The concept of military pay after taxes is a crucial aspect of understanding the overall compensation package for service members in the United States Armed Forces. The military pay scale is designed to provide a competitive income to attract and retain top talent, but the actual take-home pay can vary significantly depending on factors such as tax filing status, number of dependents, and state of residence. In this article, we will delve into the intricacies of military pay after taxes, exploring the key factors that influence take-home pay and providing insights into the financial planning strategies that service members can employ to maximize their compensation.

Understanding Military Pay and Taxes

Military pay is subject to federal income taxes, but the tax rates and brackets applied to military income are the same as those for civilian income. The tax filing status of the service member, whether single, married, or head of household, plays a significant role in determining the tax liability. Additionally, the number of dependents claimed can impact the amount of taxes owed, as each dependent can result in a tax deduction. The state of residence is also a critical factor, as some states do not tax military pay, while others may offer more favorable tax treatment.

Tax-Free Allowances and Benefits

Service members are entitled to various tax-free allowances and benefits, which can significantly impact their take-home pay. The Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS) are two examples of tax-free allowances that can help offset the cost of living expenses. The BAH is designed to cover the cost of housing, while the BAS is intended to cover the cost of food and other subsistence expenses. These allowances can range from 700 to 2,000 per month, depending on the service member’s rank, location, and family size.

| Allowance Type | Monthly Amount |

|---|---|

| Basic Allowance for Housing (BAH) | $1,200 - $2,000 |

| Basic Allowance for Subsistence (BAS) | $369 - $500 |

| Cost of Living Allowance (COLA) | $100 - $500 |

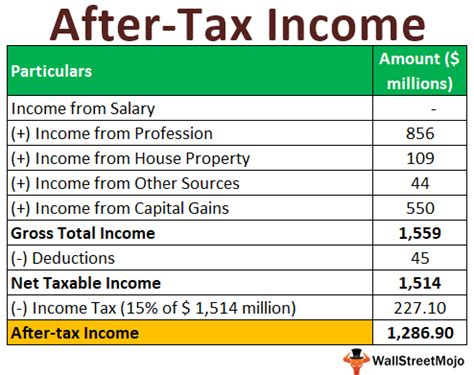

Calculating Military Pay After Taxes

To calculate military pay after taxes, service members can use a variety of online tools and resources, such as the Military Pay Calculator or the Tax Calculator. These tools take into account the service member’s rank, pay grade, and tax filing status, as well as the number of dependents and state of residence. By inputting this information, service members can estimate their monthly take-home pay and plan accordingly.

State Tax Considerations

State taxes can have a significant impact on military pay after taxes, as some states do not tax military pay, while others may offer more favorable tax treatment. For example, states like Alaska, Florida, and Texas do not tax military pay, while states like California and New York may tax military pay at a higher rate. Service members should research the tax laws in their state of residence to understand how their military pay will be taxed.

Key Points

- Military pay is subject to federal income taxes, but tax rates and brackets are the same as those for civilian income.

- Tax-free allowances and benefits, such as BAH and BAS, can significantly impact take-home pay.

- State taxes can vary significantly, with some states not taxing military pay and others offering more favorable tax treatment.

- Service members should research the tax laws in their state of residence to understand how their military pay will be taxed.

- Online tools and resources, such as the Military Pay Calculator or the Tax Calculator, can help service members estimate their monthly take-home pay.

Financial Planning Strategies for Service Members

Service members can employ various financial planning strategies to maximize their compensation and reduce their tax liability. One strategy is to take advantage of tax-free allowances and benefits, such as BAH and BAS, to offset living expenses. Another strategy is to contribute to a Thrift Savings Plan (TSP), which is a retirement savings plan that offers tax benefits and can help service members build wealth over time.

Thrift Savings Plan (TSP) Benefits

The TSP is a defined contribution plan that allows service members to contribute a portion of their pay to a retirement account. The TSP offers a range of investment options, including stocks, bonds, and mutual funds, and provides tax benefits that can help service members reduce their tax liability. By contributing to a TSP, service members can build wealth over time and create a nest egg for retirement.

| TSP Contribution Type | Contribution Limit |

|---|---|

| Traditional TSP | $19,500 per year |

| Roth TSP | $19,500 per year |

| Catch-up Contributions | $6,500 per year (age 50 and older) |

What is the difference between traditional and Roth TSP contributions?

+Traditional TSP contributions are made with pre-tax dollars, reducing taxable income for the year. Roth TSP contributions are made with after-tax dollars, providing tax-free growth and withdrawals in retirement.

How do I calculate my military pay after taxes?

+Service members can use online tools and resources, such as the Military Pay Calculator or the Tax Calculator, to estimate their monthly take-home pay. These tools take into account the service member's rank, pay grade, and tax filing status, as well as the number of dependents and state of residence.

What are the tax implications of military pay for service members living in different states?

+State taxes can have a significant impact on military pay after taxes, as some states do not tax military pay, while others may offer more favorable tax treatment. Service members should research the tax laws in their state of residence to understand how their military pay will be taxed.

Meta Description: Understand the intricacies of military pay after taxes, including tax-free allowances and benefits, state tax considerations, and financial planning strategies to maximize compensation and reduce tax liability. (140-155 characters)