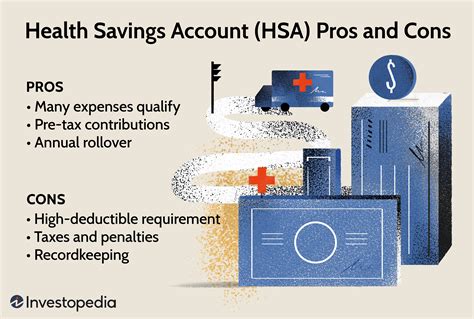

Health Savings Accounts (HSAs) have become an increasingly popular option for individuals and families seeking to manage their healthcare expenses while also saving for the future. One of the key benefits of HSAs is their rollover feature, which allows account holders to carry over unused funds from one year to the next. In this article, we will explore the specifics of HSA rollovers, including how they work, their benefits, and the rules that govern them.

Key Points

- HSAs allow account holders to rollover unused funds from one year to the next, providing a savings mechanism for future healthcare expenses.

- The rollover feature is not the same as the carryover rule, which applies to Flexible Spending Accounts (FSAs) and allows a limited amount of unused funds to be carried over to the next plan year.

- HSAs have no "use it or lose it" rule, meaning that account holders can accumulate funds over time without worrying about forfeiting unused balances.

- The rollover feature of HSAs provides flexibility and encourages long-term savings for healthcare expenses.

- HSAs are subject to annual contribution limits, and account holders must meet certain eligibility requirements to contribute to an HSA.

How HSA Rollovers Work

HSAs are designed to be paired with High Deductible Health Plans (HDHPs), which have lower premiums but higher deductibles than traditional health insurance plans. Contributions to an HSA are tax-deductible, and the funds grow tax-free over time. One of the most attractive features of HSAs is their rollover feature, which allows account holders to carry over unused funds from one year to the next. This means that account holders can accumulate funds in their HSA over time, providing a savings mechanism for future healthcare expenses.

Benefits of HSA Rollovers

The rollover feature of HSAs provides several benefits to account holders. First, it allows them to accumulate funds over time, providing a cushion against unexpected healthcare expenses. Second, it provides flexibility, as account holders can use their HSA funds to pay for qualified medical expenses at any time, without being subject to a “use it or lose it” rule. This means that account holders can save for long-term healthcare expenses, such as retirement or future medical needs.

| Year | Contribution Limit | Catch-Up Contribution Limit |

|---|---|---|

| 2022 | $3,650 (individual), $7,300 (family) | $1,000 |

| 2023 | $3,850 (individual), $7,750 (family) | $1,000 |

Rules Governing HSA Rollovers

While HSAs do allow account holders to rollover unused funds from one year to the next, there are certain rules that govern this process. First, account holders must meet certain eligibility requirements to contribute to an HSA, including being covered by an HDHP and not being eligible for Medicare or other health coverage. Second, HSAs are subject to annual contribution limits, which vary based on the type of HDHP coverage (individual or family) and the account holder’s age. Finally, account holders must use their HSA funds for qualified medical expenses, as defined by the IRS.

Comparison to Other Health Savings Options

HSAs are not the only health savings option available to individuals and families. Other options, such as Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs), also provide a mechanism for saving for healthcare expenses. However, these options have different rules and features than HSAs. For example, FSAs are subject to a “use it or lose it” rule, which means that account holders must use their funds by the end of the plan year or forfeit any unused balance. HRAs, on the other hand, are employer-funded and may have different rules and limitations than HSAs.

In conclusion, HSAs offer a valuable savings mechanism for individuals and families seeking to manage their healthcare expenses while also saving for the future. The rollover feature of HSAs provides flexibility and encourages long-term savings, making them an attractive option for those seeking to accumulate funds for future healthcare needs.

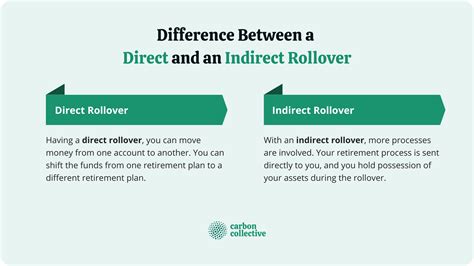

Can I rollover my HSA funds to another HSA provider?

+Yes, you can rollover your HSA funds to another HSA provider. However, you must follow the IRS guidelines for transferring HSA funds, which include filling out a transfer request form and ensuring that the new provider is an IRS-approved HSA custodian.

How do I use my HSA funds for qualified medical expenses?

+To use your HSA funds for qualified medical expenses, you must submit a claim to your HSA provider, along with documentation of the expense, such as a receipt or invoice. Your HSA provider will then reimburse you for the expense, up to the amount of your available HSA balance.

Can I use my HSA funds for non-medical expenses?

+No, you cannot use your HSA funds for non-medical expenses. HSA funds can only be used for qualified medical expenses, as defined by the IRS. If you use your HSA funds for non-medical expenses, you may be subject to penalties and taxes on the amount used.