When it comes to financing a home, especially a colonial-style one, understanding the intricacies of the mortgage market can be daunting. Colonial home loans, like other mortgage products, are designed to help individuals achieve their dream of homeownership. These loans are tailored to meet the specific needs of borrowers looking to purchase or refinance a colonial home, which can range from historic properties to newer constructions mimicking the colonial style. With the rich history and architectural charm that colonial homes offer, it's essential for potential homeowners to navigate the loan process effectively to make their ownership dreams a reality.

Understanding Colonial Home Loans

Colonial home loans encompass a broad range of mortgage products, including conventional loans, FHA loans, VA loans, and more. Each of these loan types has its own set of qualifications, benefits, and drawbacks. For instance, conventional loans might offer better interest rates for borrowers with excellent credit, while FHA loans could be more accessible for those with lower credit scores or who need lower down payments. VA loans, on the other hand, are specifically designed for veterans and active-duty military personnel, offering favorable terms like no down payment requirements and lower interest rates.

Types of Colonial Home Loans

The variety of colonial home loans available means that borrowers have numerous options to consider. Conventional Loans are popular for their flexibility and potentially lower costs compared to government-backed loans. FHA Loans are ideal for first-time homebuyers or those who may not qualify for conventional loans due to credit issues. VA Loans and USDA Loans cater to specific demographics, offering unique benefits to veterans and rural homebuyers, respectively. Understanding the nuances of each loan type is crucial for making an informed decision that aligns with one’s financial situation and goals.

| Loan Type | Description | Benefits |

|---|---|---|

| Conventional Loans | Not insured by the government | Potentially lower costs, flexible terms |

| FHA Loans | Insured by the Federal Housing Administration | Lower down payments, easier to qualify |

| VA Loans | Guaranteed by the Department of Veterans Affairs | No down payment, lower interest rates |

| USDA Loans | Guaranteed by the United States Department of Agriculture | No down payment, lower interest rates for rural areas |

Key Points

- Colonial home loans encompass various mortgage products, each with its own set of benefits and requirements.

- Understanding the different types of loans, such as conventional, FHA, VA, and USDA loans, is crucial for making an informed decision.

- Each loan type caters to different needs, whether it's lower down payments, favorable interest rates, or specific demographic groups.

- Consulting with a mortgage expert can help navigate the complexities of the loan process and identify the most suitable loan option.

- Considering factors beyond the interest rate, such as loan terms and fees, is vital for long-term financial stability.

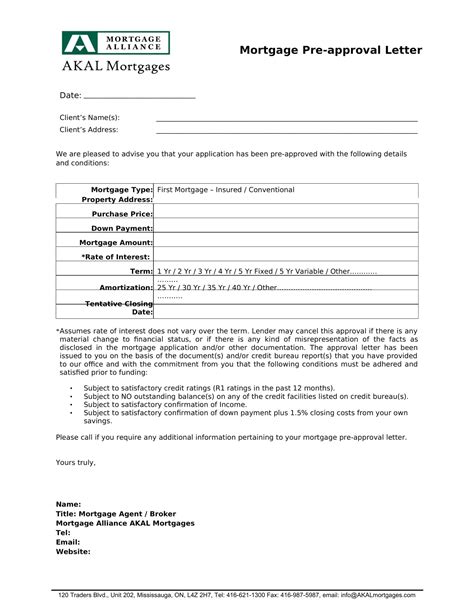

Applying for Colonial Home Loans

The application process for colonial home loans involves several steps, starting with pre-approval, where lenders assess your creditworthiness and provide an estimate of how much they are willing to lend. This step is crucial as it gives borrowers an idea of their budget and makes their offer more attractive to sellers. Following pre-approval, the formal application process begins, which includes submitting financial documents, undergoing a credit check, and possibly an appraisal of the property. The lender then reviews the application, and if approved, issues a loan commitment. Finally, the loan is closed, and the borrower receives the funds to complete the purchase of their colonial home.

Preparing for the Application Process

To ensure a smooth application process, it’s advisable to check your credit report for any errors and work on improving your credit score if necessary. Gathering financial documents, such as pay stubs, bank statements, and tax returns, in advance can also streamline the process. Furthermore, researching different lenders and comparing their offers can help borrowers find the most favorable terms for their colonial home loan.

What are the typical requirements for qualifying for a colonial home loan?

+Typical requirements include a good credit score, stable income, sufficient down payment, and a debt-to-income ratio that falls within acceptable limits. However, specific requirements can vary depending on the loan type and lender.

How long does the application process for a colonial home loan usually take?

+The application process can take anywhere from a few weeks to a couple of months, depending on the complexity of the application and the efficiency of the lender. Pre-approval can often be obtained within a few days.

Can I apply for a colonial home loan if I have a poor credit history?

+While a poor credit history may make it more challenging to qualify for a loan, it's not impossible. Certain loan types, like FHA loans, are more lenient with credit scores. However, borrowers with poor credit may face higher interest rates or stricter terms.

In conclusion, colonial home loans offer a pathway to homeownership for those looking to purchase or refinance a colonial-style home. By understanding the different types of loans available, the application process, and how to prepare, borrowers can make informed decisions that align with their financial goals and situation. Whether you’re a first-time homebuyer or looking to upgrade, navigating the complexities of colonial home loans with the right guidance can turn the dream of owning a colonial home into a reality.