The consumer health industry has witnessed significant growth in recent years, driven by increasing demand for health and wellness products, services, and technologies. This trend is expected to continue, with the global consumer health market projected to reach $1.3 trillion by 2025, growing at a compound annual growth rate (CAGR) of 5.5%. The growth equity investment landscape in consumer health is becoming increasingly attractive, with investors seeking opportunities to support innovative companies that are disrupting traditional healthcare models.

Consumer Health Market Overview

The consumer health market encompasses a broad range of products and services, including over-the-counter (OTC) medications, vitamins and supplements, health and wellness services, and medical devices. The market is driven by consumer demand for convenient, accessible, and affordable healthcare solutions. The rise of digital health technologies, such as telemedicine and health analytics, is also transforming the consumer health landscape, enabling greater connectivity and personalized care.

Key Trends Shaping the Consumer Health Market

Several key trends are shaping the consumer health market, including the increasing adoption of digital health technologies, the growing demand for personalized medicine, and the rising importance of preventive care. The COVID-19 pandemic has accelerated these trends, with consumers increasingly seeking health and wellness solutions that can be accessed remotely. The market is also witnessing a shift towards more holistic approaches to health, with consumers seeking products and services that promote overall wellness, rather than just treating specific conditions.

| Segment | Market Size (2020) | Projected Growth Rate (2020-2025) |

|---|---|---|

| OTC Medications | $134 billion | 4.2% |

| Vitamins and Supplements | $123 billion | 5.5% |

| Health and Wellness Services | $435 billion | 6.3% |

| Medical Devices | $183 billion | 5.1% |

Growth Equity Investment in Consumer Health

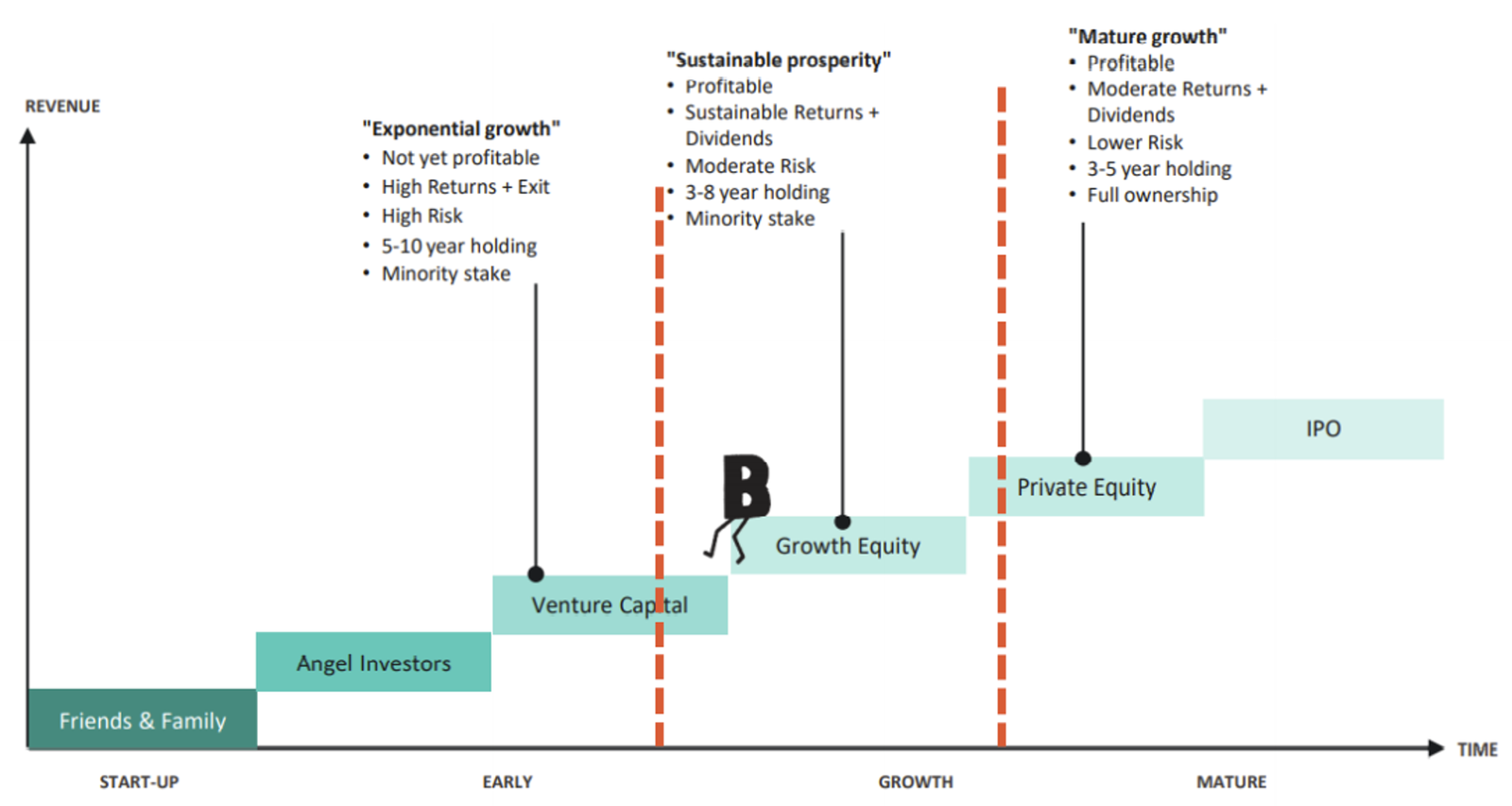

Growth equity investors are increasingly attracted to the consumer health market, seeking opportunities to support companies that are driving innovation and disruption. These investors typically target companies with strong growth potential, innovative products or services, and a clear path to scalability. The growth equity investment landscape in consumer health is characterized by a range of investment strategies, including venture capital, private equity, and corporate venture capital.

Investment Strategies in Consumer Health

