The Blended Retirement System (BRS) is a revolutionary change in the way military personnel can plan for their retirement. Introduced in 2018, the BRS combines elements of the traditional legacy retirement system with a defined contribution plan, offering service members more flexibility and control over their retirement savings. As a domain-specific expert with over a decade of experience in military finance and retirement planning, I will delve into the intricacies of the BRS, exploring its benefits, drawbacks, and strategic considerations for service members.

Key Points

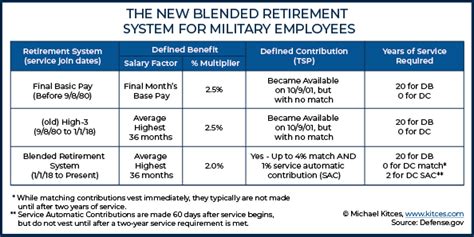

- The Blended Retirement System combines elements of the traditional legacy retirement system with a defined contribution plan.

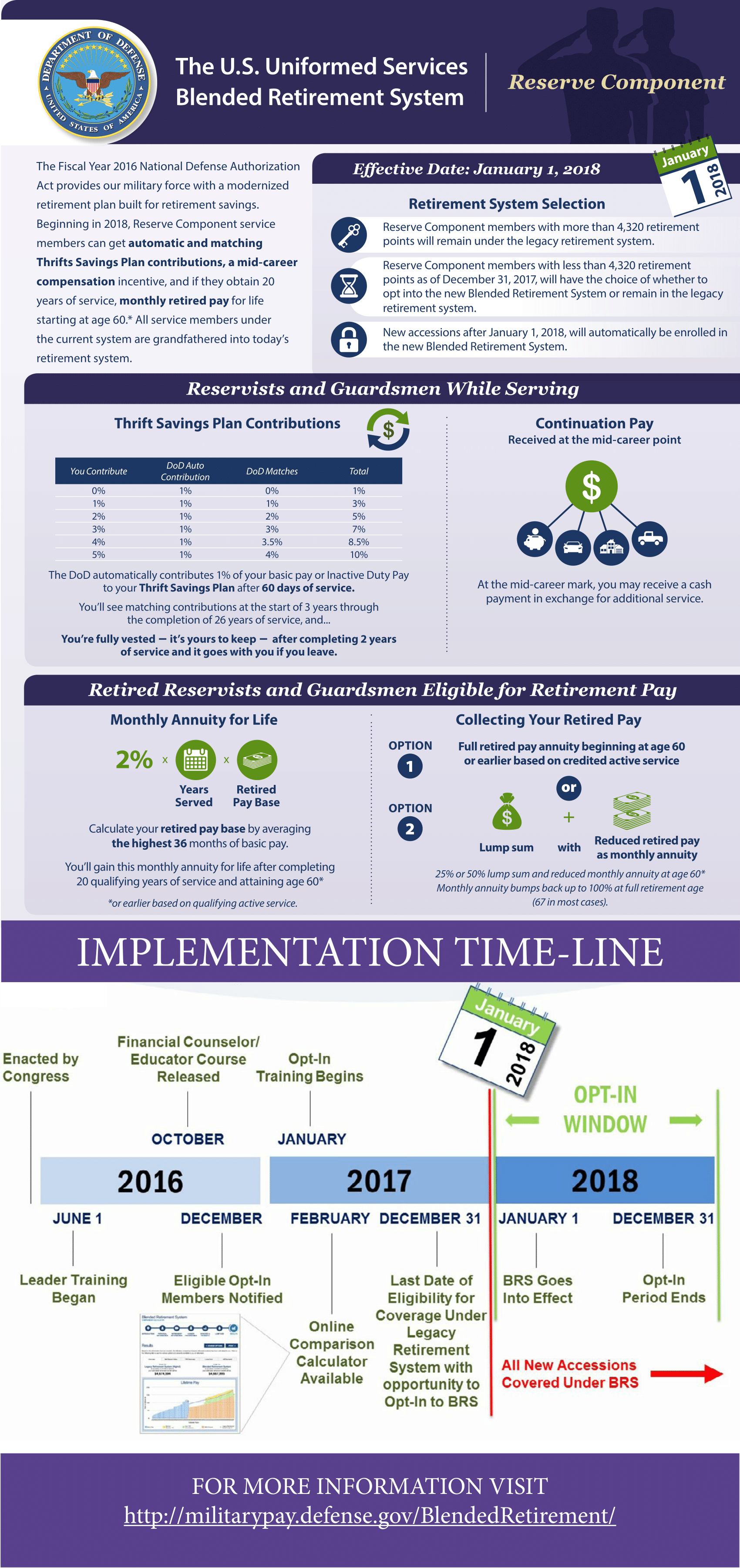

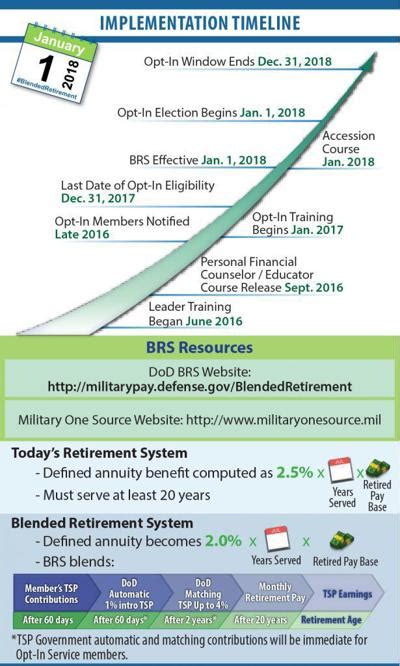

- Service members who joined the military on or after January 1, 2018, are automatically enrolled in the BRS.

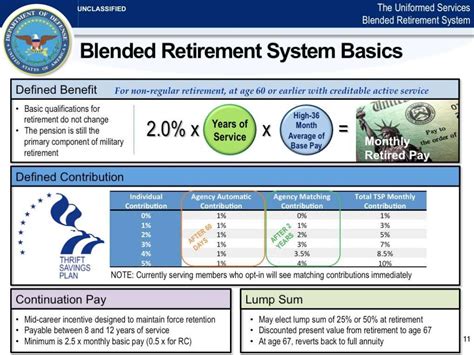

- The BRS offers a 1% to 5% contribution match by the Department of Defense to the Thrift Savings Plan (TSP).

- Service members can choose to opt-in to the BRS if they joined the military between December 31, 2005, and December 31, 2017.

- The BRS provides more flexibility and control over retirement savings, but also introduces complexity and requires proactive planning.

Understanding the Blended Retirement System

The BRS is designed to provide service members with a more modern and flexible approach to retirement planning. Under the BRS, service members are automatically enrolled in the Thrift Savings Plan (TSP), a defined contribution plan that allows them to contribute a portion of their basic pay to a retirement account. The Department of Defense (DoD) also contributes a matching amount to the TSP, ranging from 1% to 5% of the service member’s basic pay. This matching contribution is a key benefit of the BRS, as it provides service members with a guaranteed return on their investment.

Eligibility and Enrollment

Service members who joined the military on or after January 1, 2018, are automatically enrolled in the BRS. However, service members who joined the military between December 31, 2005, and December 31, 2017, have the option to opt-in to the BRS. This opt-in period was available until December 31, 2018, and service members who chose to opt-in were required to make an irrevocable decision to leave the legacy retirement system. It is essential for service members to carefully consider their options and seek professional advice before making a decision.

| Enrollment Category | Eligibility |

|---|---|

| Newly Accessioned | Automatically enrolled in BRS |

