The Army Cost of Living Allowance (COLA) is a vital component of the overall compensation package for soldiers serving in the United States Army. It is designed to help offset the higher cost of living in certain areas, ensuring that soldiers and their families can maintain a reasonable standard of living, regardless of their duty location. The COLA is paid monthly and is based on the soldier's rank, dependency status, and the specific location to which they are assigned.

The need for a COLA arises from the significant variations in the cost of living across different geographic locations. For instance, the cost of housing, food, transportation, and other necessities can be substantially higher in urban areas like New York City or San Francisco compared to rural areas. Without a COLA, soldiers stationed in high-cost areas might experience a decrease in their purchasing power, potentially affecting their quality of life and overall job satisfaction. The Army COLA is calculated and adjusted periodically to reflect changes in the cost of living indexes for various locations, ensuring that the allowance keeps pace with inflation and other economic factors.

Key Points

- The Army Cost of Living Allowance (COLA) is a monthly payment designed to offset the higher cost of living in certain duty locations.

- COLA rates are determined based on the soldier's rank, dependency status, and duty location, using data from the Council for Community and Economic Research (C2ER) Cost of Living Index.

- The COLA is part of the soldier's overall compensation package and is taxable, with rates adjusted annually to reflect changes in the cost of living.

- Eligibility for COLA is determined by the soldier's duty location, with higher rates paid for locations with a higher cost of living index, such as Hawaii or Alaska.

- The Army COLA is an important factor in maintaining the quality of life for soldiers and their families, especially in high-cost areas.

How the Army COLA is Calculated

The calculation of the Army COLA involves several steps and considers various factors. The primary data source is the Council for Community and Economic Research (C2ER) Cost of Living Index, which provides a quarterly measure of the relative cost of living in different urban areas across the United States. This index takes into account the prices of groceries, housing, utilities, transportation, healthcare, and other necessities to calculate an overall cost of living score for each area. The Army then uses this data, along with other factors such as the soldier’s rank and dependency status, to determine the appropriate COLA rate for each duty location.

