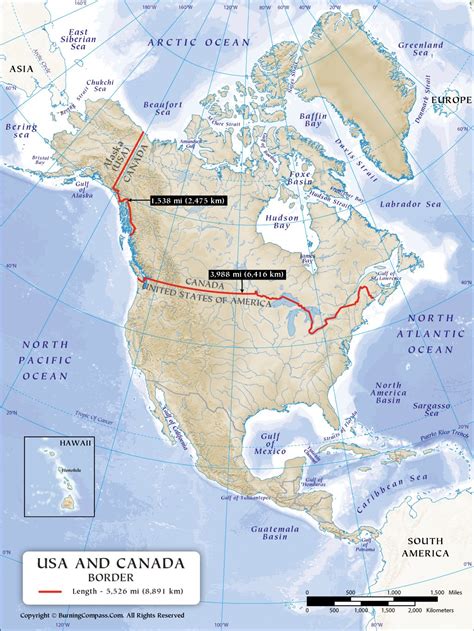

The exchange rate between the Canadian dollar (CAD) and the United States dollar (USD) is a crucial piece of information for individuals and businesses involved in international trade, travel, or investment. As of the current market conditions, the exchange rate may fluctuate, but we can provide a general overview of how to convert 135 Canadian dollars to US dollars.

Understanding Exchange Rates

Exchange rates are determined by the foreign exchange market, which is influenced by various factors such as economic indicators, trade balances, and geopolitical events. The rate at which one currency is exchanged for another can change rapidly, so it’s essential to stay up-to-date with the latest exchange rates. To convert 135 Canadian dollars to US dollars, we need to know the current exchange rate.

Exchange Rate Calculation

Assuming an exchange rate of 1 CAD = 0.77 USD (please note that this rate is subject to change), we can calculate the conversion as follows:

| Currency | Amount | Exchange Rate | Converted Amount |

|---|---|---|---|

| CAD | 135 | 1 CAD = 0.77 USD | 135 x 0.77 = 103.95 USD |

Based on this calculation, 135 Canadian dollars would be equivalent to approximately 103.95 US dollars. However, please note that this is an estimate and the actual exchange rate may vary depending on the current market conditions and the institution or service used for the exchange.

Key Points

- The exchange rate between CAD and USD can fluctuate rapidly due to various market and economic factors.

- To convert 135 CAD to USD, we use the current exchange rate, which may be around 1 CAD = 0.77 USD, but this is subject to change.

- The converted amount would be approximately 103.95 USD, based on the given exchange rate.

- Actual exchange rates may vary depending on the institution or service used for the exchange.

- It's essential to stay updated with the latest exchange rates for accurate conversions.

Factors Influencing Exchange Rates

Several factors influence the exchange rate between the Canadian dollar and the US dollar. These include:

- Economic indicators: Such as GDP growth rates, inflation rates, and unemployment rates in both Canada and the US.

- Trade balances: The difference between a country's exports and imports can affect its currency's value.

- Geopolitical events: Political instability, elections, and international conflicts can impact exchange rates.

- Monetary policy: Decisions made by central banks, such as interest rate changes, can influence currency values.

Understanding these factors can help individuals and businesses make informed decisions about their financial transactions and investments involving the Canadian and US dollars.

Practical Applications

For travelers, understanding the exchange rate is crucial for budgeting and making the most of their trips. For businesses, accurate exchange rates are vital for pricing products, managing international transactions, and forecasting revenue. Individuals investing in foreign markets also need to consider exchange rates to maximize their returns and minimize risks.

In conclusion, converting 135 Canadian dollars to US dollars requires knowledge of the current exchange rate and an understanding of the factors that influence it. By staying informed and up-to-date, individuals and businesses can better manage their financial transactions and investments across the border.

How often do exchange rates change?

+Exchange rates can change rapidly, sometimes multiple times a day, due to market fluctuations and economic events. It’s essential to check current rates before making any transactions.

What affects the value of the Canadian dollar?

+The value of the Canadian dollar is influenced by various factors, including economic indicators, trade balances, geopolitical events, and monetary policy decisions. Understanding these factors can help predict currency fluctuations.

How can I get the best exchange rate for my transaction?

+To get the best exchange rate, it’s recommended to compare rates among different banks, currency exchange services, and online platforms. Additionally, avoiding transactions at airports or tourist areas, where rates tend to be less favorable, can also help.