The Living Well High Deductible Health Plan (HDHP) is a type of health insurance plan that offers a unique approach to managing healthcare costs. With a high deductible, this plan requires individuals to pay a significant amount out-of-pocket before the insurance coverage kicks in. However, the plan also offers a range of benefits, including lower premiums, a health savings account (HSA), and access to a network of healthcare providers. In this article, we will delve into the details of the Living Well HDHP, exploring its features, advantages, and potential drawbacks, to help individuals make informed decisions about their healthcare coverage.

Key Features of the Living Well HDHP

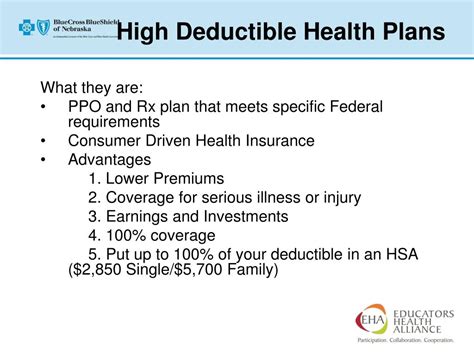

The Living Well HDHP is designed to provide individuals with a cost-effective healthcare solution. The plan features a high deductible, which can range from 1,000 to 3,000 or more, depending on the specific plan and the number of family members covered. In exchange for the high deductible, the plan offers lower premiums, which can be attractive to individuals who are looking to reduce their healthcare costs. Additionally, the plan includes a health savings account (HSA), which allows individuals to set aside pre-tax dollars to pay for qualified medical expenses.

Health Savings Account (HSA)

The HSA is a key component of the Living Well HDHP. This account allows individuals to contribute pre-tax dollars, which can be used to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. The HSA funds can also be used to pay for other healthcare-related expenses, such as dental and vision care. One of the benefits of the HSA is that the funds can be carried over from year to year, allowing individuals to build up a reserve of funds to pay for future medical expenses.

| Category | Contribution Limit |

|---|---|

| Individual | $3,550 |

| Family | $7,100 |

Advantages of the Living Well HDHP

The Living Well HDHP offers several advantages, including lower premiums, a health savings account, and access to a network of healthcare providers. The plan is designed to provide individuals with a cost-effective healthcare solution, while also offering a range of benefits and incentives to promote healthy behaviors. Additionally, the plan’s high deductible can encourage individuals to take a more active role in managing their healthcare costs, which can lead to better health outcomes and lower costs over time.

Lower Premiums

One of the primary advantages of the Living Well HDHP is the lower premiums. By opting for a high deductible, individuals can reduce their premium costs, which can be attractive to those who are looking to reduce their healthcare expenses. According to a study by the Kaiser Family Foundation, the average premium for an HDHP is 12% lower than the average premium for a traditional health plan.

A critical consideration when evaluating the Living Well HDHP is the potential impact on healthcare utilization. Some studies have shown that individuals with high-deductible plans may be less likely to seek medical care, which can lead to delayed diagnoses and poorer health outcomes. However, other studies have found that high-deductible plans can encourage individuals to take a more active role in managing their healthcare costs, which can lead to better health outcomes and lower costs over time.

Key Points

- The Living Well HDHP features a high deductible, which can range from $1,000 to $3,000 or more, depending on the specific plan and the number of family members covered.

- The plan includes a health savings account (HSA), which allows individuals to set aside pre-tax dollars to pay for qualified medical expenses.

- The plan offers lower premiums, which can be attractive to individuals who are looking to reduce their healthcare costs.

- The plan's high deductible can encourage individuals to take a more active role in managing their healthcare costs, which can lead to better health outcomes and lower costs over time.

- Individuals should carefully evaluate the plan's features and potential drawbacks before making a decision.

Potential Drawbacks of the Living Well HDHP

While the Living Well HDHP offers several advantages, there are also potential drawbacks to consider. One of the primary concerns is the high deductible, which can be a significant financial burden for individuals who require frequent medical care. Additionally, the plan’s out-of-pocket costs can be high, which can be a challenge for individuals who are living on a tight budget.

Out-of-Pocket Costs

The Living Well HDHP’s out-of-pocket costs can be high, which can be a challenge for individuals who are living on a tight budget. According to a study by the Commonwealth Fund, the average out-of-pocket costs for an HDHP are $1,400 per year, which can be a significant financial burden for individuals who require frequent medical care.

Another important consideration when evaluating the Living Well HDHP is the potential impact on healthcare access. Some studies have shown that individuals with high-deductible plans may be less likely to seek medical care, which can lead to delayed diagnoses and poorer health outcomes. However, other studies have found that high-deductible plans can encourage individuals to take a more active role in managing their healthcare costs, which can lead to better health outcomes and lower costs over time.

What is the main advantage of the Living Well HDHP?

+The main advantage of the Living Well HDHP is the lower premiums, which can be attractive to individuals who are looking to reduce their healthcare costs.

What is the potential drawback of the Living Well HDHP?

+The potential drawback of the Living Well HDHP is the high deductible, which can be a significant financial burden for individuals who require frequent medical care.

How does the Living Well HDHP encourage individuals to take a more active role in managing their healthcare costs?

+The Living Well HDHP encourages individuals to take a more active role in managing their healthcare costs by requiring them to pay a significant amount out-of-pocket before the insurance coverage kicks in. This can lead to better health outcomes and lower costs over time.

Meta Description: Learn about the Living Well High Deductible Health Plan, including its features, advantages, and potential drawbacks. Get expert insights and make informed decisions about your healthcare coverage. (147 characters)