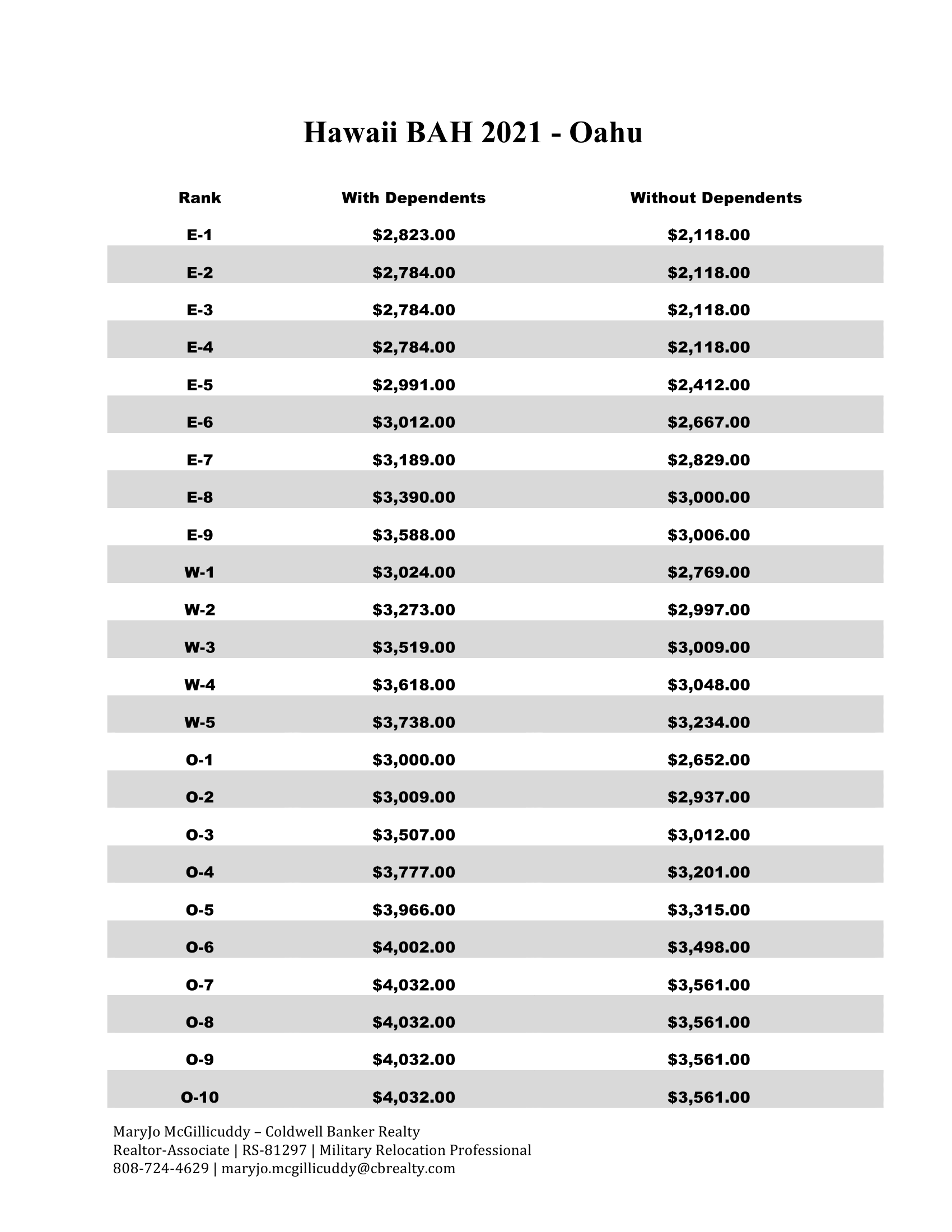

COLA Rates and Duty Locations

COLA rates can vary significantly depending on the duty location. For example, soldiers stationed in Hawaii or Alaska typically receive a higher COLA due to the significantly higher cost of living in these areas. In contrast, soldiers assigned to duty stations in areas with a lower cost of living index, such as certain parts of the southern United States, may receive a lower COLA or no COLA at all. The Army regularly reviews and updates COLA rates to ensure they accurately reflect the current cost of living conditions in each area.

| Duty Location | COLA Rate (Example) |

|---|---|

| Hawaii | $1,500/month (E-5 with dependents) |

| Alaska | $1,200/month (E-5 with dependents) |

| New York City | $800/month (E-5 with dependents) |

| Rural Areas (e.g., parts of the southern US) | $0 - $200/month (E-5 with dependents) |

Impact of COLA on Soldier Quality of Life

The Army COLA has a direct impact on the quality of life for soldiers and their families. By providing a financial cushion to offset the higher cost of living in certain areas, the COLA helps ensure that soldiers can afford the necessities of life, including housing, food, and healthcare, without having to make significant sacrifices. This, in turn, can improve job satisfaction, reduce stress related to financial difficulties, and enhance overall well-being. Moreover, the COLA can play a crucial role in the Army’s ability to attract and retain top talent, as it demonstrates a commitment to supporting the financial well-being of its personnel.

Challenges and Limitations

Despite its importance, the COLA system is not without challenges and limitations. One of the main issues is ensuring that COLA rates accurately reflect the current cost of living conditions in each area. This can be particularly challenging in areas with rapid economic growth or high inflation rates, where costs may rise quickly. Additionally, the COLA system may not fully account for individual differences in lifestyle and spending habits, potentially leading to situations where some soldiers feel that the COLA does not adequately cover their living expenses. The Army must continually review and refine the COLA system to address these challenges and ensure that it remains effective in supporting the financial well-being of its personnel.

In conclusion, the Army Cost of Living Allowance is a vital component of the military compensation package, designed to help soldiers and their families maintain a reasonable standard of living, regardless of their duty location. Through its regular adjustments and calculations based on the cost of living index, the COLA plays a critical role in ensuring that soldiers can afford the necessities of life and enjoy a good quality of life. As the cost of living continues to evolve, it is essential for the Army to remain committed to reviewing and updating the COLA system to meet the changing needs of its personnel.

How is the Army COLA calculated?

+The Army COLA is calculated based on the soldier's rank, dependency status, and duty location, using data from the Council for Community and Economic Research (C2ER) Cost of Living Index.

Which duty locations typically receive the highest COLA rates?

+Soldiers stationed in areas with a high cost of living, such as Hawaii and Alaska, typically receive the highest COLA rates.

Is the COLA taxable?

+Yes, the COLA is considered taxable income.

How often are COLA rates adjusted?

+COLA rates are typically adjusted annually to reflect changes in the cost of living.

What is the purpose of the Army COLA?

+The primary purpose of the Army COLA is to help offset the higher cost of living in certain duty locations, ensuring that soldiers and their families can maintain a reasonable standard of living.

Meta Description: Learn about the Army Cost of Living Allowance (COLA), including how it’s calculated, which duty locations receive the highest rates, and its impact on soldier quality of life.