As a licensed health insurance agent, I have witnessed firsthand the complexities and challenges individuals face when navigating the healthcare system. With the ever-changing landscape of healthcare policies and regulations, it's essential to have a knowledgeable and experienced guide to help make informed decisions. In this article, we will delve into the world of health insurance, exploring the intricacies of the system, the role of a licensed health insurance agent, and the benefits of seeking professional advice when selecting a health insurance plan.

Understanding Health Insurance: A Complex System

Health insurance is a vital component of an individual’s or family’s overall financial planning strategy. It provides financial protection against unexpected medical expenses, ensuring that individuals can receive necessary medical care without incurring significant debt. The health insurance system, however, can be daunting, with a multitude of plans, providers, and policy options available. According to the National Association of Health Underwriters, the average American has over 20 different health insurance plan options to choose from, making it increasingly difficult to select the most suitable plan.

Key Points

- A licensed health insurance agent can help individuals navigate the complex health insurance system

- There are various types of health insurance plans, including HMOs, PPOs, and EPOs

- Understanding the differences between these plans is crucial in selecting the most suitable option

- A licensed health insurance agent can provide personalized guidance and support throughout the selection process

- Seeking professional advice can help individuals avoid common pitfalls and ensure they are adequately covered

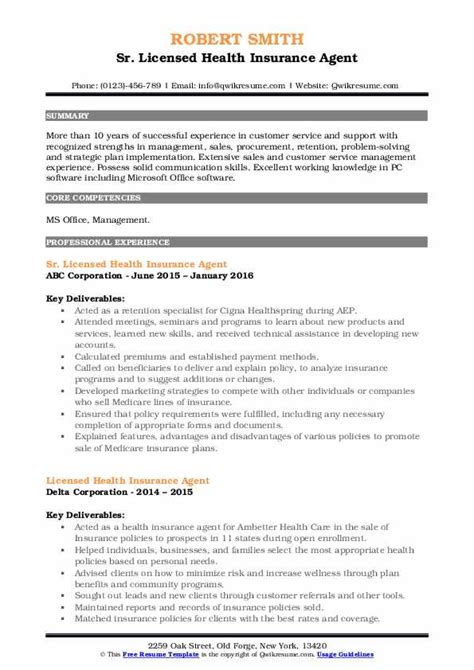

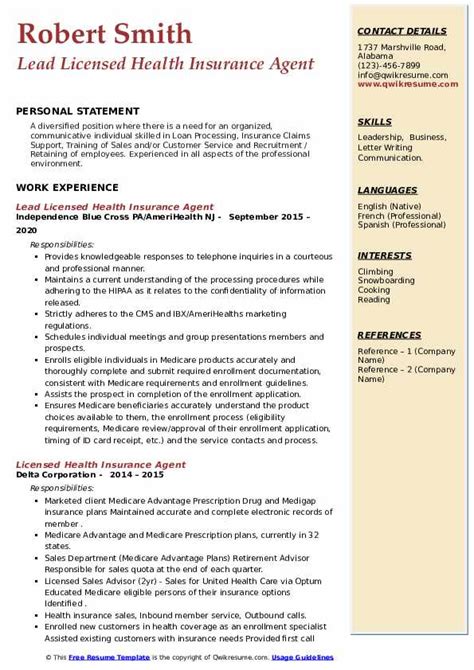

The Role of a Licensed Health Insurance Agent

A licensed health insurance agent plays a crucial role in helping individuals and families select the most suitable health insurance plan. These professionals possess in-depth knowledge of the health insurance system, including the various types of plans available, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). By working with a licensed health insurance agent, individuals can gain a better understanding of the pros and cons of each plan, ensuring they make an informed decision that meets their unique needs and budget.

| Type of Plan | Description | Benefits |

|---|---|---|

| HMO | A type of plan that requires individuals to receive medical care from a specific network of providers | Lower premiums, comprehensive coverage |

| PPO | A type of plan that allows individuals to receive medical care from both in-network and out-of-network providers | Greater flexibility, higher premiums |

| EPO | A type of plan that combines elements of HMOs and PPOs, offering a balance between flexibility and affordability | Balance between flexibility and affordability, moderate premiums |

The Benefits of Seeking Professional Advice

Seeking professional advice from a licensed health insurance agent can provide numerous benefits, including personalized guidance and support, access to a wide range of plan options, and expert knowledge of the health insurance system. By working with a licensed health insurance agent, individuals can avoid common pitfalls, such as selecting a plan with inadequate coverage or failing to understand the terms and conditions of their policy. Additionally, a licensed health insurance agent can help individuals negotiate with insurance providers and resolve claims disputes, ensuring they receive the coverage they deserve.

Common Pitfalls to Avoid

When selecting a health insurance plan, there are several common pitfalls to avoid. These include inadequate coverage, high deductibles, and limited provider networks. By working with a licensed health insurance agent, individuals can avoid these pitfalls and ensure they select a plan that meets their unique needs and budget. According to a study by the Kaiser Family Foundation, individuals who work with a licensed health insurance agent are more likely to be satisfied with their health insurance plan and have a better understanding of their coverage options.

What is the difference between an HMO and a PPO?

+An HMO requires individuals to receive medical care from a specific network of providers, while a PPO allows individuals to receive medical care from both in-network and out-of-network providers. HMOs typically have lower premiums, but PPOs offer greater flexibility.

How do I know which health insurance plan is right for me?

+To determine which health insurance plan is right for you, consider your unique needs and budget. Think about your medical history, lifestyle, and financial situation. It's also essential to work with a licensed health insurance agent who can provide personalized guidance and support throughout the selection process.

Can I change my health insurance plan at any time?

+Typically, individuals can only change their health insurance plan during the annual open enrollment period or if they experience a qualifying life event, such as a change in employment or the birth of a child. It's essential to review your plan's terms and conditions to understand any restrictions on making changes to your coverage.

In conclusion, navigating the complex health insurance system can be overwhelming, but with the guidance of a licensed health insurance agent, individuals can make informed decisions that meet their unique needs and budget. By understanding the different types of health insurance plans, avoiding common pitfalls, and seeking professional advice, individuals can ensure they have comprehensive coverage, flexibility, and affordability. As a licensed health insurance agent, I am committed to providing personalized guidance and support to help individuals and families select the most suitable health insurance plan for their needs.