Health insurance in Pakistan has become an essential consideration for individuals and families seeking to protect themselves from the financial burden of medical expenses. With a growing awareness of the importance of health insurance, the market in Pakistan has seen a significant increase in the number of insurance providers offering a range of health insurance plans. However, navigating the various options and selecting the most suitable plan can be a daunting task, particularly for those who are new to health insurance. In this article, we will delve into the world of health insurance in Pakistan, exploring the key aspects of health insurance comparison, the factors to consider when selecting a plan, and the benefits of having health insurance coverage.

Key Points

- Understanding the different types of health insurance plans available in Pakistan, including individual, family, and group plans.

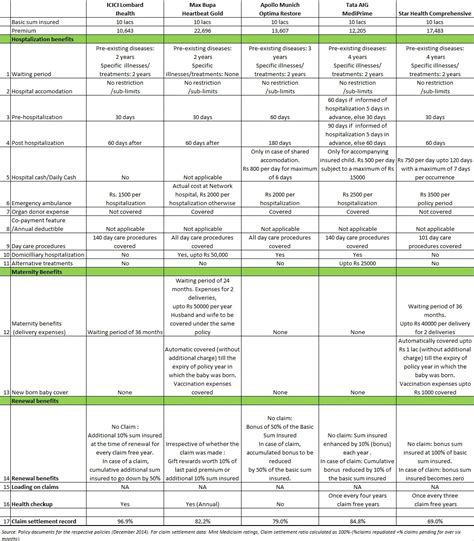

- Comparing the coverage and benefits of various health insurance plans, including hospitalization, surgical procedures, and outpatient services.

- Considering the factors that affect health insurance premiums, such as age, health status, and lifestyle.

- Evaluating the reputation and reliability of health insurance providers in Pakistan.

- Assessing the importance of pre-existing condition coverage and waiting periods in health insurance plans.

Types of Health Insurance Plans in Pakistan

In Pakistan, health insurance plans can be broadly categorized into individual, family, and group plans. Individual plans are designed for single persons, while family plans cover the entire family, including spouses and children. Group plans, on the other hand, are tailored for companies and organizations seeking to provide health insurance coverage to their employees. Each type of plan has its unique features, benefits, and drawbacks, and it is essential to carefully evaluate these factors when selecting a plan.

Individual Health Insurance Plans

Individual health insurance plans in Pakistan are designed for single persons who require health insurance coverage. These plans typically offer a range of benefits, including hospitalization, surgical procedures, and outpatient services. When comparing individual health insurance plans, it is crucial to consider the coverage limit, deductible, and premium rates. Some insurance providers in Pakistan offer flexible premium payment options, allowing individuals to pay premiums on a monthly, quarterly, or annual basis.

| Insurance Provider | Premium Rate | Coverage Limit |

|---|---|---|

| Adamjee Insurance | PKR 10,000 - 50,000 per year | PKR 100,000 - 1,000,000 |

| Jubilee Insurance | PKR 15,000 - 75,000 per year | PKR 200,000 - 2,000,000 |

| EFU Insurance | PKR 12,000 - 60,000 per year | PKR 150,000 - 1,500,000 |

Factors Affecting Health Insurance Premiums

Health insurance premiums in Pakistan are influenced by several factors, including age, health status, and lifestyle. Generally, younger individuals with no pre-existing medical conditions tend to pay lower premiums compared to older individuals or those with health issues. Insurance providers in Pakistan also consider the individual’s occupation, income level, and family medical history when determining premium rates. Furthermore, lifestyle factors such as smoking, obesity, and lack of physical activity can increase premium rates.

Pre-Existing Condition Coverage and Waiting Periods

Pre-existing condition coverage and waiting periods are critical aspects of health insurance plans in Pakistan. Pre-existing conditions refer to medical conditions that an individual has before purchasing a health insurance plan. Insurance providers in Pakistan often impose waiting periods, ranging from 30 days to 2 years, before covering pre-existing conditions. When comparing health insurance plans, it is vital to evaluate the waiting periods and pre-existing condition coverage to ensure that the plan meets individual needs.

What is the average cost of health insurance in Pakistan?

+The average cost of health insurance in Pakistan varies depending on the type of plan, coverage limit, and insurance provider. However, individual health insurance plans can range from PKR 10,000 to 50,000 per year, while family plans can range from PKR 20,000 to 100,000 per year.

What are the benefits of having health insurance in Pakistan?

+Having health insurance in Pakistan provides financial protection against medical expenses, access to quality healthcare, and peace of mind. Health insurance plans in Pakistan often cover hospitalization, surgical procedures, and outpatient services, reducing the financial burden on individuals and families.

How do I choose the best health insurance plan in Pakistan?

+When choosing the best health insurance plan in Pakistan, consider factors such as coverage limit, deductible, premium rates, pre-existing condition coverage, and waiting periods. Evaluate the reputation and reliability of the insurance provider, as well as the quality of their customer service. It is also essential to read and understand the policy terms and conditions before making a decision.

In conclusion, health insurance comparison in Pakistan requires careful evaluation of various factors, including coverage limits, premium rates, pre-existing condition coverage, and waiting periods. By understanding the different types of health insurance plans, factors affecting premiums, and the importance of pre-existing condition coverage, individuals can make informed decisions when selecting a health insurance plan. As the health insurance market in Pakistan continues to evolve, it is essential for individuals to stay informed and adapt to the changing landscape to ensure they have the best possible coverage.