As the healthcare landscape continues to evolve, individuals and families are seeking innovative ways to manage their medical expenses. One popular solution is the Health Savings Account (HSA), which offers a tax-advantaged way to save for healthcare costs. Bank of America (BoA) is one of the leading financial institutions offering HSA solutions, providing a convenient and secure way to manage healthcare savings. In this article, we will delve into the world of HSAs, exploring their benefits, features, and how BoA's HSA solution can help individuals and families take control of their healthcare expenses.

Key Points

- HSAs offer a tax-advantaged way to save for healthcare costs, with triple tax benefits: contributions are tax-deductible, earnings grow tax-free, and withdrawals are tax-free for qualified medical expenses.

- BoA's HSA solution provides a convenient and secure way to manage healthcare savings, with features like online banking, mobile banking, and a debit card for easy access to funds.

- HSAs can be used to save for a wide range of qualified medical expenses, including doctor visits, hospital stays, prescriptions, and more.

- BoA's HSA solution is designed to be flexible and adaptable, allowing individuals and families to adjust their savings strategies as their healthcare needs change.

- HSAs can also be used as a long-term savings vehicle, with funds rolling over from year to year and earning interest over time.

Understanding Health Savings Accounts (HSAs)

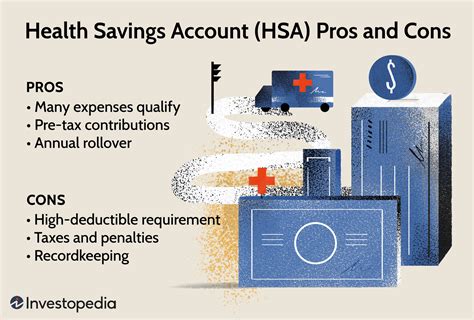

A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for qualified medical expenses. The funds contributed to an HSA are tax-deductible, and the earnings grow tax-free. Additionally, withdrawals from an HSA are tax-free if used for qualified medical expenses. This triple tax benefit makes HSAs an attractive option for those looking to reduce their healthcare costs.

Benefits of HSAs

HSAs offer several benefits, including:

- Tax advantages: Contributions are tax-deductible, and earnings grow tax-free.

- Flexibility: HSAs can be used to save for a wide range of qualified medical expenses, including doctor visits, hospital stays, prescriptions, and more.

- Portability: HSAs are portable, meaning that the funds belong to the individual, not the employer, and can be taken with them if they change jobs or retire.

- Long-term savings: HSAs can be used as a long-term savings vehicle, with funds rolling over from year to year and earning interest over time.

Bank of America’s HSA Solution

BoA’s HSA solution is designed to provide a convenient and secure way to manage healthcare savings. With features like online banking, mobile banking, and a debit card, individuals and families can easily access and manage their HSA funds. BoA’s HSA solution also offers a range of investment options, allowing individuals to grow their HSA balance over time.

Features of BoA’s HSA Solution

Some of the key features of BoA’s HSA solution include:

- Online banking: Manage HSA accounts online, including viewing account balances, transaction history, and investment options.

- Mobile banking: Access HSA accounts on-the-go with BoA’s mobile banking app, including depositing checks and transferring funds.

- Debit card: Use a debit card to pay for qualified medical expenses, with the option to earn rewards on certain purchases.

- Investment options: Choose from a range of investment options, including mutual funds and ETFs, to grow HSA balances over time.

| Feature | Description |

|---|---|

| Contribution limit | $3,550 for individual plans and $7,100 for family plans in 2022 |

| Out-of-pocket maximum | $7,050 for individual plans and $14,100 for family plans in 2022 |

| Minimum deductible | $1,400 for individual plans and $2,800 for family plans in 2022 |

Using HSAs for Long-Term Savings

HSAs can be used as a long-term savings vehicle, with funds rolling over from year to year and earning interest over time. This makes HSAs an attractive option for individuals and families looking to build a safety net for future healthcare expenses. By contributing to an HSA regularly and investing the funds wisely, individuals can create a substantial nest egg for healthcare costs in retirement or other future needs.

Strategies for Maximizing HSA Savings

To maximize HSA savings, consider the following strategies:

- Contribute regularly: Set up automatic contributions to an HSA to take advantage of tax benefits and build savings over time.

- Invest wisely: Choose investment options that align with your risk tolerance and financial goals, and consider consulting with a financial advisor for personalized guidance.

- Monitor and adjust: Regularly review HSA account balances and investment options, and make adjustments as needed to ensure alignment with changing healthcare needs and financial goals.

What is a Health Savings Account (HSA)?

+A Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for qualified medical expenses.

How do I contribute to an HSA?

+Contributions to an HSA can be made by the individual, their employer, or a combination of both. Contributions are tax-deductible, and the funds can be used to pay for qualified medical expenses.

Can I use my HSA for non-medical expenses?

+While HSAs are designed for qualified medical expenses, individuals can use their HSA funds for non-medical expenses after age 65 without penalty, although they will be subject to income tax. Before age 65, using HSA funds for non-medical expenses may result in a 20% penalty and income tax.

Meta Description: Discover the benefits of Health Savings Accounts (HSAs) and how Bank of America’s HSA solution can help you manage your healthcare expenses and build long-term savings. Learn about HSA features, contribution limits, and strategies for maximizing savings.