Alabama, known as the Yellowhammer State, is home to over 5 million residents who require access to quality healthcare services. The state's healthcare landscape is complex, with various options available for individuals, families, and groups. Alabama health plans are designed to provide comprehensive coverage, flexibility, and affordability to meet the diverse needs of its residents. In this article, we will delve into the world of Alabama health plans, exploring the different types, benefits, and considerations for those seeking to enroll in a plan that suits their needs.

Types of Alabama Health Plans

Alabama health plans can be broadly categorized into several types, each with its unique features and advantages. The primary types of plans include Individual and Family Plans, Group Plans, Medicaid Plans, and Medicare Plans. Individual and Family Plans are designed for people who are not covered by their employer or are self-employed, while Group Plans are typically offered by employers to their employees. Medicaid Plans are government-funded programs for low-income individuals and families, and Medicare Plans are designed for seniors and individuals with disabilities.

Individual and Family Plans

Individual and Family Plans in Alabama are available through the Affordable Care Act (ACA) marketplace or directly from insurance companies. These plans offer a range of benefits, including preventive care, hospitalization, prescription medication coverage, and mental health services. Some popular insurance companies offering Individual and Family Plans in Alabama include Blue Cross and Blue Shield of Alabama, UnitedHealthcare, and Humana. According to the Centers for Medicare and Medicaid Services (CMS), in 2022, over 170,000 Alabamians enrolled in ACA marketplace plans.

| Insurance Company | Plan Type | Premium Range |

|---|---|---|

| Blue Cross and Blue Shield of Alabama | Individual and Family Plans | $300-$1,200 per month |

| UnitedHealthcare | Individual and Family Plans | $250-$1,000 per month |

| Humana | Individual and Family Plans | $200-$900 per month |

Group Plans

Group Plans in Alabama are designed for employers with 2-50 employees. These plans offer a range of benefits, including medical coverage, dental coverage, vision coverage, and life insurance. Group Plans are often more affordable than Individual and Family Plans, as the risk is spread across a larger pool of employees. According to the National Federation of Independent Business (NFIB), in 2022, over 70% of small businesses in Alabama offered health insurance to their employees.

Medicaid Plans

Medicaid Plans in Alabama are designed for low-income individuals and families. These plans offer comprehensive coverage, including doctor visits, hospital stays, prescription medications, and mental health services. To be eligible for Medicaid in Alabama, individuals must meet specific income and resource requirements. According to the Alabama Medicaid Agency, in 2022, over 900,000 Alabamians were enrolled in Medicaid.

Key Points

- Alabama health plans offer a range of benefits, including preventive care, hospitalization, and prescription medication coverage.

- Individual and Family Plans are available through the ACA marketplace or directly from insurance companies.

- Group Plans are designed for employers with 2-50 employees and offer a range of benefits, including medical, dental, and vision coverage.

- Medicaid Plans are designed for low-income individuals and families and offer comprehensive coverage.

- Policyholders should carefully review plan details, including network providers, deductibles, copays, and maximum out-of-pocket expenses.

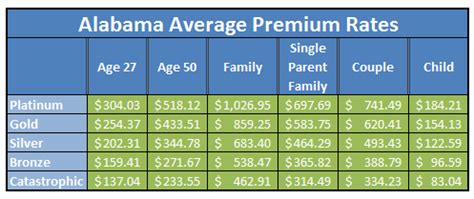

Considerations for Alabama Health Plans

When selecting an Alabama health plan, there are several considerations to keep in mind. Premium costs are a significant factor, as they can vary widely depending on the plan type, insurance company, and individual or family characteristics. Network providers are also crucial, as policyholders will want to ensure that their primary care physician and any specialists they see are part of the plan’s network. Out-of-pocket expenses, including deductibles, copays, and coinsurance, should also be carefully reviewed.

In addition to these factors, policyholders should also consider the plan's prescription medication coverage, mental health services, and wellness programs. Some plans may offer additional benefits, such as telemedicine services or health coaching. By carefully evaluating these factors, individuals and families can select an Alabama health plan that meets their unique needs and budget.

What is the difference between an Individual and Family Plan and a Group Plan in Alabama?

+An Individual and Family Plan is designed for individuals or families who are not covered by their employer or are self-employed, while a Group Plan is designed for employers with 2-50 employees. Group Plans are often more affordable and offer a range of benefits, including medical, dental, and vision coverage.

How do I apply for Medicaid in Alabama?

+To apply for Medicaid in Alabama, individuals can visit the Alabama Medicaid Agency website or contact their local Medicaid office. Applicants will need to provide documentation, including proof of income, residency, and citizenship or immigration status.

Can I purchase an Alabama health plan outside of the ACA marketplace?

+Yes, individuals can purchase an Alabama health plan directly from an insurance company outside of the ACA marketplace. However, these plans may not offer the same level of coverage or subsidies as plans available through the marketplace.

In conclusion, Alabama health plans offer a range of options for individuals, families, and groups. By carefully considering factors such as premium costs, network providers, and out-of-pocket expenses, policyholders can select a plan that meets their unique needs and budget. Whether you’re looking for an Individual and Family Plan, a Group Plan, or a Medicaid Plan, there are resources available to help you navigate the complex world of Alabama health insurance.