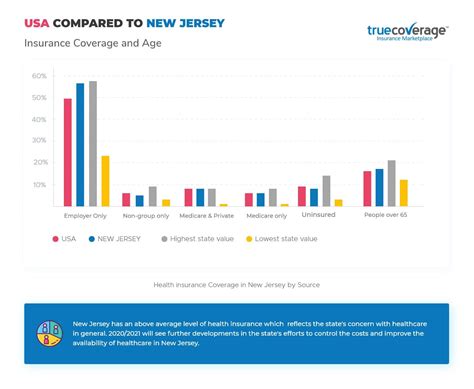

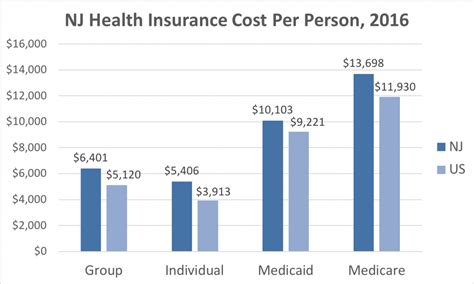

Affordable health insurance in New Jersey (NJ) is a crucial aspect of healthcare for residents, given the state's high cost of living and diverse population. With the Affordable Care Act (ACA) still in place, individuals and families can explore various options to find affordable health insurance that meets their needs. According to data from the New Jersey Department of Banking and Insurance, the state's uninsured rate has decreased significantly since the implementation of the ACA, with approximately 8.7% of the population remaining uninsured as of 2022.

The New Jersey health insurance market offers a range of plans from reputable carriers, including Horizon Blue Cross Blue Shield of New Jersey, AmeriHealth, and Oscar. These plans are categorized into metal tiers – Bronze, Silver, Gold, and Platinum – based on their actuarial value, which represents the percentage of medical expenses covered by the plan. For instance, a Bronze plan typically covers around 60% of medical expenses, while a Platinum plan covers approximately 90%. Understanding these tiers is essential for individuals to choose a plan that balances premium costs with out-of-pocket expenses.

Key Points

- Affordable health insurance options are available in New Jersey through the ACA marketplace and private insurers.

- Plan tiers (Bronze, Silver, Gold, Platinum) vary in premium costs and coverage levels, with Bronze being the most affordable and Platinum offering the most comprehensive coverage.

- Subsidies are available for eligible individuals and families to reduce premium costs, with approximately 70% of New Jersey enrollees receiving financial assistance.

- Short-term health insurance plans offer temporary coverage but may not provide essential health benefits or pre-existing condition coverage.

- Catastrophic plans are available for young adults or those who cannot afford other coverage options, providing limited benefits at lower premiums.

Understanding Affordable Health Insurance Options in NJ

When searching for affordable health insurance in NJ, it’s essential to consider not only the premium costs but also the out-of-pocket expenses, network providers, and coverage levels. The New Jersey health insurance marketplace, accessible through the federal platform Healthcare.gov, allows residents to compare plans, check eligibility for subsidies, and enroll in coverage during the annual open enrollment period or during special enrollment periods for qualifying life events.

Subsidies and Financial Assistance

Subsidies play a significant role in making health insurance affordable for many New Jersey residents. These subsidies, in the form of Advanced Premium Tax Credits (APTCs), can significantly reduce the monthly premium costs for eligible individuals and families. According to the Kaiser Family Foundation, in 2022, approximately 70% of New Jersey marketplace enrollees received financial assistance, with an average subsidy of $442 per month. Understanding eligibility criteria and applying for subsidies can make a substantial difference in the affordability of health insurance.

| Plan Type | Average Monthly Premium (2022) | Out-of-Pocket Maximum |

|---|---|---|

| Bronze | $443 | $8,700 |

| Silver | $543 | $7,900 |

| Gold | $643 | $6,900 |

| Platinum | $743 | $4,000 |

Special Considerations for NJ Residents

New Jersey residents have unique considerations when it comes to health insurance. The state’s high cost of living, coupled with the diverse needs of its population, means that residents must carefully evaluate their health insurance options. For instance, families with young children may prioritize plans with robust pediatric care coverage, while individuals with pre-existing conditions must ensure their chosen plan provides comprehensive coverage without exclusions.

Short-Term and Catastrophic Plans

For those who cannot afford major medical plans or need temporary coverage, short-term health insurance plans and catastrophic plans are available. However, these plans come with limitations, such as less comprehensive coverage and, in the case of short-term plans, potential exclusions for pre-existing conditions. Catastrophic plans, which are available to young adults or those who cannot afford other coverage, offer limited benefits at lower premiums but are designed to protect against worst-case scenarios.

In conclusion, affordable health insurance in New Jersey is achievable through a combination of marketplace plans, subsidies, and careful consideration of individual and family needs. By understanding the nuances of health insurance plans, including their coverage levels, network providers, and out-of-pocket expenses, NJ residents can make informed decisions that balance affordability with comprehensive healthcare coverage.

What is the open enrollment period for health insurance in New Jersey?

+The open enrollment period for health insurance in New Jersey typically runs from November to December each year, though special enrollment periods may be available for qualifying life events.

How do I apply for subsidies to reduce my health insurance premium costs in NJ?

+To apply for subsidies, you can visit the Healthcare.gov website, where you can fill out an application, compare plans, and check your eligibility for Advanced Premium Tax Credits (APTCs).

What are the differences between Bronze, Silver, Gold, and Platinum health insurance plans in NJ?

+The main differences between these plans lie in their actuarial value, which represents the percentage of medical expenses covered by the plan. Bronze plans cover around 60% of expenses, Silver plans around 70%, Gold plans around 80%, and Platinum plans around 90%. Premiums and out-of-pocket costs vary accordingly.