When it comes to managing finances, understanding the intricacies of payroll and tax calculations is crucial. For residents and employers in Arkansas, utilizing a reliable paycheck calculator can significantly simplify the process of determining take-home pay. Arkansas, known for its diverse economy ranging from agriculture to aerospace, hosts a wide array of industries, each with its unique payroll needs. In this article, we will delve into the specifics of the Arkansas paycheck calculator, exploring its functionality, the factors it considers, and how it can be a valuable tool for both employees and employers across the state.

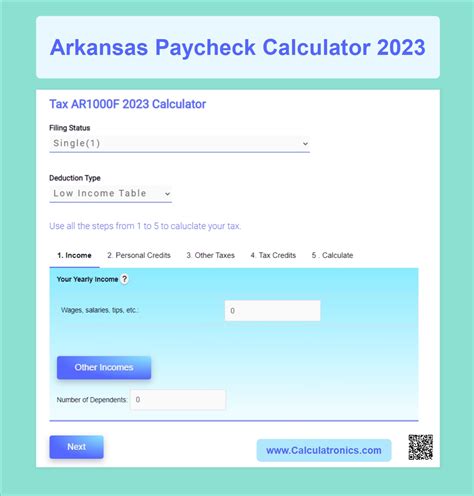

Understanding Arkansas Paycheck Calculator

A paycheck calculator, specifically designed for Arkansas, takes into account the state’s tax laws and regulations to provide accurate calculations of gross pay and net pay. This tool is indispensable for understanding the impact of taxes, deductions, and other factors on one’s salary. For instance, it considers federal income tax, state income tax (where applicable), Social Security tax, and Medicare tax, along with any deductions for health insurance, 401(k), or other benefits. The calculator’s ability to factor in Arkansas’s specific tax rates and exemptions makes it a tailored solution for those seeking to understand their payroll in the context of the state’s financial landscape.

Factors Considered by the Calculator

The Arkansas paycheck calculator is designed to be comprehensive, considering a variety of factors that can affect an individual’s paycheck. These include:

- Federal Income Tax: This is calculated based on the taxpayer’s filing status and the number of allowances claimed on their W-4 form.

- Arkansas State Income Tax: Arkansas has a progressive income tax system, with rates ranging from 2.5% to 7%. The calculator applies the appropriate tax rate based on the individual’s income level.

- Local Taxes: While Arkansas does not have local income taxes, some cities and counties may have other types of taxes or fees that could be relevant.

- Other Deductions: These can include health insurance premiums, retirement plan contributions, and other pre-tax deductions that reduce taxable income.

| Tax Bracket | Single Filers | Joint Filers |

|---|---|---|

| 2.5% | $0 - $4,299 | $0 - $8,599 |

| 3% | $4,300 - $8,399 | $8,600 - $16,799 |

| 4% | $8,400 - $12,699 | $16,800 - $25,399 |

| 5% | $12,700 - $20,399 | $25,400 - $38,099 |

| 6% | $20,400 - $33,699 | $38,100 - $64,699 |

| 7% | $33,700+ | $64,700+ |

Key Points

- The Arkansas paycheck calculator is a tool designed to calculate an individual's take-home pay after considering federal, state, and local taxes, along with other deductions.

- Arkansas has a progressive state income tax system with rates from 2.5% to 7%.

- Understanding and utilizing the calculator can help in making informed financial decisions.

- The calculator considers various factors including filing status, number of allowances, and pre-tax deductions.

- It's essential for both employees and employers to stay updated with the latest tax laws and rates to ensure accurate payroll calculations.

Benefits of Using an Arkansas Paycheck Calculator

Beyond the basic function of calculating net pay, an Arkansas paycheck calculator offers several benefits. It provides a clear picture of one’s financial situation, helping in budgeting and financial planning. For employers, it ensures compliance with tax laws and facilitates the management of payroll, which can be complex, especially in a state with a progressive tax system like Arkansas. Moreover, it helps in planning for tax season, allowing individuals to anticipate their tax liability or potential refund.

For Employees

Employees can use the calculator to:

- Plan Finances: By understanding their take-home pay, individuals can better manage their expenses and savings.

- Adjust W-4: If an employee finds they are consistently receiving a large refund or owing a significant amount, they can adjust their W-4 to more accurately match their tax liability.

For Employers

Employers benefit from the calculator as it helps in:

- Accurate Payroll Processing: Ensuring that payroll is processed correctly is crucial for maintaining employee satisfaction and avoiding legal issues.

- Compliance with Tax Laws: The calculator helps employers stay compliant with federal and state tax regulations, reducing the risk of audits or penalties.

What is the purpose of an Arkansas paycheck calculator?

+The purpose of an Arkansas paycheck calculator is to provide an accurate calculation of an individual's take-home pay, considering federal, state, and local taxes, along with other deductions.

How does the Arkansas state income tax system work?

+Arkansas has a progressive income tax system with tax rates ranging from 2.5% to 7%, depending on the individual's income level and filing status.

Can the calculator help with financial planning?

+Yes, by providing a clear picture of one's take-home pay, the calculator can help individuals plan their finances more effectively, including budgeting and planning for taxes.

In conclusion, the Arkansas paycheck calculator is a vital tool for anyone looking to understand and manage their finances within the context of Arkansas’s tax landscape. Whether you’re an employee seeking to plan your finances more effectively or an employer aiming to ensure compliance with tax laws, this calculator offers a straightforward and reliable way to calculate take-home pay. By considering the various factors that affect payroll, including federal and state taxes, deductions, and exemptions, the calculator provides a comprehensive view of one’s financial situation, facilitating better financial planning and decision-making.