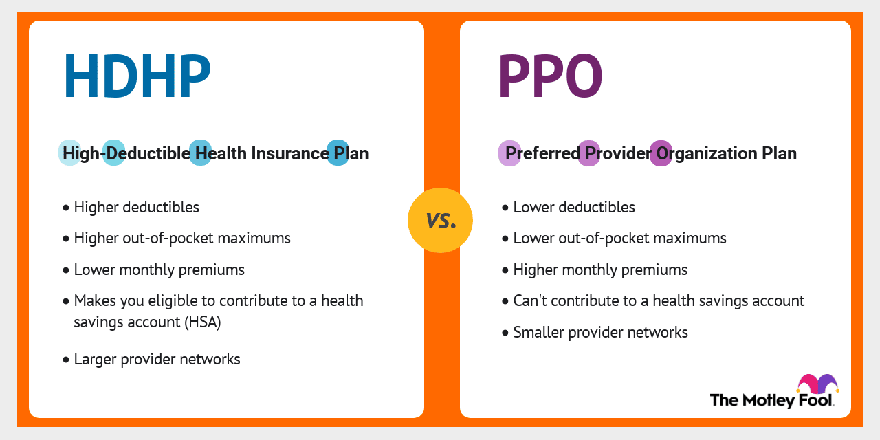

When navigating the complex landscape of health insurance, two popular options often come to the forefront: High Deductible Health Plans (HDHPs) and Preferred Provider Organization (PPO) plans. Each has its unique set of benefits and drawbacks, tailored to different needs and preferences. Understanding the intricacies of these plans is crucial for making an informed decision that aligns with your health care requirements and financial situation.

Introduction to High Deductible Health Plans (HDHPs)

High Deductible Health Plans are designed to offer lower premiums in exchange for higher deductibles. This means that individuals and families must pay a significant amount out-of-pocket before their health insurance coverage kicks in. HDHPs are often paired with Health Savings Accounts (HSAs), which allow participants to set aside pre-tax dollars to cover qualified medical expenses. The combination of an HDHP and an HSA can provide a tax-advantaged way to save for healthcare costs.

Key Characteristics of HDHPs

Some key features of HDHPs include:

- Lower Premiums: The monthly premiums for HDHPs are typically lower compared to other types of health insurance plans.

- Higher Deductibles: Before the insurance coverage begins, individuals must meet a higher deductible, which can range from 1,000 to 7,000 or more for individual plans.

- HSAs: Eligibility to contribute to a Health Savings Account, which offers tax benefits for saving towards medical expenses.

- Out-of-Pocket Maximums: After meeting the deductible and possibly other cost-sharing requirements, the plan covers 100% of eligible expenses up to the out-of-pocket maximum.

Introduction to Preferred Provider Organization (PPO) Plans

PPO plans offer a network of healthcare providers from which to choose, with the flexibility to see any healthcare provider, both in-network and out-of-network, though at different cost levels. This flexibility is a key feature, as it allows individuals to manage their healthcare without the need for referrals from a primary care physician to see specialists.

Key Characteristics of PPO Plans

Some key features of PPO plans include:

- Network and Out-of-Network Coverage: Lower costs for in-network care and higher costs for out-of-network care, with the option to choose any provider without a referral.

- No Referrals Needed: Patients can see specialists without needing a referral from a primary care physician.

- Higher Premiums: PPO plans typically have higher monthly premiums compared to HDHPs due to their broader coverage and flexibility.

- Cost Sharing: Plans may include copays, coinsurance, or both, in addition to deductibles, to share the costs of healthcare services.

Key Points

- HDHPs offer lower premiums but higher deductibles, often paired with HSAs for tax-advantaged savings.

- PPO plans provide flexibility with both in-network and out-of-network coverage, at different costs, without the need for referrals.

- Choice between HDHP and PPO depends on individual health needs, financial situation, and preference for control over healthcare choices.

- Understanding plan specifics, including deductibles, out-of-pocket maximums, and network coverage, is crucial for selecting the right plan.

- Both types of plans have their advantages and can be beneficial depending on the individual's or family's health care needs and financial priorities.

When deciding between an HDHP and a PPO plan, it's essential to consider your health care needs, budget, and personal preferences. If you anticipate having significant medical expenses and value the potential for lower premiums and tax-advantaged savings, an HDHP might be the better choice. On the other hand, if you prioritize flexibility in choosing healthcare providers and are willing to pay higher premiums for more comprehensive coverage without needing referrals, a PPO plan could be more suitable.

| Plan Type | Premium Costs | Deductible | Network Flexibility |

|---|---|---|---|

| HDHP | Lower | Higher | Limited to in-network for best costs |

| PPO | Higher | Varies | Both in-network and out-of-network coverage |

Comparative Analysis

A comparative analysis between HDHPs and PPOs reveals that both have their strengths and weaknesses. HDHPs are advantageous for those who are healthy and do not anticipate significant medical expenses, as they offer lower premiums and the opportunity to save pre-tax dollars in an HSA. However, for individuals or families with ongoing medical needs, the higher deductibles of HDHPs might pose a financial challenge.

Considerations for Choosing Between HDHP and PPO

When making the decision, several factors should be considered:

- Health Status: Individuals with chronic conditions might prefer the broader coverage and flexibility of a PPO, despite higher premiums.

- Financial Situation: Those on a tighter budget might opt for an HDHP for its lower premiums, planning to use an HSA for medical expenses.

- Preference for Control: Some individuals value the flexibility to choose any healthcare provider without restrictions, making a PPO more appealing.

In conclusion, the choice between a High Deductible Health Plan and a Preferred Provider Organization plan depends on a nuanced evaluation of personal health needs, financial constraints, and preferences regarding healthcare flexibility and control. Understanding the specifics of each plan type, including premiums, deductibles, network coverage, and the option for HSAs, is essential for making an informed decision.

What is the main difference between an HDHP and a PPO plan?

+The main difference lies in the structure of the plans. HDHPs have lower premiums but higher deductibles, often paired with an HSA, while PPO plans offer more flexibility in choosing healthcare providers, both in-network and out-of-network, at different costs.

Are HDHPs suitable for individuals with chronic conditions?

+Generally, HDHPs might not be the best choice for individuals with chronic conditions due to the higher deductibles and potential out-of-pocket costs. However, the decision depends on the individual’s specific health needs and financial situation.

Can I have an HSA with a PPO plan?

+Typically, HSAs are paired with HDHPs. However, some PPO plans might be HSA-eligible if they meet certain criteria, such as having a deductible that meets the IRS’s minimum requirement for HDHPs. It’s essential to check the specifics of the plan.