Healthcare First Credit Union (HFCU) is a not-for-profit financial cooperative that serves the healthcare community, providing a range of financial services and products tailored to meet the unique needs of healthcare professionals and organizations. Established with the goal of improving the financial well-being of its members, HFCU operates under the principles of cooperation, mutual aid, and social responsibility. This article will delve into the history, services, and benefits of HFCU, as well as its role in supporting the financial health of the healthcare sector.

History and Development of Healthcare First Credit Union

HFCU was founded by a group of visionary healthcare professionals who recognized the need for a financial institution that understood the specific challenges and opportunities faced by those in the healthcare industry. Over the years, HFCU has grown in membership and assets, expanding its services to include consumer and mortgage loans, credit cards, investment services, and insurance products. This growth has been guided by a commitment to providing personalized service, competitive rates, and innovative financial solutions that cater to the diverse needs of its healthcare-focused membership.

Membership and Eligibility

Membership in HFCU is generally open to individuals who work in the healthcare industry, including doctors, nurses, technicians, and administrative staff, as well as organizations and businesses that operate within the healthcare sector. Eligibility may also extend to family members of existing members, offering a broader range of financial services to those connected to the healthcare community. By maintaining a membership base rooted in the healthcare industry, HFCU is able to tailor its products and services to address the unique financial challenges faced by healthcare professionals and organizations.

| Membership Category | Eligibility Criteria |

|---|---|

| Healthcare Professionals | Employed in the healthcare industry |

| Healthcare Organizations | Operate within the healthcare sector |

| Family Members | Related to existing HFCU members |

Services and Products Offered by Healthcare First Credit Union

HFCU offers a comprehensive array of financial services designed to meet the diverse needs of its membership. This includes checking and savings accounts, loans for personal and professional use, credit cards, investment services, and insurance products. Additionally, HFCU may provide financial education resources, retirement planning services, and other tools aimed at enhancing the financial literacy and well-being of its members. By leveraging its expertise in the healthcare sector, HFCU is well-positioned to offer guidance on financial planning, debt management, and wealth accumulation strategies that are specifically tailored to the financial circumstances of healthcare professionals.

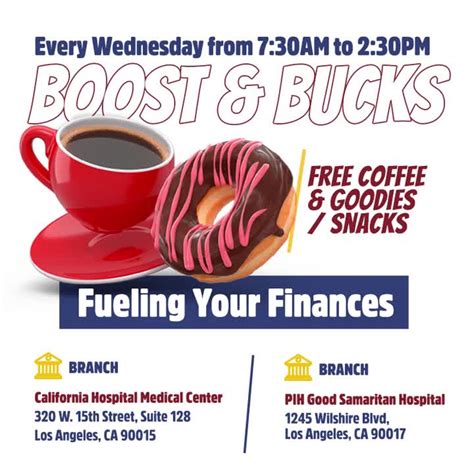

Financial Education and Planning

HFCU recognizes the importance of financial literacy and planning in achieving long-term financial stability and success. To this end, the credit union often provides its members with access to financial seminars, workshops, and one-on-one counseling sessions. These educational resources cover a wide range of topics, from basic budgeting and saving strategies to more complex issues such as investment planning, retirement savings, and debt management. By empowering its members with the knowledge and tools necessary to make informed financial decisions, HFCU plays a critical role in supporting the financial health and security of the healthcare community.

Key Points

- HFCU serves the healthcare community with tailored financial services.

- Membership is open to healthcare professionals, organizations, and their family members.

- The credit union offers a range of financial products, including loans, credit cards, and investment services.

- HFCU provides financial education and planning resources to enhance member financial literacy.

- The credit union's targeted approach allows for highly relevant and beneficial services.

In conclusion, Healthcare First Credit Union stands as a testament to the power of cooperative finance in supporting the unique needs of specific industries and communities. Through its commitment to providing personalized service, competitive financial products, and educational resources, HFCU plays a vital role in enhancing the financial well-being of healthcare professionals and organizations. As the healthcare sector continues to evolve, the importance of specialized financial institutions like HFCU will only continue to grow, underscoring the value of tailored financial services in navigating the complexities of the healthcare industry.

What are the benefits of joining a credit union like HFCU?

+Joining a credit union like HFCU offers several benefits, including competitive rates on loans and deposits, lower fees compared to traditional banks, and a more personalized service experience. Additionally, credit unions are not-for-profit, which means they are driven by the goal of serving their members rather than maximizing profits for shareholders.

How does HFCU support the financial education of its members?

+HFCU supports the financial education of its members through various means, including financial seminars, workshops, and one-on-one counseling sessions. These educational resources are designed to empower members with the knowledge and skills necessary to make informed financial decisions and achieve their long-term financial goals.

What kinds of loans does HFCU offer to its members?

+HFCU offers a variety of loans to its members, including personal loans, mortgage loans, auto loans, and loans specifically designed for healthcare professionals, such as medical school loans or practice financing. These loans are often provided at competitive rates and with flexible repayment terms to accommodate the unique financial circumstances of healthcare professionals.