taxes, as well as other deductions such as health insurance and 401(k) contributions. These calculators are essential for providing a realistic picture of what an employee can expect to take home after all deductions have been made. The calculator’s accuracy depends on the data input, including the gross salary, filing status, number of dependents, and any additional income or deductions.

Factors Influencing Salary Calculations

Several factors play a critical role in determining an individual’s net pay in New Jersey. These include:

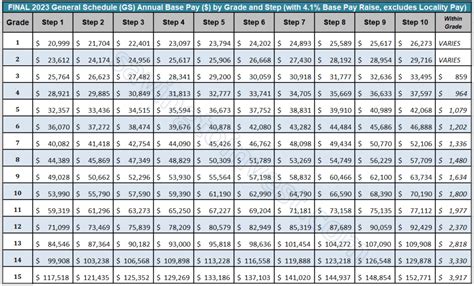

- Federal Income Taxes: These are progressive, meaning that higher income levels are taxed at a higher rate. The federal tax system has seven tax brackets, ranging from 10% to 37%.

- New Jersey State Income Taxes: New Jersey has a progressive state income tax system with rates ranging from 5.525% to 10.75%. The tax rate applied depends on the individual’s taxable income.

- Local Taxes: Some municipalities in New Jersey may have local income taxes, although these are less common. These taxes can vary by location.

- Other Deductions: Health insurance premiums, retirement contributions (such as 401(k) or IRA), and other pre-tax deductions can significantly reduce taxable income, thus affecting the net pay.

| Taxable Income Bracket | Federal Tax Rate | New Jersey Tax Rate |

|---|---|---|

| $0 - $9,875 | 10% | 5.525% |

| $9,876 - $40,125 | 12% | 5.525% |

| $40,126 - $80,250 | 22% | 6.37% |

| $80,251 - $164,700 | 24% | 6.37% |

| $164,701 - $214,700 | 32% | 8.97% |

| $214,701 - $518,400 | 35% | 10.75% |

| Above $518,400 | 37% | 10.75% |

Using a New Jersey Salary Calculator Effectively

To get the most out of a New Jersey salary calculator, it’s essential to have all relevant financial information at hand. This includes gross salary, expected deductions, and any additional income. The calculator will then estimate the net pay, providing a clear picture of monthly or annual take-home pay. This tool is not only useful for employees but also for employers looking to structure competitive compensation packages that account for the state’s tax environment.

Practical Applications and Considerations

Beyond the technical aspects of salary calculation, there are practical considerations. For instance, individuals may need to adjust their withholding or explore tax-advantaged savings options to minimize their tax liability. Employers, on the other hand, must ensure compliance with all tax regulations while offering compensation that attracts and retains top talent in a competitive job market.

Key Points

- Accurate calculation of net pay in New Jersey involves considering federal, state, and local taxes, as well as other deductions.

- A reliable salary calculator is a valuable tool for both employees and employers to navigate the complexities of the tax system.

- Understanding the tax brackets and rates, both federal and state, is crucial for making informed financial decisions.

- Practical applications of salary calculators include adjusting withholding, exploring tax-advantaged savings, and structuring competitive compensation packages.

- Compliance with tax regulations and offering attractive compensation are key considerations for employers.

In conclusion, a New Jersey salary calculator is an indispensable resource for anyone looking to understand the intricacies of salary calculation in the state. By considering the various factors that influence net pay and utilizing these calculators effectively, individuals and employers can make more informed decisions about their finances and compensation strategies.

How do I choose the right New Jersey salary calculator for my needs?

+Look for a calculator that considers all relevant factors, including federal, state, and local taxes, as well as other deductions. It should also be updated with the latest tax rates and regulations.

Can a New Jersey salary calculator help with financial planning?

+Yes, by providing a clear picture of net pay, these calculators can help individuals plan their finances more effectively, including making decisions about savings, investments, and debt management.

How often should I review and adjust my withholding using a salary calculator?

+It’s a good idea to review and adjust your withholding annually or whenever there’s a significant change in your financial situation, such as a change in income, marital status, or number of dependents.