The Army Loan Repayment Plan (LRP) is a valuable incentive program designed for eligible Army personnel, offering financial assistance to help repay qualified education loans. Established to attract and retain high-quality soldiers, the LRP aims to alleviate the burden of student loan debt, thereby enhancing the overall quality of life for Army members and their families. As a domain-specific expert in military benefits, I will delve into the intricacies of the Army Loan Repayment Plan, exploring its eligibility criteria, application process, and repayment terms.

Eligibility Criteria and Program Overview

To be eligible for the Army Loan Repayment Plan, soldiers must meet specific requirements, including enlisting in the Army for a minimum of three years, possessing a high school diploma or equivalent, and scoring a minimum of 50 on the Armed Forces Qualification Test (AFQT). Additionally, soldiers must have qualified student loans, which include Federal Family Education Loans (FFEL) and William D. Ford Federal Direct Loans. The program is available to both active-duty and reserve soldiers, with some variations in eligibility and repayment terms. It is essential to note that the LRP is a competitive program, and not all applicants are guaranteed approval.

Key Points

- The Army Loan Repayment Plan is available to eligible Army personnel, including active-duty and reserve soldiers.

- Eligibility requirements include enlisting for a minimum of three years, possessing a high school diploma or equivalent, and scoring a minimum of 50 on the AFQT.

- Qualified student loans include FFEL and William D. Ford Federal Direct Loans.

- The program offers up to $65,000 in loan repayment assistance, paid annually over a three-year period.

- Soldiers must reenlist for an additional three years to receive the full loan repayment benefit.

Application Process and Repayment Terms

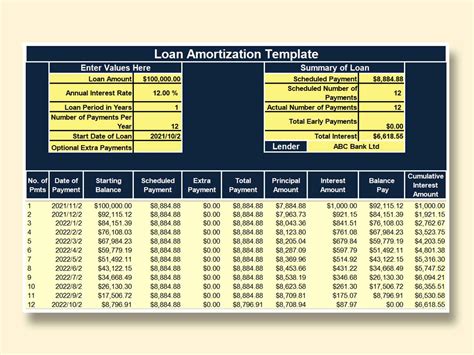

The application process for the Army Loan Repayment Plan involves submitting a request through the Army’s online portal, which includes providing required documentation, such as loan statements and proof of enlistment. Once approved, soldiers can expect to receive annual loan repayment installments, which are paid directly to the loan servicer. The repayment terms vary depending on the type of loan and the soldier’s enlistment status, with a maximum repayment amount of $65,000 over a three-year period. It is crucial to understand that the LRP is not a forgiveness program, and soldiers are still responsible for repaying their loans in full.

| Loan Type | Repayment Amount | Repayment Period |

|---|---|---|

| FFEL | Up to $20,000 | 3 years |

| William D. Ford Federal Direct Loans | Up to $45,000 | 3 years |

Program Benefits and Limitations

The Army Loan Repayment Plan offers several benefits, including reduced financial burden, increased cash flow, and improved overall quality of life. However, the program also has some limitations, such as the requirement to reenlist for an additional three years to receive the full loan repayment benefit. Soldiers must carefully weigh the pros and cons of the LRP before making a decision, considering their individual financial goals and career aspirations.

Comparison with Other Military Loan Repayment Programs

The Army Loan Repayment Plan is just one of several military loan repayment programs available to eligible service members. Other programs, such as the Navy’s Loan Repayment Program and the Air Force’s College Loan Repayment Program, offer similar benefits and eligibility criteria. A thorough comparison of these programs is essential to determine which one best aligns with an individual’s financial needs and career goals.

What is the maximum repayment amount under the Army Loan Repayment Plan?

+The maximum repayment amount under the Army Loan Repayment Plan is $65,000, paid annually over a three-year period.

Can I receive loan repayment assistance if I have a private student loan?

+No, the Army Loan Repayment Plan only covers qualified federal student loans, such as FFEL and William D. Ford Federal Direct Loans.

How do I apply for the Army Loan Repayment Plan?

+To apply for the Army Loan Repayment Plan, submit a request through the Army's online portal, providing required documentation, such as loan statements and proof of enlistment.

In conclusion, the Army Loan Repayment Plan is a valuable incentive program designed to attract and retain high-quality soldiers, offering financial assistance to help repay qualified education loans. By understanding the program’s eligibility criteria, application process, and repayment terms, soldiers can make informed decisions about their financial future and take advantage of this beneficial program. As a domain-specific expert in military benefits, I recommend that soldiers carefully review the program’s specifics and consult with a financial advisor to determine the best course of action for their individual financial situation.