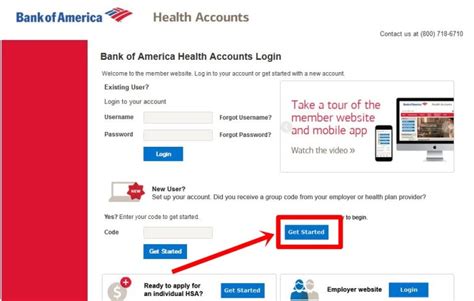

The Bank of America Health Savings Account (HSA) is a type of savings account that allows individuals with high-deductible health plans (HDHPs) to set aside pre-tax dollars for medical expenses. This account offers a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. In this article, we will delve into the details of the Bank of America HSA, its benefits, and how it can be a valuable tool for managing healthcare costs.

Key Features of the Bank of America HSA

The Bank of America HSA is designed to help individuals and families save for medical expenses while reducing their taxable income. Some key features of this account include:

- High-deductible health plan requirement: To be eligible for an HSA, you must have an HDHP with a minimum deductible of 1,400 for individual coverage or 2,800 for family coverage in 2022.

- Contribution limits: The annual contribution limit for an HSA is 3,650 for individual coverage and 7,300 for family coverage in 2022. Individuals 55 or older can contribute an additional $1,000 as a catch-up contribution.

- Investment options: Bank of America offers a range of investment options for HSA funds, including mutual funds, exchange-traded funds (ETFs), and other investments.

- Debit card and checks: Account holders can access their HSA funds using a debit card or checks, making it easy to pay for qualified medical expenses.

Benefits of the Bank of America HSA

The Bank of America HSA offers several benefits, including:

- Tax advantages: Contributions, earnings, and withdrawals for qualified medical expenses are all tax-free, reducing your taxable income and lowering your tax liability.

- Flexibility: HSA funds can be used to pay for a wide range of qualified medical expenses, including doctor visits, prescriptions, glasses, and dental care.

- Portability: HSA funds are portable, meaning you can take them with you if you change jobs or retire.

- Investment opportunities: By investing your HSA funds, you can potentially grow your account balance over time, providing a source of funds for future medical expenses.

| Contribution Limits | Individual | Family |

|---|---|---|

| 2022 | $3,650 | $7,300 |

| 2023 | $3,850 | $7,750 |

Key Points

- The Bank of America HSA is a tax-advantaged savings account for individuals with HDHPs.

- Contributions, earnings, and withdrawals for qualified medical expenses are all tax-free.

- The annual contribution limit for an HSA is $3,650 for individual coverage and $7,300 for family coverage in 2022.

- HSA funds can be invested in a range of options, including mutual funds and ETFs.

- Account holders can access their HSA funds using a debit card or checks.

Eligibility and Requirements

To be eligible for a Bank of America HSA, you must have an HDHP with a minimum deductible of 1,400 for individual coverage or 2,800 for family coverage in 2022. You must also meet certain income requirements and not be enrolled in any other health coverage, such as Medicare or a spouse’s plan.

Qualified Medical Expenses

HSA funds can be used to pay for a wide range of qualified medical expenses, including:

- Doctor visits and copays

- Prescriptions and medication

- Glasses and contact lenses

- Dental care, including cleanings and fillings

- Chiropractic care and acupuncture

What is the difference between an HSA and a flexible spending account (FSA)?

+An HSA is a savings account that allows you to set aside pre-tax dollars for medical expenses, while an FSA is a type of savings account that allows you to set aside pre-tax dollars for medical expenses, but the funds must be used within a certain timeframe or they will be forfeited.

Can I use my HSA funds to pay for non-medical expenses?

+No, HSA funds can only be used to pay for qualified medical expenses. If you use your HSA funds for non-medical expenses, you may be subject to penalties and taxes.

Can I contribute to an HSA if I am over 65?

+Yes, you can contribute to an HSA if you are over 65, but you must have an HDHP and not be enrolled in Medicare. If you are enrolled in Medicare, you are not eligible to contribute to an HSA.

In conclusion, the Bank of America HSA is a valuable tool for managing healthcare costs and reducing taxable income. By contributing to an HSA, you can enjoy tax-free withdrawals for qualified medical expenses, grow your savings over time, and potentially reduce your tax liability. As a financial expert, I recommend considering an HSA as part of your overall healthcare strategy.