Growth equity investors in consumer health employ a range of investment strategies, including investing in early-stage companies with innovative products or services, supporting the growth of established companies with strong track records, and partnering with corporate venture arms to drive innovation and growth. Investors must carefully evaluate the market potential, competitive landscape, and regulatory environment when considering investment opportunities in consumer health.

Key Points

- The consumer health market is projected to reach $1.3 trillion by 2025, growing at a CAGR of 5.5%.

- Digital health technologies, personalized medicine, and preventive care are key trends shaping the market.

- Growth equity investors are increasingly attracted to the consumer health market, seeking innovative companies with strong growth potential.

- Investment strategies in consumer health include venture capital, private equity, and corporate venture capital.

- Companies must demonstrate a deep understanding of consumer needs and preferences to succeed in the competitive consumer health market.

The consumer health market is poised for continued growth and innovation, driven by increasing demand for health and wellness products, services, and technologies. Growth equity investors must carefully evaluate the market potential, competitive landscape, and regulatory environment when considering investment opportunities in consumer health. By supporting innovative companies that are driving disruption and growth, investors can capitalize on the attractive investment landscape in consumer health.

What are the key trends shaping the consumer health market?

+The key trends shaping the consumer health market include the increasing adoption of digital health technologies, the growing demand for personalized medicine, and the rising importance of preventive care.

What investment strategies do growth equity investors employ in consumer health?

+Growth equity investors in consumer health employ a range of investment strategies, including investing in early-stage companies with innovative products or services, supporting the growth of established companies with strong track records, and partnering with corporate venture arms to drive innovation and growth.

What are the key characteristics of successful consumer health companies?

+Successful consumer health companies demonstrate a deep understanding of consumer needs and preferences, develop innovative products and services that meet these needs, and have a clear path to scalability.

Meta description: “The consumer health market is projected to reach $1.3 trillion by 2025, driven by increasing demand for health and wellness products, services, and technologies. Growth equity investors are increasingly attracted to the market, seeking innovative companies with strong growth potential.” (149 characters)