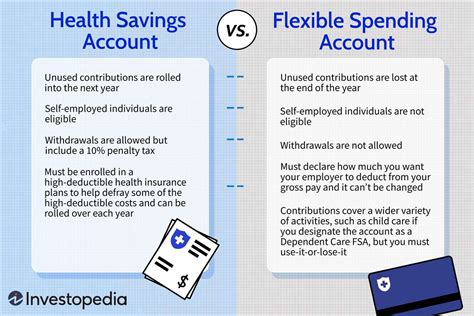

When it comes to managing healthcare expenses, two popular options for individuals and families are Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs). Both types of accounts offer tax advantages and can help reduce the financial burden of medical expenses. However, they have distinct differences in terms of eligibility, contributions, and usage. In this article, we will delve into the details of HSAs and FSAs, exploring their benefits, limitations, and key considerations to help you make an informed decision about which option is best for your healthcare needs.

Key Points

- HSAs are available to individuals with high-deductible health plans (HDHPs) and offer triple tax benefits.

- FSAs are available to individuals with any type of health insurance and offer tax benefits, but have a "use it or lose it" rule.

- HSAs have higher contribution limits and allow for investment opportunities.

- FSAs are more flexible in terms of eligibility and can be used for dependent care expenses.

- Both HSAs and FSAs can be used to pay for qualified medical expenses, but HSAs can also be used for non-medical expenses in retirement.

Health Savings Account (HSA)

A Health Savings Account (HSA) is a tax-advantaged savings account available to individuals with a high-deductible health plan (HDHP). The HSA is designed to help individuals save for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays. One of the primary benefits of an HSA is its triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

To be eligible for an HSA, an individual must have an HDHP with a minimum deductible of 1,400 for individual coverage or 2,800 for family coverage in 2022. The maximum out-of-pocket expenses for an HDHP are 7,050 for individual coverage and 14,100 for family coverage. HSAs have higher contribution limits than FSAs, with a maximum annual contribution of 3,650 for individual coverage and 7,300 for family coverage in 2022.

HSA Investment Opportunities

One of the unique features of an HSA is the ability to invest the funds in a variety of assets, such as stocks, bonds, and mutual funds. This allows the account balance to grow over time, providing a potential source of retirement income. However, it’s essential to note that investing HSA funds involves risk, and individuals should carefully consider their investment options and risk tolerance before making investment decisions.

Flexible Spending Account (FSA)

A Flexible Spending Account (FSA) is a tax-advantaged savings account that allows individuals to set aside pre-tax dollars for qualified medical expenses. FSAs are available to individuals with any type of health insurance, and the account is typically sponsored by an employer. The FSA is funded by the employee through payroll deductions, and the funds can be used to pay for qualified medical expenses, such as doctor visits, prescriptions, and hospital stays.

The primary benefit of an FSA is its tax advantage: contributions are made with pre-tax dollars, reducing an individual’s taxable income. However, FSAs have a “use it or lose it” rule, which means that any unused balance at the end of the plan year is forfeited. Some employers may offer a grace period or allow employees to carry over a limited amount to the next plan year, but this is not always the case.

FSA Eligibility and Contribution Limits

FSAs are available to individuals with any type of health insurance, and there are no eligibility restrictions based on income or health status. The maximum annual contribution to an FSA is $2,850 in 2022, and the funds can be used to pay for qualified medical expenses, as well as dependent care expenses, such as childcare or adult care.

| Account Type | Eligibility | Contribution Limit | Tax Benefits |

|---|---|---|---|

| HSA | HDHP required | $3,650 (individual), $7,300 (family) | Triple tax advantage |

| FSA | Any health insurance | $2,850 | Pre-tax contributions, tax-free withdrawals |

Comparison of HSA and FSA

Both HSAs and FSAs offer tax advantages and can help reduce the financial burden of medical expenses. However, there are key differences between the two types of accounts. HSAs are available to individuals with HDHPs and offer triple tax benefits, while FSAs are available to individuals with any type of health insurance and have a “use it or lose it” rule. HSAs have higher contribution limits and allow for investment opportunities, while FSAs are more flexible in terms of eligibility and can be used for dependent care expenses.

Key Considerations

When deciding between an HSA and an FSA, there are several key considerations to keep in mind. First, consider your eligibility for each type of account. If you have an HDHP, you may be eligible for an HSA, while FSAs are available to individuals with any type of health insurance. Next, consider your medical expenses and whether you can take advantage of the tax benefits offered by each type of account. Finally, think about your financial goals and whether you want to invest your HSA funds or use them for current medical expenses.

What is the main difference between an HSA and an FSA?

+The main difference between an HSA and an FSA is the eligibility requirements and the tax benefits. HSAs are available to individuals with HDHPs and offer triple tax benefits, while FSAs are available to individuals with any type of health insurance and have a "use it or lose it" rule.

Can I have both an HSA and an FSA?

+Yes, you can have both an HSA and an FSA, but there are certain limitations. If you have an HSA, you can only have a limited-purpose FSA, which can only be used for dental and vision expenses. If you have a general-purpose FSA, you are not eligible for an HSA.

How do I choose between an HSA and an FSA?

+To choose between an HSA and an FSA, consider your individual circumstances, including your health insurance coverage, medical expenses, and financial goals. If you have an HDHP and are eligible for an HSA, it may be a good option for you, especially if you can take advantage of the investment opportunities. On the other hand, if you have a lower-deductible health plan or are not eligible for an HSA, an FSA may be a better choice.

In conclusion, both HSAs and FSAs offer tax advantages and can help reduce the financial burden of medical expenses. However, there are key differences between the two types of accounts, and individuals should carefully consider their eligibility, medical expenses, and financial goals before making a decision. By understanding the benefits and limitations of each type of account, individuals can make an informed decision and choose the option that best meets their needs.