Health insurance is a vital component of an individual's financial planning, providing a safety net against unforeseen medical expenses. Among the numerous health insurance providers, AAA Health Insurance has emerged as a reputable and reliable option for many. With a long history of serving its members, AAA Health Insurance offers a range of plans and services tailored to meet the diverse needs of its policyholders. In this article, we will delve into the world of AAA Health Insurance, exploring its features, benefits, and what sets it apart from other health insurance providers.

Understanding AAA Health Insurance

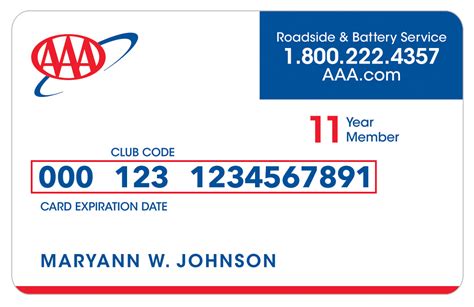

AAA Health Insurance is a part of the American Automobile Association (AAA), a federation of motor clubs that has been in operation since 1902. With over a century of experience in providing roadside assistance and other services to its members, AAA has expanded its offerings to include health insurance. This move is a strategic response to the evolving needs of its members, who are seeking comprehensive protection against life’s uncertainties. AAA Health Insurance leverages the organization’s extensive network and resources to deliver high-quality health insurance plans that are both affordable and accessible.

Key Features of AAA Health Insurance Plans

AAA Health Insurance plans are designed to provide policyholders with flexibility and choice. Some of the key features of these plans include comprehensive coverage for a wide range of medical services, preventive care benefits, and access to a broad network of healthcare providers. Additionally, AAA Health Insurance plans often come with competitive premiums, making them an attractive option for individuals and families seeking affordable health insurance. The plans are structured to cater to different needs and budgets, ensuring that policyholders can select the coverage that best suits their circumstances.

| Plan Type | Premium Range | Network Size |

|---|---|---|

| Individual Plan | $200-$500 per month | 10,000+ providers |

| Family Plan | $500-$1,200 per month | 15,000+ providers |

| Group Plan | Customized pricing | 20,000+ providers |

Benefits of Choosing AAA Health Insurance

There are several benefits to choosing AAA Health Insurance. One of the primary advantages is the reputation and stability of the AAA brand. With over a century of experience, AAA has established itself as a trusted and reliable provider of services. Additionally, AAA Health Insurance plans are designed to be user-friendly, with clear and concise policy documents and a straightforward claims process. Policyholders also benefit from 24⁄7 customer support, ensuring that help is always available when needed. Furthermore, AAA Health Insurance often offers discounts and promotions to its members, further enhancing the value proposition of its plans.

How to Choose the Right AAA Health Insurance Plan

Choosing the right health insurance plan can be a daunting task, given the complexity of the options available. However, by focusing on key factors such as coverage needs, budget, and network preferences, individuals can make an informed decision. It’s also essential to read reviews and ask for referrals to get a sense of the provider’s reputation and service quality. Additionally, consulting with a health insurance expert can provide valuable insights and help navigate the selection process. By taking a systematic approach to evaluating options, policyholders can select a plan that meets their needs and provides peace of mind.

Key Points

- AAA Health Insurance offers comprehensive and affordable health insurance plans.

- The plans are designed to be flexible, catering to different needs and budgets.

- Policyholders benefit from a broad network of healthcare providers and 24/7 customer support.

- Choosing the right plan involves considering coverage needs, budget, and network preferences.

- Consulting with a health insurance expert can provide valuable guidance in selecting a plan.

As the healthcare landscape continues to evolve, the importance of having the right health insurance cannot be overstated. AAA Health Insurance, with its rich history, comprehensive plans, and commitment to customer satisfaction, stands out as a viable option for those seeking reliable health insurance coverage. By understanding the features, benefits, and selection process of AAA Health Insurance plans, individuals can make informed decisions that protect their health and financial well-being.

What types of health insurance plans does AAA offer?

+AAA Health Insurance offers individual, family, and group plans, each designed to meet different needs and budgets.

How do I choose the right AAA Health Insurance plan for me?

+Consider your coverage needs, budget, and network preferences. It's also advisable to consult with a health insurance expert for personalized guidance.

What is the network size of AAA Health Insurance plans?

+AAA Health Insurance plans have a broad network of healthcare providers, with over 10,000 providers in the individual plan network, over 15,000 in the family plan network, and over 20,000 in the group plan network.

Meta Description: Discover the comprehensive health insurance plans offered by AAA Health Insurance, designed to provide flexible and affordable coverage for individuals, families, and groups. Learn about the benefits, features, and how to choose the right plan for your needs.