Allegiance Health Insurance, a name that may evoke a sense of commitment and dedication to one's health and well-being, has been a topic of interest for many individuals and families seeking reliable and comprehensive health insurance coverage. As the healthcare landscape continues to evolve, understanding the nuances of health insurance providers like Allegiance Health Insurance is crucial for making informed decisions about one's health care. In this article, we will delve into the specifics of Allegiance Health Insurance, exploring its features, benefits, and how it stands out in the competitive health insurance market.

Overview of Allegiance Health Insurance

Allegiance Health Insurance is designed to provide individuals and families with a range of health insurance plans that cater to different needs and budgets. With a focus on accessibility and affordability, Allegiance Health Insurance aims to bridge the gap between quality healthcare services and the financial constraints that many face. By offering a variety of plans, from basic coverage to more comprehensive options, Allegiance Health Insurance strives to ensure that its policyholders have access to necessary medical care without incurring undue financial burden.

Key Features of Allegiance Health Insurance Plans

The health insurance plans offered by Allegiance include a multitude of features designed to provide policyholders with peace of mind and financial protection against unexpected medical expenses. Some of the key features include:

- Comprehensive Coverage: Allegiance Health Insurance plans often cover a wide range of medical services, including doctor visits, hospital stays, surgical procedures, and prescription medications.

- Network of Providers: Policyholders have access to a network of healthcare providers, including primary care physicians, specialists, hospitals, and other medical facilities.

- Preventive Care Services: Many plans cover preventive care services at no additional cost, such as annual check-ups, vaccinations, and screenings.

- Flexible Premium Payment Options: Allegiance Health Insurance offers flexible payment plans to help policyholders manage their premiums, making healthcare more accessible.

| Plan Type | Key Benefits |

|---|---|

| Basic Plan | Covers essential health benefits, including doctor visits and hospital stays, with lower premiums. |

| Premium Plan | Offers comprehensive coverage, including preventive care services, prescription drug coverage, and lower out-of-pocket costs. |

Benefits of Allegiance Health Insurance

Beyond the basic features of its plans, Allegiance Health Insurance offers several benefits that distinguish it from other health insurance providers. These benefits include:

- Personalized Customer Service: Allegiance Health Insurance prides itself on providing policyholders with personalized support, helping them navigate the complexities of health insurance and ensuring they get the most out of their plans.

- Quality Care at Affordable Rates: By negotiating with healthcare providers and leveraging its network, Allegiance Health Insurance aims to offer high-quality care at rates that are competitive in the market.

- Health and Wellness Programs: Many Allegiance Health Insurance plans come with additional health and wellness programs designed to promote healthy living and prevent illnesses, further enhancing the value of its insurance offerings.

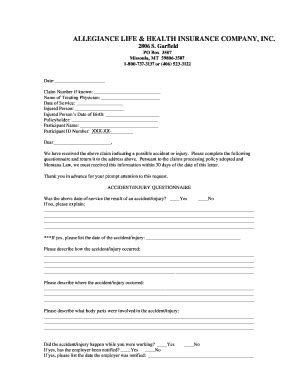

Eligibility and Enrollment

Eligibility for Allegiance Health Insurance plans varies depending on several factors, including age, income level, and employment status. The enrollment process typically involves selecting a plan, providing personal and health information, and choosing a payment method. It’s crucial to review the plan details carefully and ask questions to ensure the selected plan meets one’s specific health care needs.

Key Points

- Allegiance Health Insurance offers a range of plans to cater to different health care needs and budgets.

- Policyholders have access to a network of healthcare providers and comprehensive coverage options.

- Preventive care services and flexible premium payment options are available.

- Personalized customer service and quality care at affordable rates are key benefits.

- Eligibility and enrollment processes are designed to be straightforward, with support available for policyholders.

Conclusion and Forward-Looking Implications

In conclusion, Allegiance Health Insurance presents a compelling option for those seeking reliable and comprehensive health insurance coverage. By offering a variety of plans, emphasizing accessibility and affordability, and providing personalized customer service, Allegiance Health Insurance aims to make a positive impact on the health and well-being of its policyholders. As the healthcare landscape continues to evolve, the ability of health insurance providers like Allegiance to adapt and innovate will be crucial in meeting the changing needs of individuals and families.

What types of health insurance plans does Allegiance Health Insurance offer?

+Allegiance Health Insurance offers a range of plans, including basic, premium, and specialized plans designed to meet different health care needs and budgets.

How do I enroll in an Allegiance Health Insurance plan?

+Enrollment in an Allegiance Health Insurance plan typically involves selecting a plan, providing personal and health information, and choosing a payment method. Support is available to guide policyholders through the process.

What is the network of providers for Allegiance Health Insurance?

+Allegiance Health Insurance has a network of healthcare providers, including primary care physicians, specialists, hospitals, and other medical facilities. Policyholders can access these providers for their healthcare needs.

By focusing on the specific needs of its policyholders and continually working to improve its services, Allegiance Health Insurance strives to be a leader in the health insurance market, providing not just coverage, but peace of mind and a path to better health and well-being.