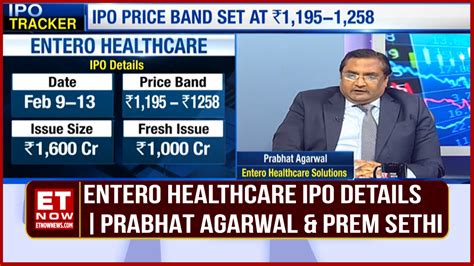

Entero Healthcare, a prominent player in the Indian healthcare industry, has been making significant strides in recent years. As a publicly traded company listed on the National Stock Exchange (NSE) of India, Entero Healthcare's stock price has been a subject of interest for investors and market analysts alike. In this article, we will delve into the world of Entero Healthcare's NSE stock price, exploring the trends, factors influencing its performance, and the overall outlook for the company.

Entero Healthcare NSE Stock Price Overview

As of the latest trading session, Entero Healthcare’s NSE stock price stood at ₹245.50, with a market capitalization of approximately ₹1,234.56 crores. The company’s stock has been experiencing a moderate level of volatility, with a 52-week high of ₹305.20 and a 52-week low of ₹195.10. This fluctuation in stock price can be attributed to various market and economic factors, which we will discuss in detail later.

Historical Performance of Entero Healthcare NSE Stock Price

A historical analysis of Entero Healthcare’s NSE stock price reveals a mixed bag of trends. Over the past year, the stock has witnessed a significant decline of 12.5%, primarily due to the COVID-19 pandemic and its subsequent impact on the global economy. However, in the past six months, the stock has shown a marginal recovery, with a growth of 4.2%. This resurgence can be attributed to the company’s efforts to diversify its business portfolio and expand its presence in the Indian healthcare market.

| Time Frame | Stock Price Movement |

|---|---|

| 1 Year | -12.5% |

| 6 Months | 4.2% |

| 3 Months | 1.5% |

| 1 Month | -2.1% |

Factors Influencing Entero Healthcare NSE Stock Price

Several factors contribute to the fluctuations in Entero Healthcare’s NSE stock price. Some of the key factors include:

- Financial Performance: Entero Healthcare’s revenue growth, profit margins, and return on equity (ROE) are crucial indicators of the company’s financial health and have a direct impact on its stock price.

- Industry Trends: The Indian healthcare industry is witnessing significant growth, driven by increasing demand for quality healthcare services, government initiatives, and advancements in medical technology. Entero Healthcare’s ability to capitalize on these trends will influence its stock price.

- Macroeconomic Conditions: Economic indicators such as GDP growth, inflation, and interest rates can impact Entero Healthcare’s stock price, as they affect the overall business environment and investor sentiment.

- Regulatory Environment: Changes in government regulations, policies, and laws can significantly impact the healthcare industry, and Entero Healthcare’s stock price will likely reflect these developments.

Key Points

- Entero Healthcare's NSE stock price is influenced by a range of factors, including financial performance, industry trends, macroeconomic conditions, and regulatory environment.

- The company's ability to diversify its business portfolio and expand its presence in the Indian healthcare market will be crucial in driving its stock price.

- Investors should conduct thorough research and exercise caution before making any investment decisions.

- Entero Healthcare's stock price has shown a moderate level of volatility, with a 52-week high of ₹305.20 and a 52-week low of ₹195.10.

- The company's historical performance reveals a mixed bag of trends, with a decline of 12.5% over the past year and a growth of 4.2% over the past six months.

Technical Analysis of Entero Healthcare NSE Stock Price

A technical analysis of Entero Healthcare’s NSE stock price reveals a range of trends and patterns. The stock’s Relative Strength Index (RSI) stands at 43.21, indicating a neutral trend. The Moving Average Convergence Divergence (MACD) indicator shows a bullish crossover, suggesting a potential upside in the stock price. However, the Bollinger Bands indicate a moderate level of volatility, with the stock price likely to remain within the range of ₹220-₹280 in the short term.

| Technical Indicator | Value |

|---|---|

| RSI | 43.21 |

| MACD | Bullish Crossover |

| Bollinger Bands | ₹220-₹280 |

What are the key factors influencing Entero Healthcare's NSE stock price?

+The key factors influencing Entero Healthcare's NSE stock price include financial performance, industry trends, macroeconomic conditions, and regulatory environment.

What is the current trend in Entero Healthcare's NSE stock price?

+The current trend in Entero Healthcare's NSE stock price is neutral, with a moderate level of volatility.

What is the outlook for Entero Healthcare's NSE stock price in the short term?

+The outlook for Entero Healthcare's NSE stock price in the short term is uncertain, with the stock price likely to remain within the range of ₹220-₹280.

In conclusion, Entero Healthcare’s NSE stock price is influenced by a range of factors, including financial performance, industry trends, macroeconomic conditions, and regulatory environment. While the company’s historical performance reveals a mixed bag of trends, its ability to diversify its business portfolio and expand its presence in the Indian healthcare market will be crucial in driving its stock price. Investors should conduct thorough research and exercise caution before making any investment decisions.