| Opt-in Eligible | May choose to opt-in to BRS if joined between December 31, 2005, and December 31, 2017 |

| Legacy System | Remain in legacy retirement system if joined before December 31, 2005 |

Benefits and Drawbacks of the Blended Retirement System

The BRS offers several benefits, including a guaranteed matching contribution from the DoD, flexibility in retirement planning, and the ability to take the TSP account with them if they leave the military. However, the BRS also introduces complexity and requires proactive planning, as service members must make decisions about their TSP contributions and investment options. Additionally, the BRS may not provide the same level of guaranteed retirement income as the legacy retirement system, which can be a concern for service members who value predictability in their retirement planning.

Strategic Considerations

To maximize the benefits of the BRS, service members should develop a comprehensive retirement plan that takes into account their individual circumstances and goals. This may involve contributing to the TSP, investing in other retirement accounts, and developing a strategy for managing their retirement income. Service members should also consider seeking professional advice from a financial advisor or retirement planner to ensure they are making informed decisions about their retirement planning.

What is the Blended Retirement System?

+The Blended Retirement System is a retirement plan that combines elements of the traditional legacy retirement system with a defined contribution plan, offering service members more flexibility and control over their retirement savings.

Who is eligible for the Blended Retirement System?

+Service members who joined the military on or after January 1, 2018, are automatically enrolled in the BRS. Service members who joined the military between December 31, 2005, and December 31, 2017, may choose to opt-in to the BRS.

What are the benefits of the Blended Retirement System?

+The BRS offers a guaranteed matching contribution from the DoD, flexibility in retirement planning, and the ability to take the TSP account with them if they leave the military.

In conclusion, the Blended Retirement System is a significant change in the way military personnel can plan for their retirement. While it offers several benefits, including flexibility and control over retirement savings, it also introduces complexity and requires proactive planning. Service members should carefully evaluate their individual circumstances and consider seeking professional advice before making a decision about the BRS. By developing a comprehensive retirement plan and making informed decisions, service members can maximize the benefits of the BRS and achieve their long-term retirement goals.